Guidelines for the preparation of the macroeconomic scenario

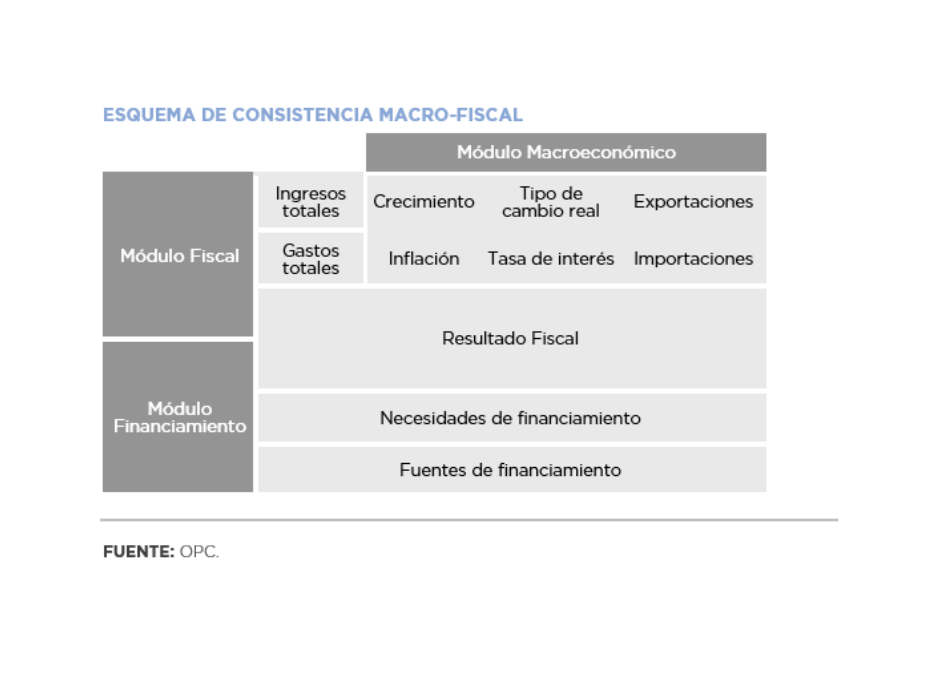

The purpose of this document is to outline the main methodological aspects and the technical tools used for the preparation of the macroeconomic scenario adopted by the OPC in the framework of the report “Revised Estimates – 2020 Budget Bill”.

The approaches included in this document are not intended to specify a closed macroeconomic model, to investigate the causal processes of the phenomena under study or to provide certainty for future budgetary outcomes. Rather, it seeks to contribute to the analysis of how the argentine economy and public budget will evolve if the current economic policy and the same conditions are to remain unchanged.

Macroeconomic variables play a fundamental role in the design of budgetary policy as they are closely linked to the revenues and spending estimates (and financing needs) included in the Budget Bill.

Making short, medium, and long-term projections of significant national macroeconomic variables allows, among other things, producing independent analyses of the impact of these variables on the public sector balance sheet, forecasting their future evolution for multi-year horizons, as well as conducting studies on the intertemporal sustainability of the national public debt.