by Juan Fourcaud | Oct 27, 2020 | Budget Execution

In the first nine months of the year, national government revenue grew by 5.0% YoY in real terms, while expenditure grew by 9.4% YoY, mainly driven by expenditures to mitigate the consequences of the pandemic.

- Excluding the profits transferred by the Central Bank (BCRA), which totaled AR$1.17 trillion as of September, total resources contracted by 17.6% YoY in real terms compared to the previous year.

- Primary expenditures increased by 21.9% YoY, basically to mitigate the health crisis.

- As of September, approximately AR$723.2 billion of expenditures related to COVID-19 were accrued, without which primary expenditure would have expanded by 2.4% YoY in real terms.

- The primary balance up to September 30, 2019, excluding BCRA profits, went from a surplus of AR$75.9 billion to a deficit of AR$1.4 trillion in the same period of 2020.

- Social programs registered an execution of AR$85.1 billion in the first nine months of 2019 and AR$671.9 billion in the term January-September 2020, which means an increase of 447.0% YoY in real terms.

- The initial budget for the year increased by $2.7 trillion and 62.7% of this increase was allocated to reinforce social benefits.

by Nicolas Perez | Jul 15, 2020 | Budget Execution

- During the first half of the year, the national government recorded a primary deficit of AR$911.12 billion due to the increase in expenditures and the decrease in revenues, both conditioned by the health crisis. his deficit was financed with profits from the Central Bank of Argentina.

- In the first half of the year, primary expenditures increased 22.3% YoY in real terms. This variation is almost entirely explained by the fiscal measures adopted by the national government within the framework of the COVID-19 emergency and the social isolation measures. Meanwhile, given the year-on-year drop in debt interest (-38.7% YoY), the increase in total expenditures had a more moderate expansion of 0.9% YoY.

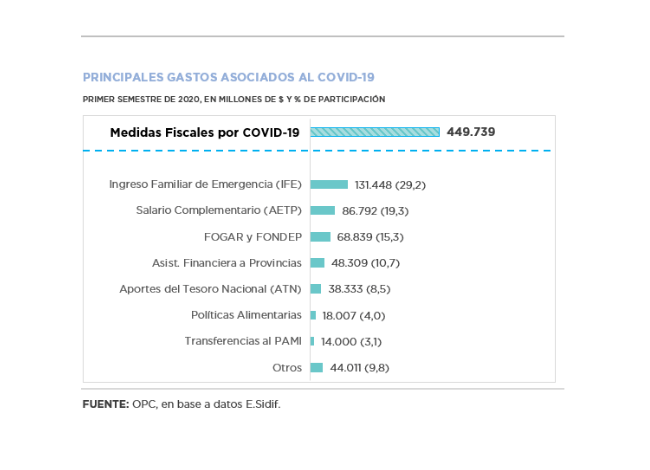

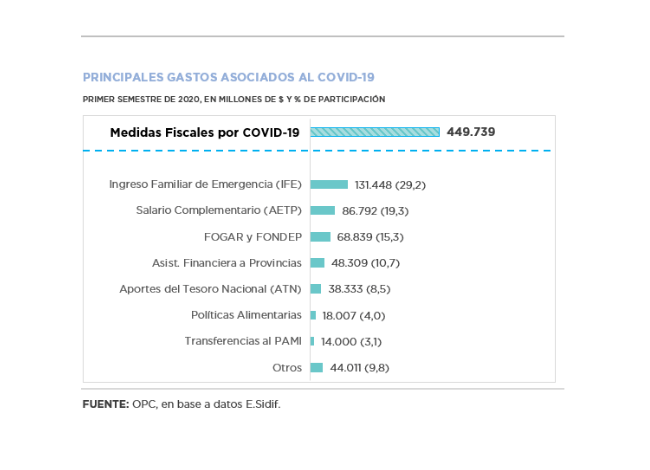

- The programs implemented to face the health challenge implied an expenditure of around AR$449.73 billion, without which primary expenditure would have grown by 3.2% in real terms compared to the first half of the previous year.

- Through twelve amendments, the initial Budget for the fiscal year increased by AR$845.41 billion, 67.6% of which was allocated to reinforce social benefits.

- In June, pensions and retirement benefits fell in real terms for the first time in the semester (1.4%), but supplementary bonuses caused lower pensions to increase 11.7% above inflation.

- The 71.8% drop in expenditure on housing and urban development was partly offset by the increase in expenditures on Potable Water and Sewerage, which rose 142.0% YoY, and on Financial Assistance for the Construction of Emergency Modular Hospitals, within the framework of COVID-19 ($4.38 billion).

by Juan Fourcaud | Jun 19, 2020 | Cost Estimates

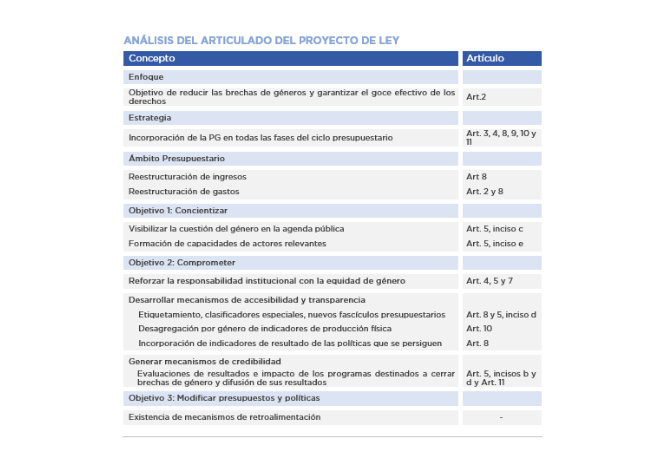

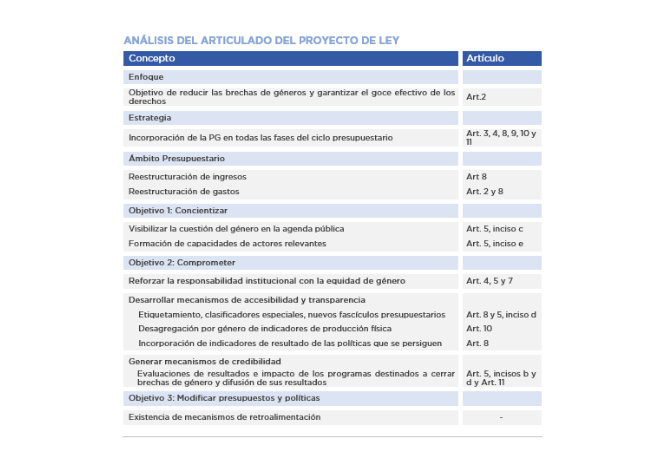

Gender Responsive Budgeting (GRB) provides a vehicle for determining the effect that government policies have on the achievement of gender equality and thus provides valuable information to policymakers.

To that effect, Bill S-0268/2020 provides for the implementation of gender perspective in public budgets. To review the Bill a two-level approach is made: on the one hand, the main conceptual and methodological aspects to be considered when implementing gender perspective in public budgets, and on the other hand, technical suggestions for amendments to Law No. 24,156 on Financial Administration and Control Systems of the National Public Sector.

by Nicolas Perez | May 13, 2020 | Budget Execution

As a result of the increase in primary expenditures to mitigate the effects of the crisis caused by the pandemic and the real drop in tax resources, the primary balance (net of Central Bank’s profits) went from a surplus of AR$10.05 billion in April 2019 to a deficit of AR$263.75 billion in April 2020.

This situation is drastically mitigated by the transfer of Central Bank (BCRA) profits for AR$230 billion, which managed to offset the fall in tax revenues and Social Security resources produced by the economic paralysis caused by the Mandatory Preventive Social Isolation (ASPO). Considering the inflow of profits, the primary deficit is reduced to AR$33.75 billion.

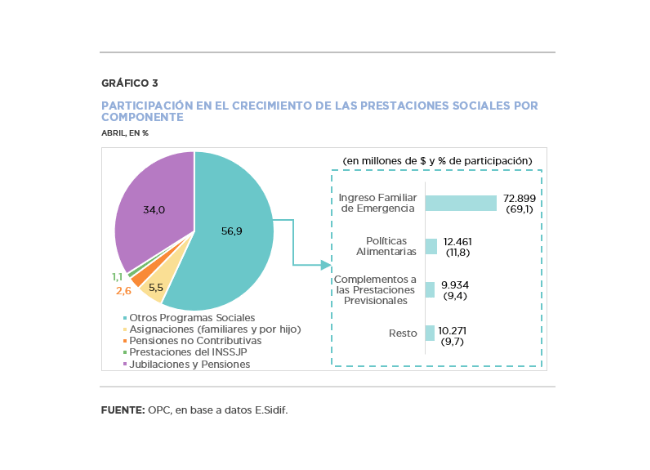

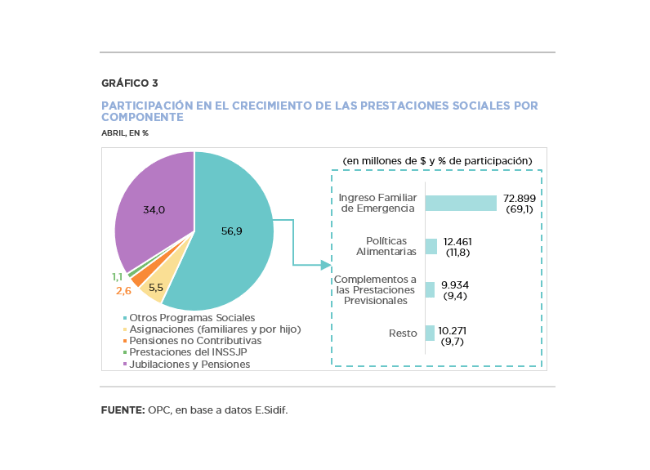

The distinctive feature of April’s implementation was the significant increase in primary expenditures, 54.1% year on year (YoY) in real terms, because of the measures adopted by the national government within the framework of the health emergency, among which the Emergency Family Income (IFE) stands out. However, since interest on debt fell 63.1% YoY, the increase in total expenditure was less pronounced, at 26.9% YoY.

Within tax revenues (AR$171.42 billion), VAT and income tax fell by 16.1% YoY and 32.9% YoY, respectively, not only due to the economic retraction caused by the quarantine but also to regulatory matters, such as the VAT refund for food purchases and the reduction of employer contributions.

During the first four months of the year, the initial appropriation increased by AR$203.11 billion, 91.0% of the increase being concentrated in social benefits (AR$87.82 billion), in transfers to the provinces (AR$73.65 billion) and in other current expenditures (AR$32.52 billion).

by Juan Fourcaud | Feb 4, 2020 | Other Publications

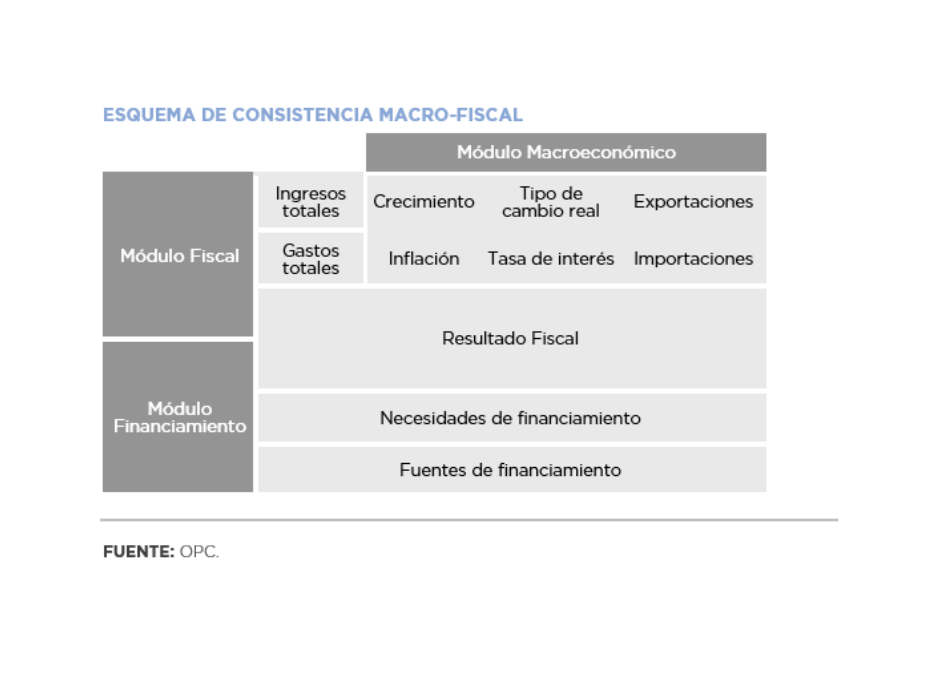

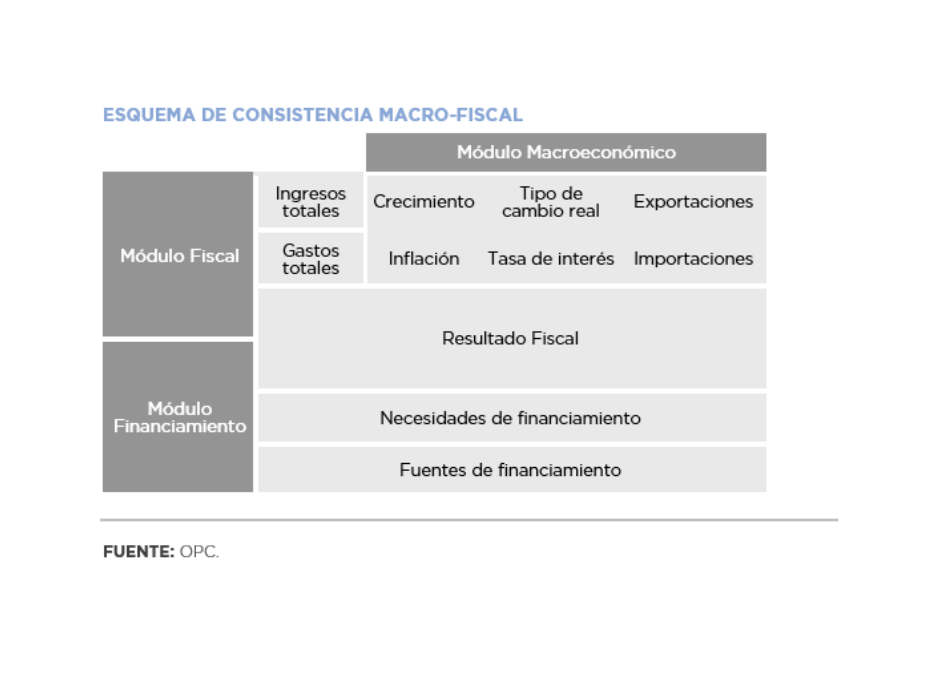

The purpose of this document is to outline the main methodological aspects and the technical tools used for the preparation of the macroeconomic scenario adopted by the OPC in the framework of the report “Revised Estimates – 2020 Budget Bill”.

The approaches included in this document are not intended to specify a closed macroeconomic model, to investigate the causal processes of the phenomena under study or to provide certainty for future budgetary outcomes. Rather, it seeks to contribute to the analysis of how the argentine economy and public budget will evolve if the current economic policy and the same conditions are to remain unchanged.

Macroeconomic variables play a fundamental role in the design of budgetary policy as they are closely linked to the revenues and spending estimates (and financing needs) included in the Budget Bill.

Making short, medium, and long-term projections of significant national macroeconomic variables allows, among other things, producing independent analyses of the impact of these variables on the public sector balance sheet, forecasting their future evolution for multi-year horizons, as well as conducting studies on the intertemporal sustainability of the national public debt.

by Nicolas Perez | Jan 10, 2020 | Sustainable Development Goals

Sustainable Development Goal (SDG) number 17, “Partnerships for achieving the goals”, seeks to promote synergies between governments and civil society, both nationally and internationally, to facilitate the fulfillment of purposes set forth in the program conceived under the umbrella of the United Nations.

Argentina adopted six of the nineteen goals set by the UN relating to: technology, capacity building, multi-stakeholder partnerships and data, monitoring and accountability.

Among other global goals, this adhesion commits the country to having reliable data, providing sustainable development indicators, and increasing the population’s access to technologies such as the Internet, with definitive goals for 2030 and some others prior to that. Due to methodological issues or lack of baseline data, this monitoring is not always feasible to carry out under the required conditions.

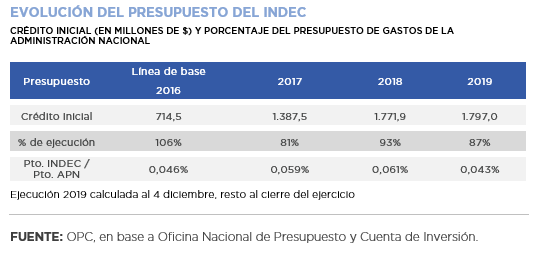

The general analysis of the available indicators shows, among many other points, that Argentina is waiting for a new National Statistical Plan, part of a legislative bill to modernize the system developed by INDEC (National Institute of Statistics and Censuses). According to an official study conducted in 2016 with the support of UNICEF, there is a 3.8% of under-recording of births and no accurate record of all deaths, also an under implementation of the actions related to the National Plan for the eradication of gender violence in the scope of INAM (National Institute for Women).

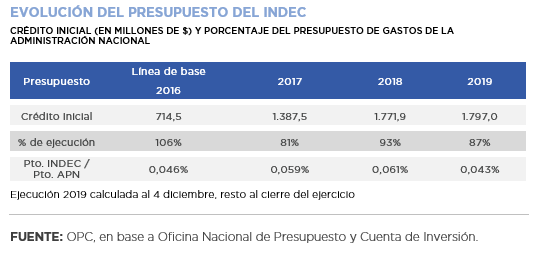

Direct expenditure projected for 2019 totaled $3.28 billion (39% higher than in 2018) and as of November its execution was 110%.