FISCAL IMPACT OF BILL ON THE CREATION OF A REGISTRY OF ENERGY-INTENSIVE IRRIGATORS (S-0024/2020)

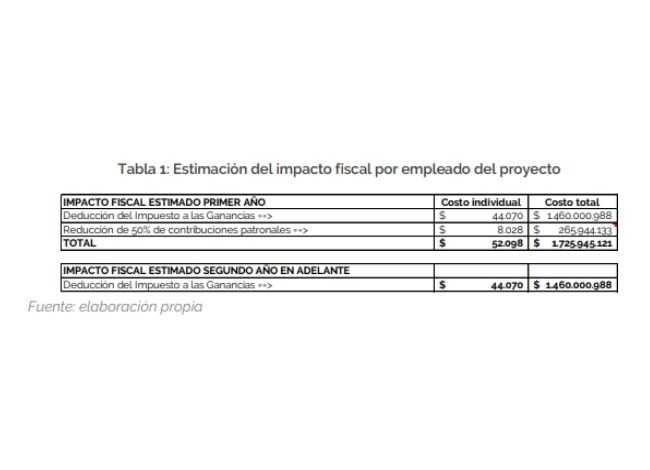

The Bill proposes the creation of a Registry of agricultural producers that use irrigation with intensive electric energy consumption and provides for a set of tax measures to encourage those producers to replace that system for less energy-demanding irrigation technologies.

The benefits included in the Bill are a reduction in the VAT rate for the purchase of electric energy, reduction in current energy rates and access to credit lines for energy reconversion.

The analysis carried out by OPC shows that the direct fiscal impact is very low, since the VAT reduction mechanism on purchases of certain links in the production chain only has a financial impact for the taxpayers subject to that tax.