by Nicolas Perez | Jul 7, 2021 | Tax Revenue

In June, tax revenues grew 69% year-on-year in nominal terms and 12.8% adjusted for inflation.

The increase was driven by the depreciation of the exchange rate (37% YoY), the increase in international commodity prices and regulatory changes. But the main factor behind the increase was the low basis of comparison since a year ago the Preventive and Compulsory Social Isolation (ASPO) was fully in force.

- Higher customs duties revenues (47.6% YoY) – due to the increase in the exchange rate and the recovery of imports – drove an improvement in VAT.

- The nominal increase of the dollar and the values of exported goods promoted an increase of 59.1% in the collection of Export Duties (YoY).

- Social Security resources increased for the third consecutive time in eight months, although the expansion of the wage bill has been systematically below the CPI since June 2018.

- PAIS Tax collection contracted again in the year-on-year comparison.

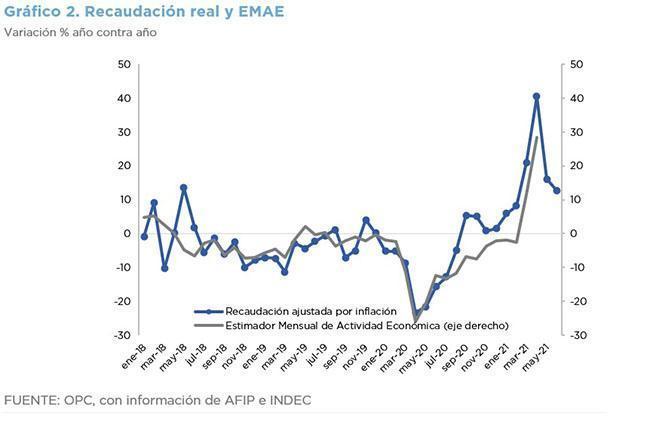

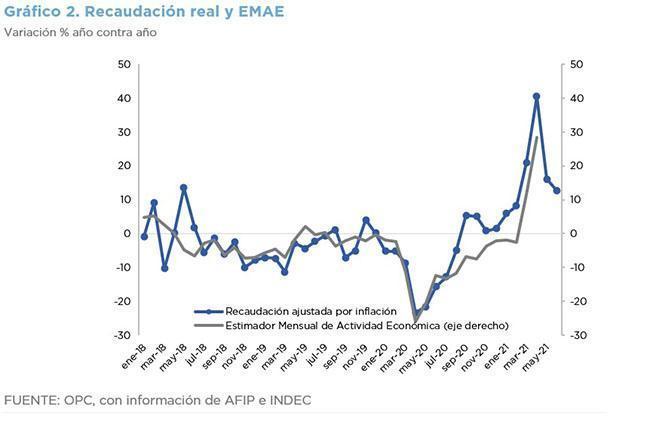

- The growth of the economy continues to be the main determinant of tax revenue, which fell steadily since mid-2018, due to a lower level of activity and the implementation of Law 27,430 on Tax Reform and began to recover after the worst effects of the measures adopted to contain the health effects of the pandemic.

by Nicolas Perez | Aug 10, 2020 | Tax Revenue

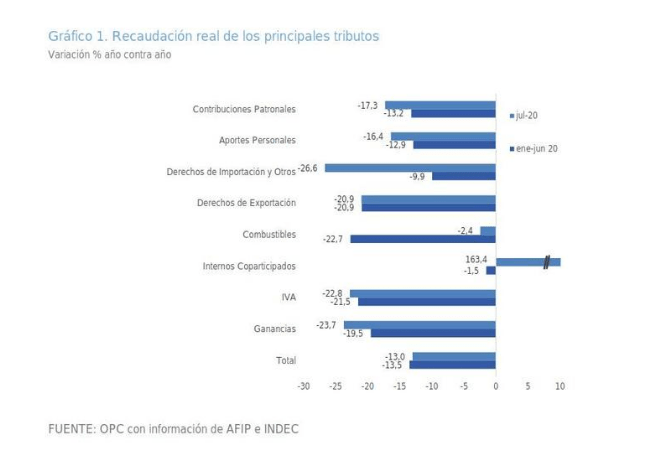

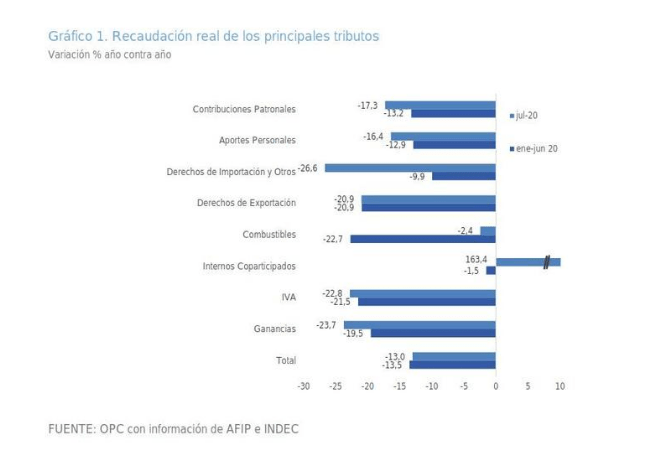

Total tax revenue amounted to AR$559.09 billion in July, which implied a nominal growth of 24% YoY, however, it contracted for the seventh consecutive month when adjusted for inflation, showing a decrease of 13% YoY.

In the first seven months of the year, total collection amounted to AR$3.44 trillion, 26.2% higher than in the same period of last year.

The main factor behind the drop in inflation-adjusted tax revenues was the economic impact of COVID-19. The national tax revenue is strongly linked to the level of activity, so the recessionary context, deepened by the pandemic, is the main factor explaining why tax revenue has decreased in 22 of the last 25 months in real terms.

by Nicolas Perez | May 11, 2020 | Tax Revenue

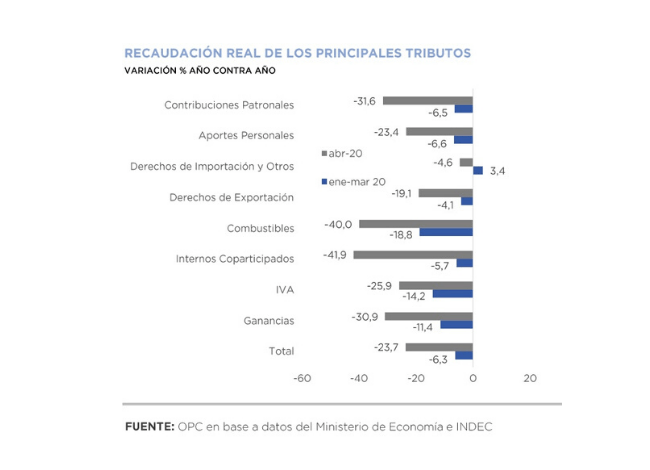

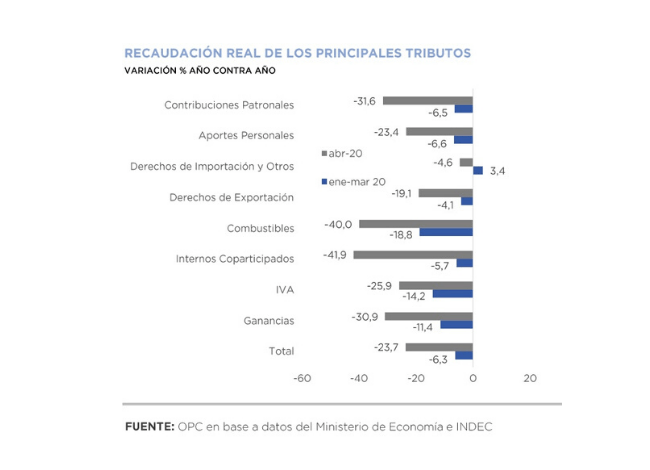

As anticipated, inflation-adjusted tax revenue fell 23.7% year on year (YoY) in April. Beyond some tax measures adopted by the National Executive Power to assist the productive sector in coping with the economic impact of the Mandatory Preventive Social Isolation (ASPO), the fall is explained by the slowdown in economic activity.

Revenues from national taxes totaled AR$398.66 billion, which implied a growth of 11.6% YoY.

The most important taxes had a significant drop in real terms. Income tax collection fell by 30.9% YoY, VAT by 25.9% YoY and Social Security resources contracted by 24.7% YoY. In addition, foreign trade revenues fell 15.2% YoY.

Although the pandemic and the ASPO were the main factors behind the poor collection performance in April, other factors also contributed. From the regulatory point of view, VAT refunds for the purchase of food, the reduction of Employer Contributions for the health sector, the deferral of the SIPA component of Employer Contributions for two months and the freezing of part of the Fuel Taxes in effect during March contributed to the lower inflow of resources. From the macroeconomic point of view, the deterioration of the labor market and the contraction of international trade contributed to the sharp drop in revenues.

May revenues are expected to continue to fall in real terms. Although some economic activities were exempted from the quarantine during April, the impact of the measure on the level of activity remained. On the other hand, measures such as the reduction or deferral of Employer Contributions, the reduction in the rate of the Tax on Debits and Credits to Current Accounts and the VAT refund for dairy products will have an impact on May revenues.

by Nicolas Perez | Oct 3, 2019 | Tax Policy and Fiscal Federalism

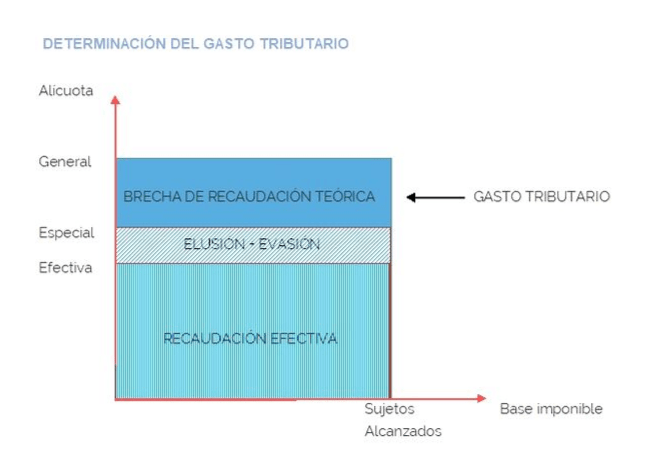

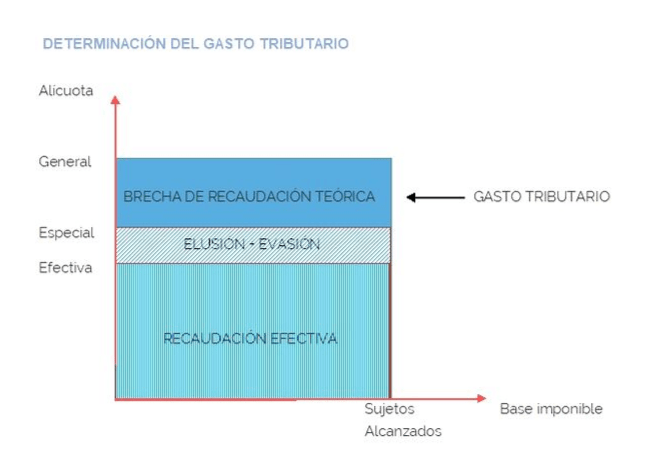

This paper introduces a conceptual discussion aimed at developing a practical methodology for the evaluation of differential tax treatment policies. A two-stage process is proposed; one technical and one political. The first of these stages is the object of study of this paper.

For the development of this evaluation stage, the existing definitions on the concept of tax expenditure, the economic and practical foundations of the use of differential tax treatments as an economic policy tool to the detriment of other instruments are studied, and different methodologies for calculating tax expenditure of an economic measure are described.

Among the mistakes to avoid, the OPC warns against considering that financing public policy through tax expenditure measures is less expensive than financing it through direct expenditure.