TAX BURDEN ON PRODUCTIVE ACTIVITY – METHODOLOGY

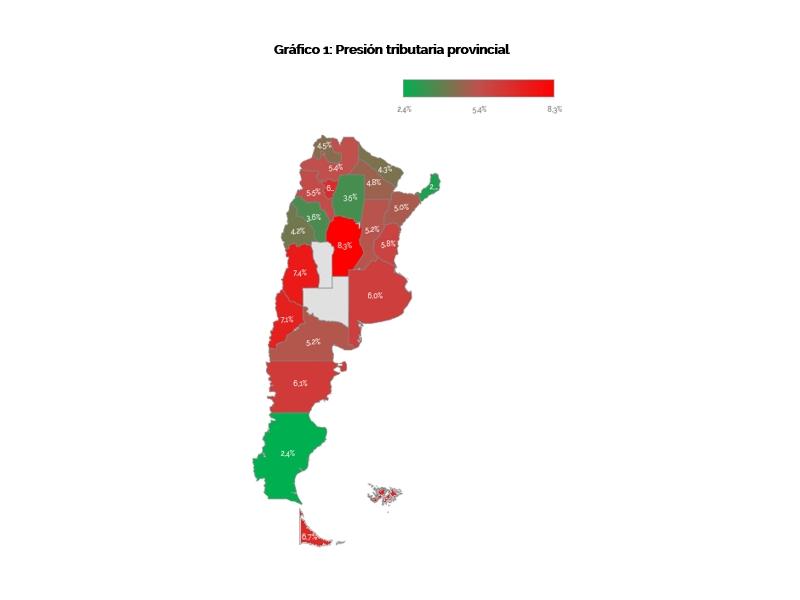

The OPC is developing a project to analyze the tax burden on a set of economic activities at national, provincial, and municipal levels in Argentina, a research that covers 30 cities in 23 provinces and the Autonomous City of Buenos Aires.

This work is a methodological approach, which includes a mapping of provincial taxes and their capacity to provide public funds.

The overview of the main taxes, their legal basis and their collection impact aims to determine, among other things, the true magnitude of tax burden, tax burden on employment and the amount of resources generated by each tax.

Due to difficulties in establishing benchmarks and making comparative measurements, the focus will be on measuring the “theoretical tax burden”, according to the place where each activity is carried out. The assumption will be that each activity is carried out only in one place of residence and is taxed in only one jurisdiction.

In summary, this study, focused on 30 cities and on 5 sectors of activity, has revealed the existence of more than 150 taxes on economic activity in Argentina with places that accumulate between the three levels of government from 21 to 40 different taxes, which gives clear indications of the difficulty faced by any economic agent in complying with them.

The complex universe of the provincial tax system makes it difficult to have a solid basis for comparison and its performance is different per jurisdiction: unlike 2018, where some provinces took advantage of the opportunity to increase their tax rates up to the limit allowed by law, in 2019 there is a declining trend.

The permanent modifications in rates and fees diminish the legality and transparency of the system.