by Nicolas Perez | Oct 11, 2019 | Public Debt Operations

- At the end of September, the Executive Branch submitted to Congress a Bill for the inclusion of Collective Action Clauses in sovereign bonds under domestic law. The Bill does not include a restructuring proposal but establishes the basis for such restructuring. It would affect domestic marketable government securities issued under Argentine law, which represent 24% of the gross public debt and of which it is estimated that at the end of September 2019 there was about USD27 billion in face value held by private creditors.

- Further measures were announced to cover the financial program in the last quarter of the year, and the ban on public credit operations to finance operating expenses was suspended for the rest of the year.

- During September, there were placements of securities and disbursements for the equivalent of USD291 million and principal and interest payments totaling USD3.25 billion, of which 64% were amortizations. Interest payments totaled USD1.18 billion, of which 69% were made in pesos.

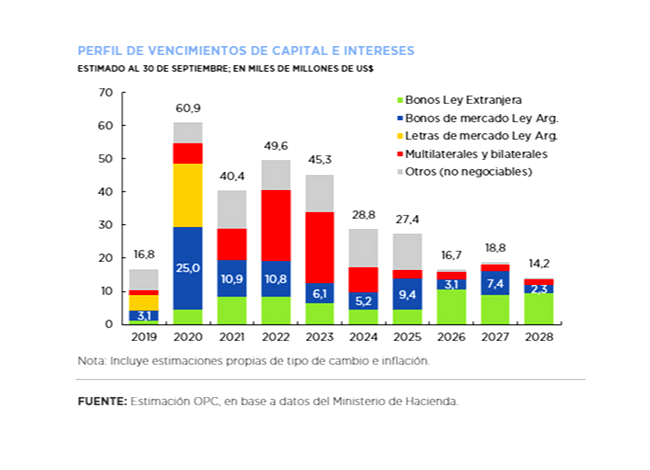

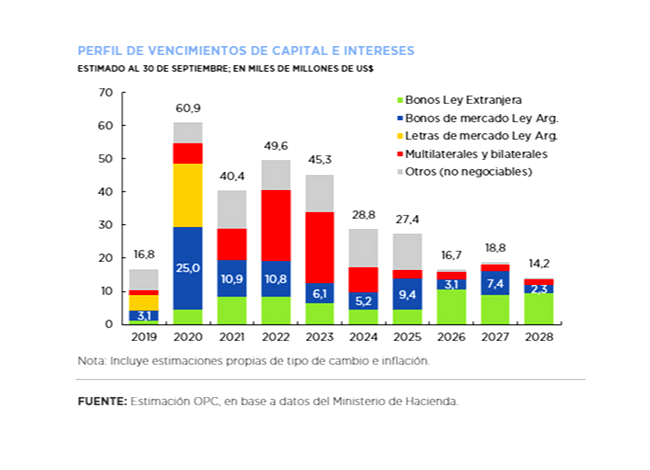

- For the last quarter of the year, debt maturities are expected to be approximately USD16.75 billion between amortizations (USD11.46 billion) and interest (USD5.29 billion), of which 62% will be paid in pesos. The approval of the fifth review of the IMF Stand-By program and the respective disbursement is still pending.

by Nicolas Perez | Sep 12, 2019 | Public Debt Operations

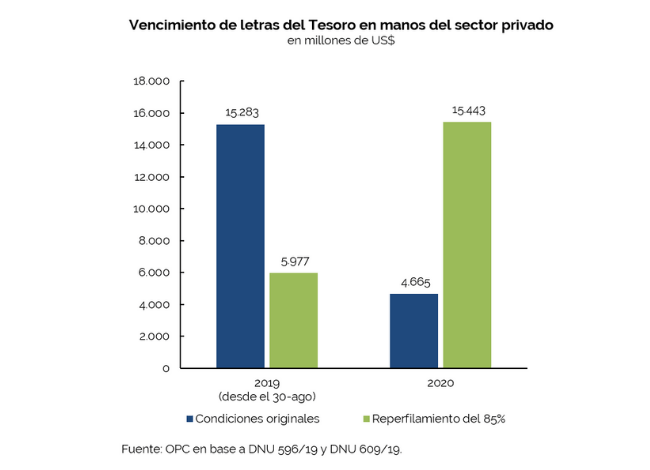

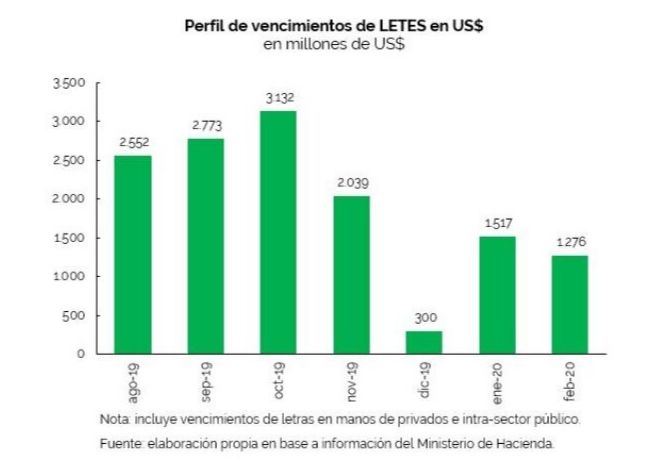

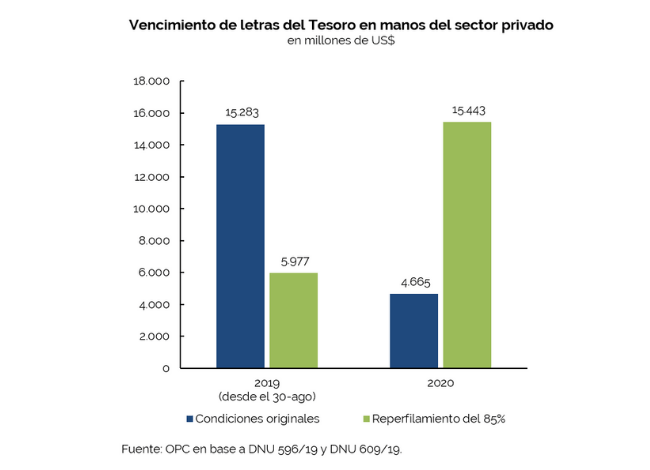

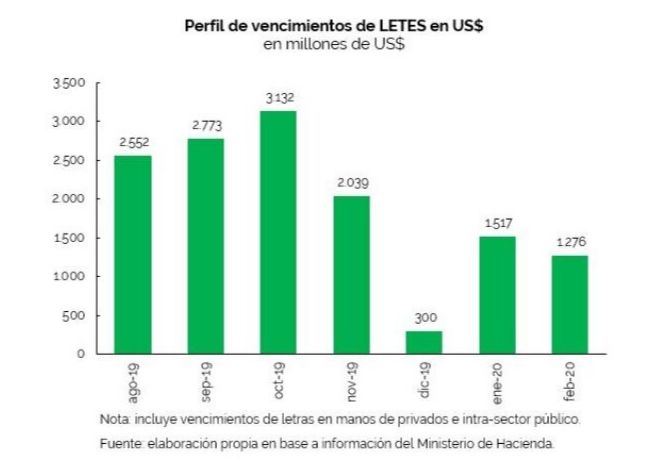

- With the financial markets facing an episode of extreme volatility, the Executive Branch announced in August a rescheduling of the maturities of Treasury bills held by institutional holders.

- The rescheduling reversed the maturity burden: under the original terms, 77% of the payments were to be made this year. But under the new schedule, 72% will be cancelled in 2020. Estimated maturities for 2019 are reduced by USD9.3 billion, but because of the extension of maturities, an additional USD1.47 billion of interest will accrue with respect to the original payment schedule.

- Placements of securities and loan disbursements for the equivalent of USD1.8 billion were recorded in August, mainly with transactions within the public sector.

- Principal and interest cancellations for USD17.06 billion were made during the month, of which 96% were for repayments of principal. The major amortizations for the month were the cancellation of bonds issued as collateral for repo transactions.

by Nicolas Perez | Aug 13, 2019 | Public Debt Operations

Placements of government securities and loan disbursements for USD13.1 billion were recorded during July. The International Monetary Fund (IMF) made the fourth disbursement under the Stand-By Arrangement for USD5.39 billion.

- Treasury Bills in pesos and dollars for the equivalent of USD5.57 billion were placed through three auctions.

- During the month, debt services amounted to USD9.2 billion, USD6.57 billion in payments of principal and USD2.64 billion in interest.

- On July 1, approximately USD1.01 billion of interest were paid on the Discount and Cuasipar bonds.

- The main maturities scheduled for August are Treasury bills in pesos and dollars. In addition, interest payments to the IMF for USD240 million are expected to be made.

by Nicolas Perez | Nov 6, 2018 | Public Debt

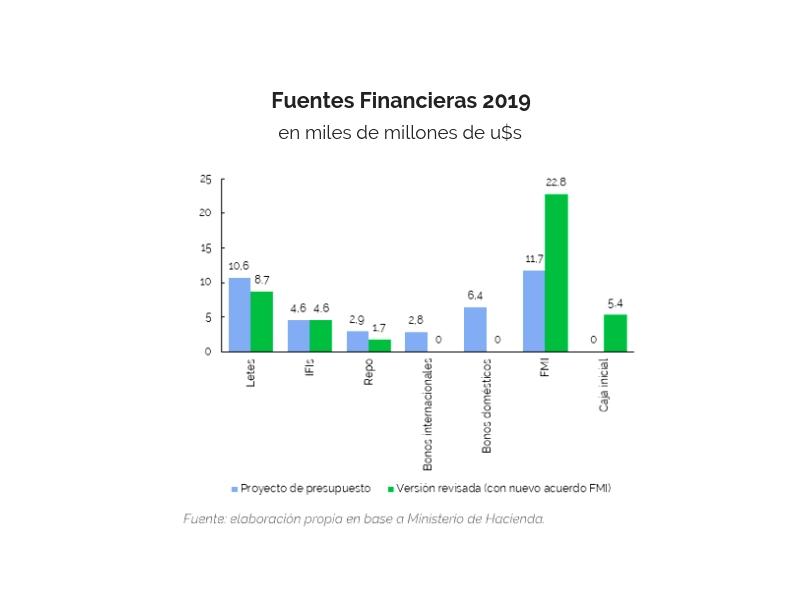

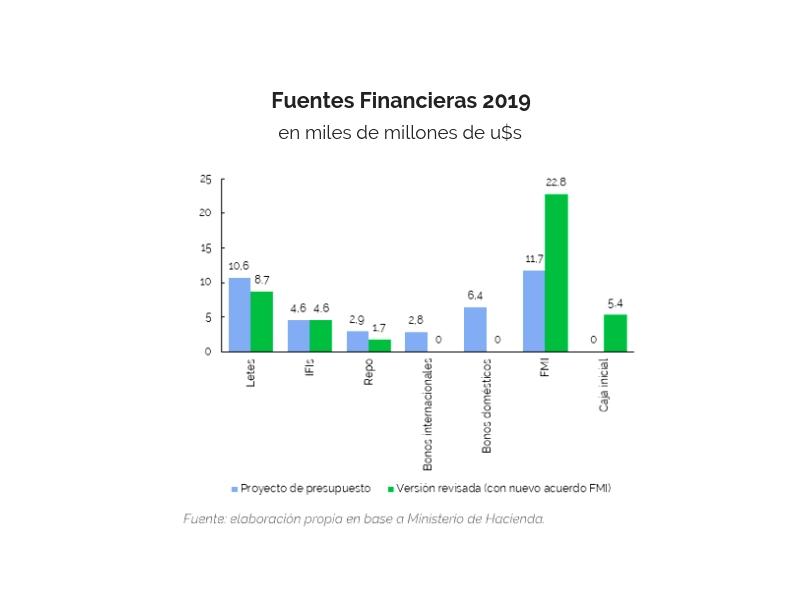

The renegotiation of the stand-by arrangement with the International Monetary Fund (IMF) resulted in a reformulation of the 2019 Financial Program with respect to the version included in the Budget Bill.

With the new arrangement, the IMF will increase its disbursements by USD7.6 billion this year and USD11.1 billion next year. The IMF assistance will cover 54% of next year’s financial needs, a figure that will drop to 14.7% in 2020.