by Nicolas Perez | Jan 17, 2020 | Public Debt Operations

During December, placements of securities and loan disbursements were recorded for the equivalent of USD9.82 billion, of which USD4.84 billion were net transfers of Temporary Advances from the Central Bank (BCRA). For the first time since July 26, an auction of instruments in pesos was held, which resulted in the placement of Treasury bills for AR$37.01 billion.

In December, the National Executive Power ordered a new deferral of payments of Treasury bills in dollars until August 31, which implied a deferral of maturities for approximately USD7.47 billion.

In the first half of 2019, the Treasury was financed mainly through the placement of short-term bills, repo transactions with commercial banks and the disbursement of the International Monetary Fund. The worsening of financial conditions in the second half of the year implied the closing of the market and the search for financing in public sector entities.

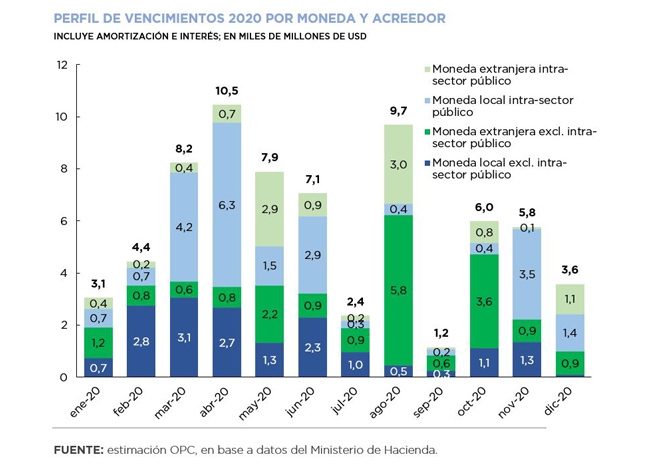

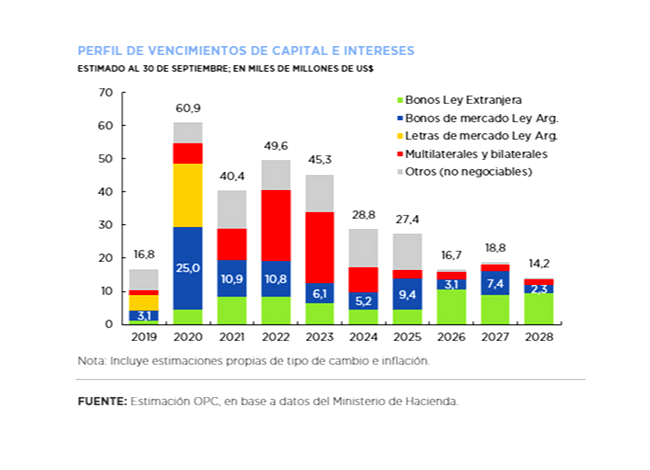

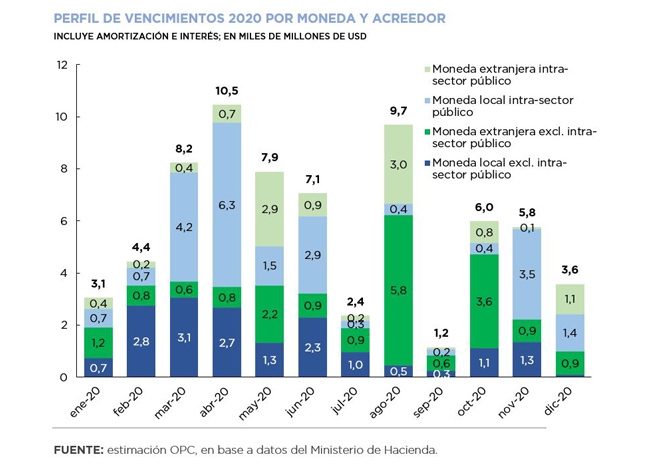

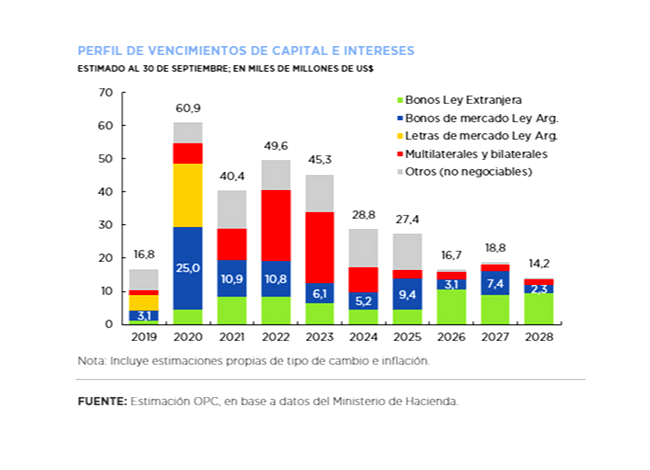

The debt service maturity profile (principal and interest) for 2020 totals USD69.7 billion. However, excluding maturities within the public sector, estimated services are reduced to USD36.21 billion.

For January, debt maturities of approximately USD3.06 billion are expected between amortizations (USD1.66 billion) and interest (USD1.39 billion).

by Nicolas Perez | Jan 15, 2020 | Budget Execution

Fiscal year 2019 ended with a real increase in resources of 2.1% with respect to the previous year and with a contraction in expenditure of 6.4% YoY, spread across the main components, apart from debt interest, which increased by 10.7% YoY in real terms.

The combination of these behaviors resulted in a financial deficit of AR$845.99 billion, equivalent to 3.9% of the Gross Domestic Product, 1.7 percentage points below that of the previous year. The primary balance showed a surplus of AR$75.49 billion, an improvement compared to 2018.

The evolution of Export Duties was decisive in the increase in tax revenues, which had a real jump of 164.4% year-on-year because of the increase in tax rates, the devaluation of the exchange rate and the higher quantities exported by the soybean sector.

This scenario offset the fall in other tax items and the resources of the social security system, affected by the lower economic activity and the reduction of taxable wages.

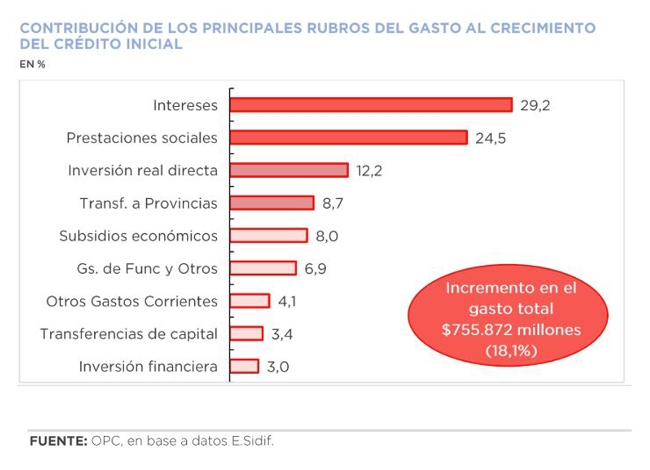

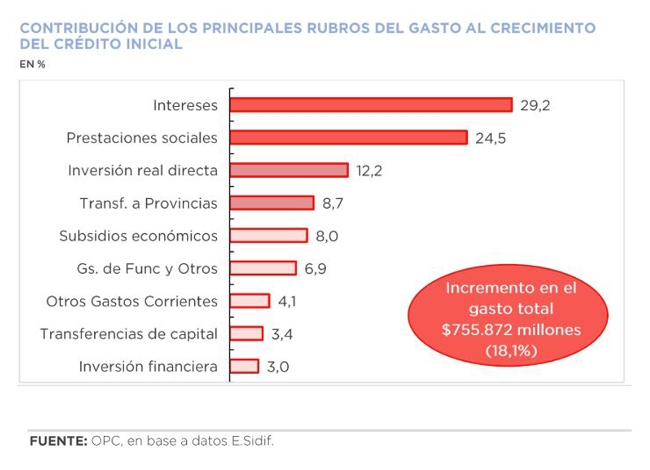

In 2019, national government expenditure reached AR$4.74 trillion, which implies an execution level of 96.2% of the allocated budget. The initial approved appropriation increased by 18.1%, with debt interest being the item that most contributed to such variation (29.2%).

by Nicolas Perez | Dec 19, 2019 | Sustainable Development Goals

The purpose of this paper is to carry out a budgetary analysis and evaluation of the progress made in Argentina in relation to Sustainable Development Goal 15 (Life of Land): to combat desertification, halt and reverse land degradation and halt biodiversity loss.

This is one of the SDGs set by the United Nations in the framework of the 2030 Agenda, a program to which the country has adhered since 2015 and for which it carried out a process of adaptation of goals and indicators.

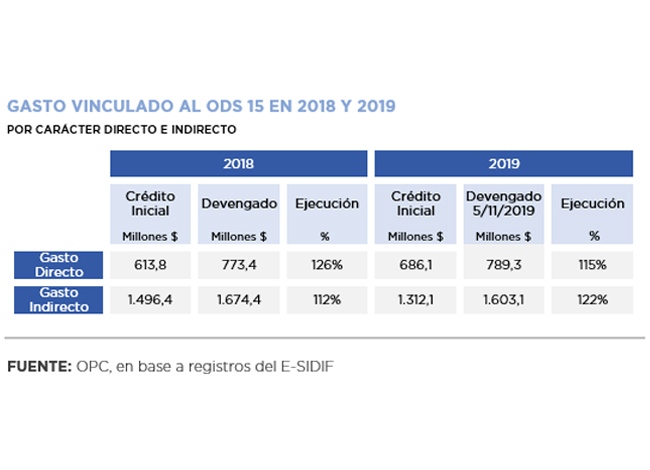

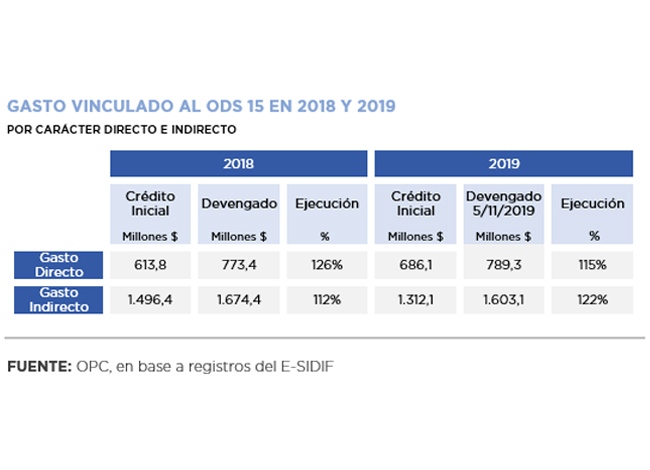

To advance with the implementation of the SDG 15, Argentina allocated AR$686 million in direct expenditures as of October (95% for current expenditures and 5% for investments). This amount is 12% higher than that of 2018 in nominal terms and its execution, two months before the closing of the fiscal year, already exceeds 112%. The budgetary significance given to sustainable forest management stands out (91% of direct expenditure related to SDG 15).

The Secretariat of Environment and Sustainable Development is the main agency responsible for its fulfillment, although there are other government agencies involved in the implementation of related programs or sub-programs.

The analysis of their compliance is difficult due to the scarcity of partial and final targets, and in some cases also of baseline. Their budgetary execution is very uneven at the level of programs and activities, ranging from over-execution of more than 300% to activities with no execution at all.

One example is the National Fund for the Enrichment and Conservation of Native Forests (FNECBN), which began to receive specific budget allocations only in 2010. These never covered the minimum amount provided for by Law 26,331 and were even under-executed in most of the fiscal years.

by Nicolas Perez | Dec 12, 2019 | Public Debt Operations

During November, interest payments totaled USD1.35 billion, of which 68% were made in foreign currency. The main disbursements were for the IMF Stand-By credit, a BONAR in dollars and the BONTE in pesos.

There were placements of securities and loan disbursements for the equivalent of USD2.11 billion, of which USD834 million were securities, placed almost entirely with different public sector entities.

Temporary advances -non-interest-bearing loans from the Central Bank to the Treasury- were made for AR$60 billion, bringing the stock of this instrument to AR$562.73 billion at the end of the month (AR$384.73 billion below the legal ceiling).

Debt maturities of approximately USD7.3 billion between amortizations (USD4.68 billion) and interest (USD2.62 billion) are to be paid in December.

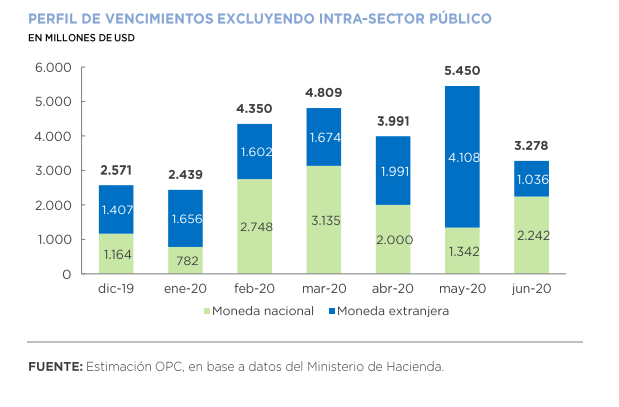

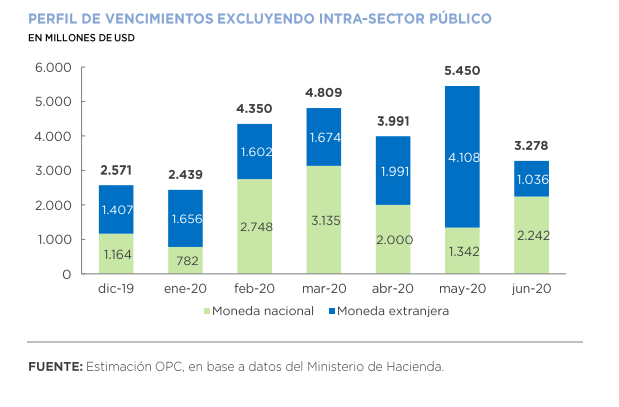

The debt service maturity profile for the first half of 2020 totals USD45.23 billion. However, when excluding maturities within the public sector, estimated services for the semester are reduced to USD24.31 billion.

by Nicolas Perez | Dec 11, 2019 | Budget Execution

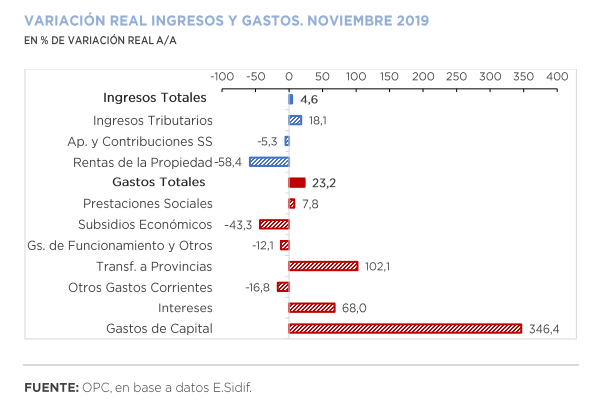

The primary balance for the month of November resulted in a deficit of AR$109.34 billion, the third month of the fiscal year with a negative outcome. Debt interest amounted to AR$124.23 billion, which had an impact on the deficit of AR$233.57 billion in the month and accumulated a disequilibrium of AR$568.49 billion in the eleven months of the current year. Even so, this figure implied a real improvement of 32.9% YoY compared to that recorded in November last year.

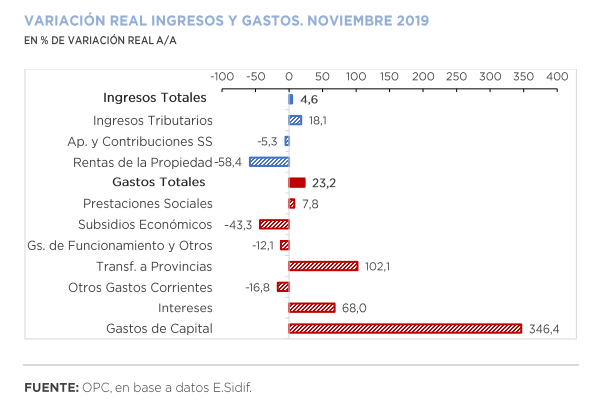

National government revenues increased 58.8% year-on-year (YoY), mainly explained by the growth of Export Duties (141.1% YoY in real terms), as the agro-export sector speeded up settlements due to the expectation of an increase in tax rates.

November was the month with the highest year-on-year expansion of total expenditures so far this year (87.2% YoY), mainly driven by the growth of real direct investment (1,302.6% YoY), transfers to provinces (206.9% YoY) and interest on debt (155.1% YoY).

As of November 30, 82.0% of total budget was accrued, with the execution of current transfers to the provinces (86.2%) standing out. During this period, the initial budget approved for the year increased by AR$797.26 billion, which represents 19.1% of the initial appropriation. A total of 88.8% of the amendments were implemented through Necessity and Emergency Decrees, and the remaining 11.2% through Administrative Decisions.

by Nicolas Perez | Oct 11, 2019 | Public Debt Operations

- At the end of September, the Executive Branch submitted to Congress a Bill for the inclusion of Collective Action Clauses in sovereign bonds under domestic law. The Bill does not include a restructuring proposal but establishes the basis for such restructuring. It would affect domestic marketable government securities issued under Argentine law, which represent 24% of the gross public debt and of which it is estimated that at the end of September 2019 there was about USD27 billion in face value held by private creditors.

- Further measures were announced to cover the financial program in the last quarter of the year, and the ban on public credit operations to finance operating expenses was suspended for the rest of the year.

- During September, there were placements of securities and disbursements for the equivalent of USD291 million and principal and interest payments totaling USD3.25 billion, of which 64% were amortizations. Interest payments totaled USD1.18 billion, of which 69% were made in pesos.

- For the last quarter of the year, debt maturities are expected to be approximately USD16.75 billion between amortizations (USD11.46 billion) and interest (USD5.29 billion), of which 62% will be paid in pesos. The approval of the fifth review of the IMF Stand-By program and the respective disbursement is still pending.