by Nicolas Perez | Jul 21, 2020 | Public Debt

On Thursday, July 16, the Executive Branch sent to Congress a Bill for the restructuring of securities in dollars issued under Argentine legislation. The swap offer covers a set of securities with a total outstanding amount of US$41.7 billion (of which 35% is held by private bondholders). Eligible bonds represent 12.9% of total debt and 12.5% of GDP.

In general terms, the proposed transaction has similar terms to the last offer to restructure bonds under foreign legislation that was submitted at the beginning of the month. As a novelty, for some eligible securities, the alternative of swapping for inflation-adjustable bonds (CER) is included. For securities in dollars payable in pesos (USD linked), the only alternative is the swap for CER bonds.

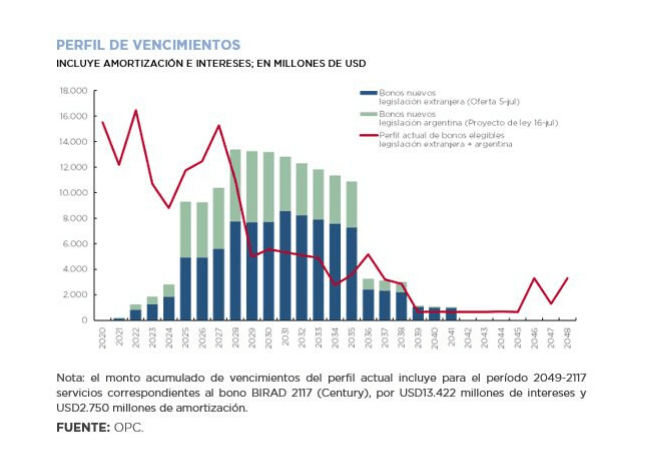

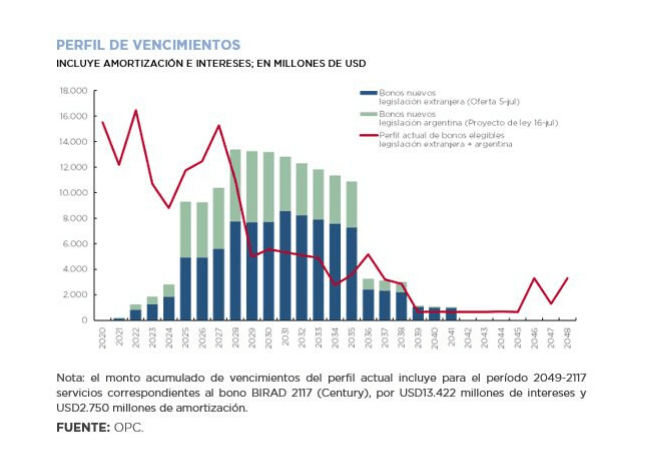

Under the assumption that all eligible securities are swapped, the new bonds would generate amortization and accrued interest of approximately USD2.2 billion for the term 2020-2024 and USD32.5 billion for 2020-030. Compared to the current maturity profile, this implies a reduction in debt service of approximately US$30.4 billion and US$19.6 billion, respectively.

by Nicolas Perez | Jul 7, 2020 | Public Debt

Argentine government announced an improvement in the terms and conditions of its proposal to restructure bonds issued under foreign legislation, whose acceptance deadline is August 4.

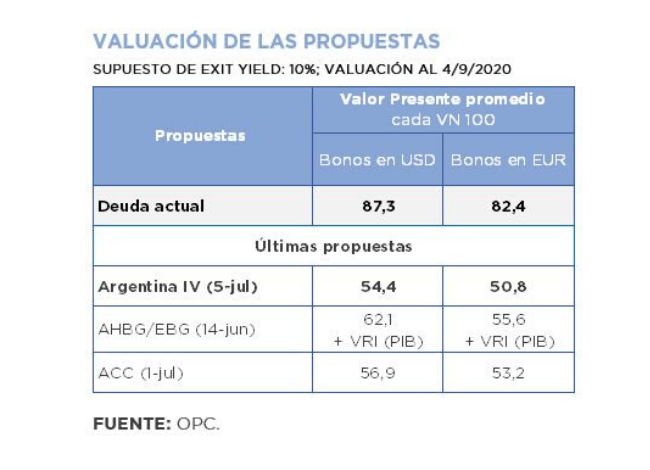

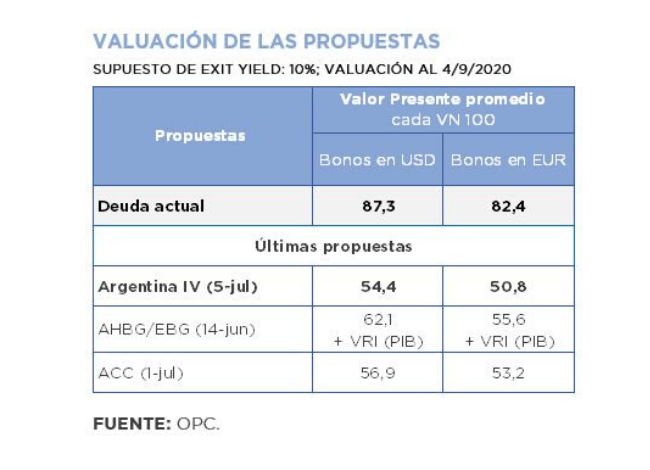

The new proposal has an estimated average value of USD54.4 for dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest proposals from creditors are between USD57 and USD62.

Compared to the original offer submitted on April 22, reductions on principal are lowered, interest accrual is brought forward, coupon rates are increased, and the average life is reduced. The new proposal involves amortization and interest payments of approximately USD4 billion in the term 2020-2024 and USD42.4 billion in 2020-2030.

In addition, the original indentures of the eligible securities are maintained, and accrued interest is recognized through the delivery of a bond maturing in 2030. Despite the improvement of the Argentine offer, there are still differences in relation to the financial and legal terms with respect to the position of the main bondholders groups, particularly the last joint proposal of the AHBG and EBG groups. For their part, the investment funds Gramercy and Fintech have publicly announced their support to the new proposal.

by Nicolas Perez | Jun 10, 2020 | Budget Execution

The transfer of profits from the Central Bank to the National Treasury for AR$430 billion during May improved total revenues to face the higher expenses demanded by the health emergency and reduced the deficit in public accounts.

- Primary expenditures increased by 45.1% year-on-year (YoY) in real terms, basically to cover expenditures made in the context of the pandemic, which amounted to approximately AR$160.86 billion during the month.

- The increase in total expenditures slowed down to 21.3% YoY, mainly due to a 52.4% YoY decrease in debt interest payments.

- Without the Central Bank’s help, the primary deficit would have totaled AR$265.34 billion and total revenues would have fallen by 35.8% YoY compared to the previous year.

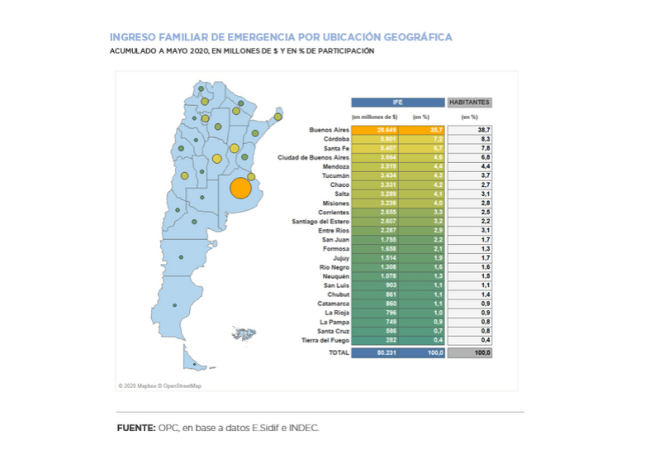

- The initial budget appropriation increased by AR$788.17 billion (16.2%), 93.4% of the increase being concentrated in social benefits (AR$541.23 billion), in transfers to the provinces (AR$124.92 billion) and in other current expenditures (AR$69.83 billion).

by Nicolas Perez | May 14, 2020 | Public Debt Operations

The government submitted its proposal for the restructuring of bonds issued under foreign legislation in April. The proposal covers twenty-one series of bonds totaling US$65.62 billion, eligible for swap into ten new securities (five denominated in dollars and five in euros), with annual payments, maturing in 2030, 2036, 2039, 2043, and 2047. The deadline for creditors to submit their consent, which was due on Friday, May 8, was extended to May 22.

Within the course of the negotiation, the payment of the interest coupons of the BIRAD 2021, 2026 and 2046 bonds (which are part of the bonds eligible for the swap) for a total amount of USD503 million, due on April 22, was not made. The grace period to make the payment runs until May 22, after which a default will occur.

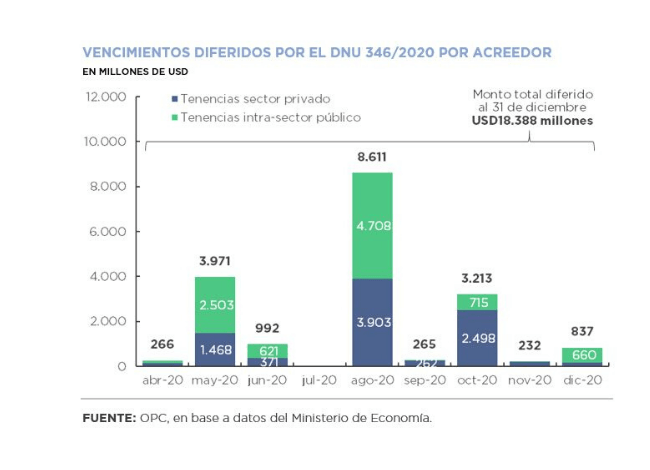

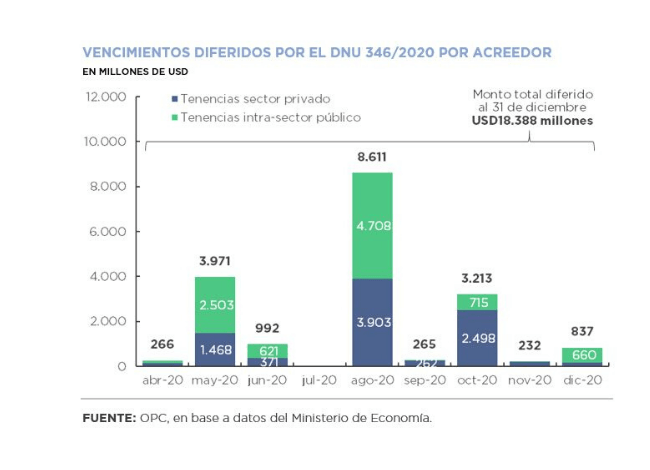

Necessity and Urgency Decree (DNU) 346/2020 postponed to December 31 the payments of interest and amortization of public debt securities in dollars issued under domestic legislation. As a result, payments of USD18.38 billion were deferred until the end of the year, USD9.01 billion of which were held by private investors.

Six auctions were held during the month, resulting in the placement of AR$435.97 billion in securities in pesos, including AR$314.07 billion as part of a swap transaction of the BONCER TC20. In addition, financing was obtained from the Central Bank through the placement of USD171 million in Bills and Temporary Advances (TA) for AR$80 billion.

by Nicolas Perez | Apr 25, 2020 | Public Debt

The Government submitted its proposal for the restructuring of bonds issued under foreign legislation. The swap proposal covers 21 series of bonds, issued under New York and UK legislation, and denominated in dollars, euros, and Swiss francs, totaling USD65.62 billion.

The proposal includes the swap of the eligible bonds for ten new bonds (five in dollars and five in euros), repayable in annual payments, maturing in 2030, 2036, 2039, 2043, and 2047.

Acceptance of the offer would imply a reduction of principal of 5.4%. The stock of bonds issued under foreign legislation would be reduced by USD3.67 billion (from USD65.62 billion to USD61.95 billion).

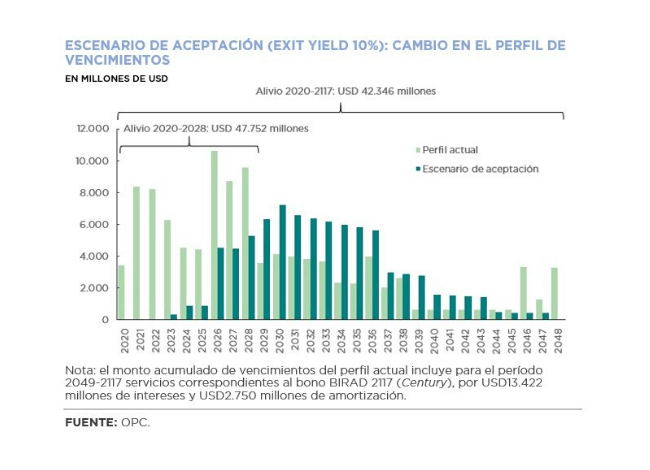

The maturity schedule would be significantly modified, due to a combination of interest coupon reduction, grace period and maturity extension. The average maturity would increase from 5.9 to 11 years.

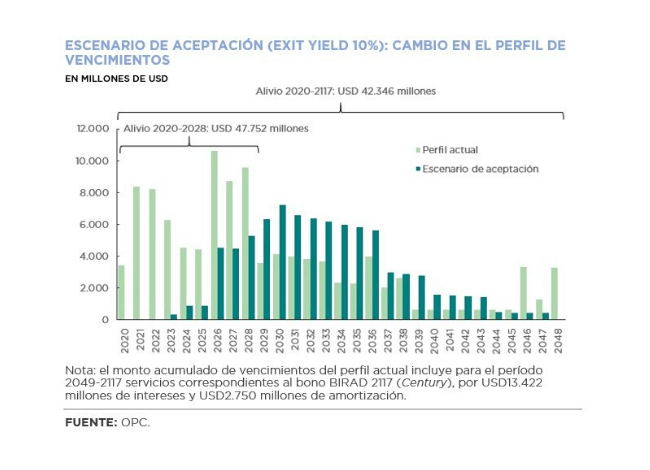

Throughout the bonds’ life, the interest burden would be reduced by USD38.67 billion (from USD59.67 billion to USD20.99 billion). By adding the reduction of principal, a net reduction of US$42.34 billion in total servicing would be obtained. The relief would be concentrated in the first years, accumulating USD47.75 billion in the term 2020-2028.

by Nicolas Perez | Feb 19, 2020 | Budget Execution

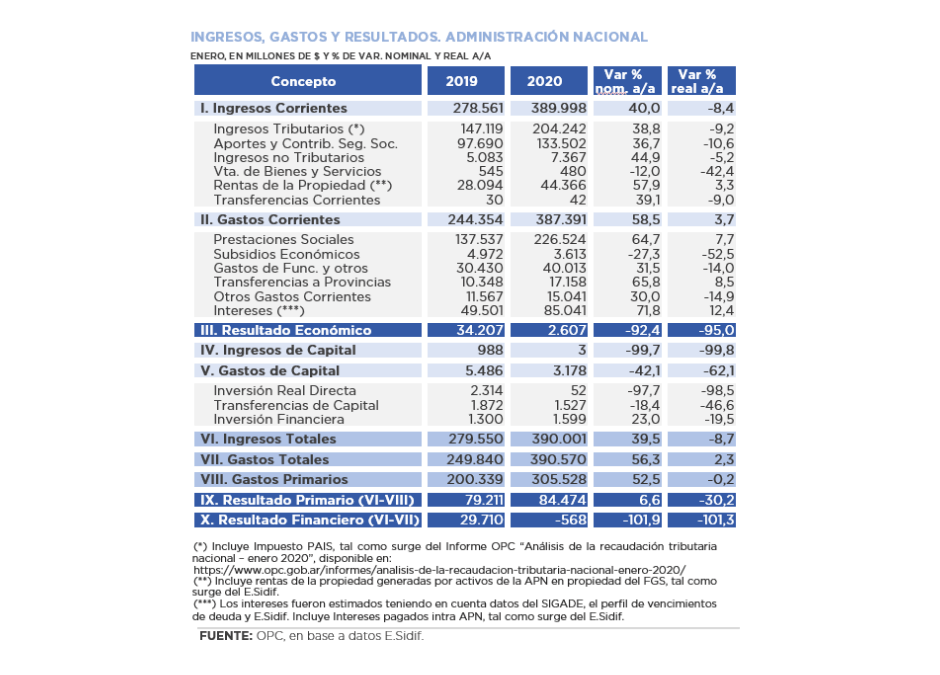

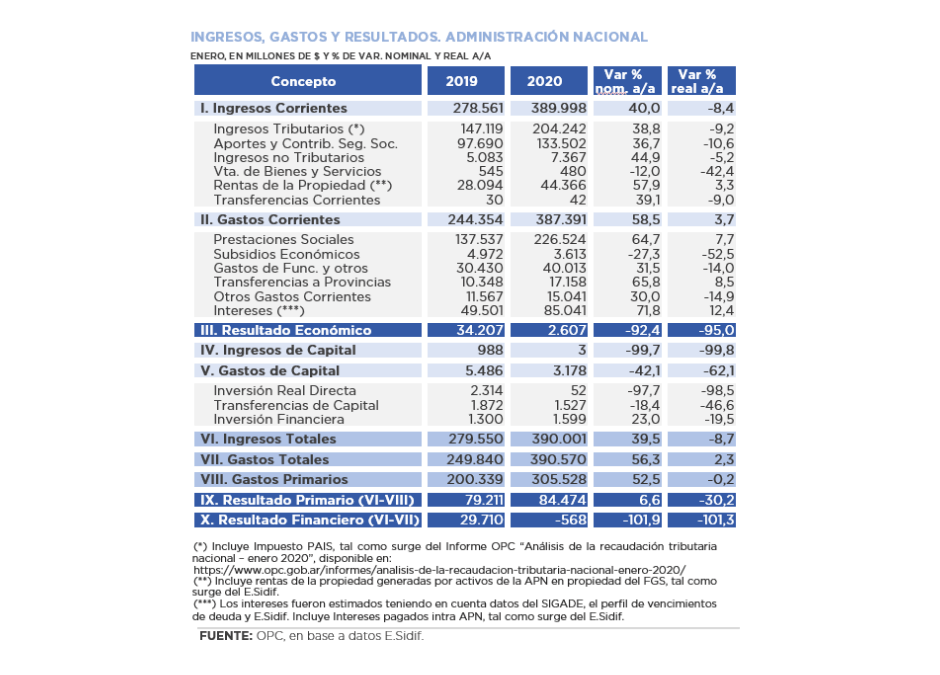

Total revenue recorded a real drop of 8.7% year on year (YoY) in January, while total expenditures had a growth of 2.3% YoY.

This uneven performance resulted in a financial deficit of AR$568 million, which contrasts with the surplus of AR$29.71 billion recorded in January 2019. On the other hand, the primary balance was AR$84.47 billion, 30.2% lower in real terms than in the same month of last year (AR$79,21 billion).

- Tax and social security resources, which together accounted for 86.6% of revenues, showed significant decreases. Income Tax (-18.1% YoY) led the decline mainly due to regulatory issues. The drop is also explained by the legal amendment that reduced the obligation to make contributions on a segment of salaries, in addition to the reduction in the number of contributors last year.

- The distinctive feature of January’s performance was the lower dynamism of Export Duties, which rose only 3.8% in the year-on-year comparison and had been acting as the driving force of the tax collection with sharp increases.

- On the other hand, property income increased, basically due to resources from the Sustainability Guarantee Fund (FGS), which reached AR$42.8 billion, showing a real increase of 7.6% YoY.

- The item Pensions fell 0.6% YoY in real terms. Considering the extraordinary “bonus” of AR$5,000 for the lowest pensions, there was a recovery of 10.3% YoY.

- Economic subsidies (AR$3.61 billion) contracted 52.5% YoY, which is mainly explained by energy subsidies which had registered an execution of AR$2.05 billion in January 2019 and recorded no outlays in January 2020.

- Consumer goods and payment of utilities reflected a real drop of 58.4% YoY, as well as capital expenditures, which fell 62.1% YoY. Debt services, on the other hand, increased by 12.4% YoY compared to January of the previous year.