TAX BURDEN ON PRODUCTIVE ACTIVITY. MAIN RESULTS

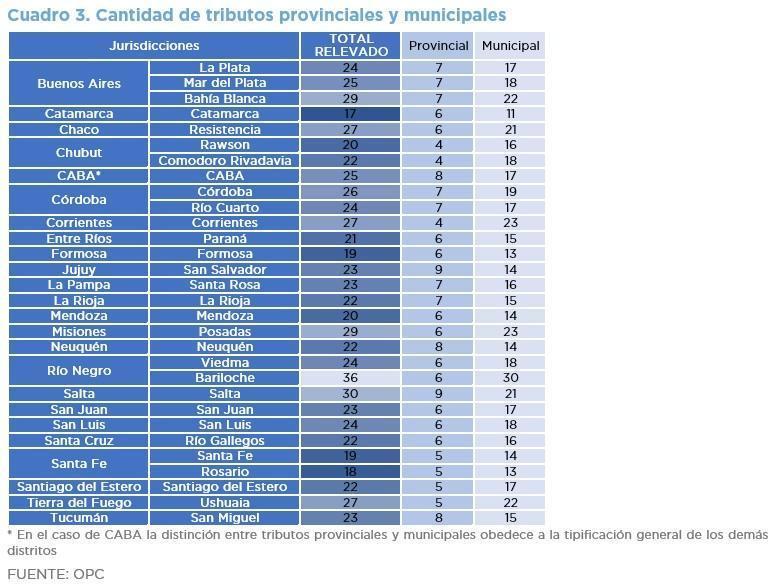

The purpose of this report is to evaluate the consolidated tax burden on the meatpacking, metal-mechanic, supermarket, transportation, and hotel sectors in thirty locations in the country.

Under certain assumptions and without including some taxes such as Fuel Taxes or Export Duties, the average tax burden is equivalent to 12% of the companies’ turnover.

- There is an important tax burden dispersion by activity and location. From a minimum of 7.5% of the total turnover for a meat packing activity carried out by an SME in the city of San Luis, to a maximum of 17.3% for a large hotel in Bariloche.

- There are also differences in the tax burden depending on whether it is a small or large company and between firms in the same industry: from 25% in hotels to 50% in the meat packing sector.

- There is double or triple taxation due to the overlapping of taxes, which makes it difficult to know the real cost that the productive sectors face.

- This study refers to a tax burden baseline and is limited by the lack of information requested from chambers of commerce and municipalities, but which was not provided.