by Nicolas Perez | Dec 11, 2019 | Budget Execution

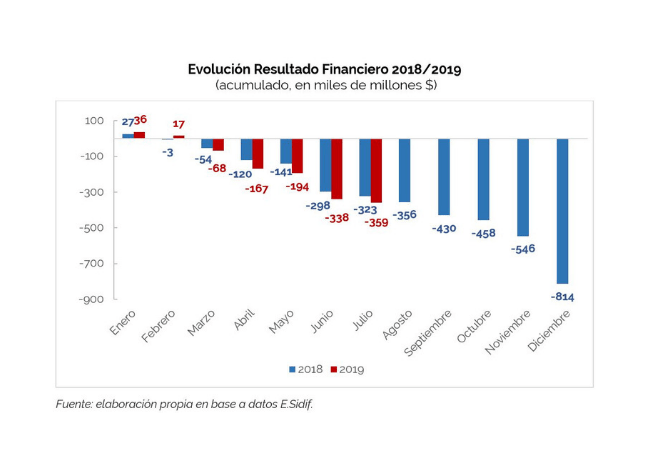

The primary balance for the month of November resulted in a deficit of AR$109.34 billion, the third month of the fiscal year with a negative outcome. Debt interest amounted to AR$124.23 billion, which had an impact on the deficit of AR$233.57 billion in the month and accumulated a disequilibrium of AR$568.49 billion in the eleven months of the current year. Even so, this figure implied a real improvement of 32.9% YoY compared to that recorded in November last year.

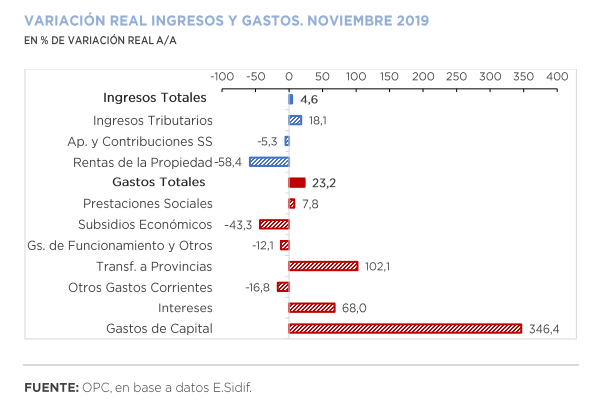

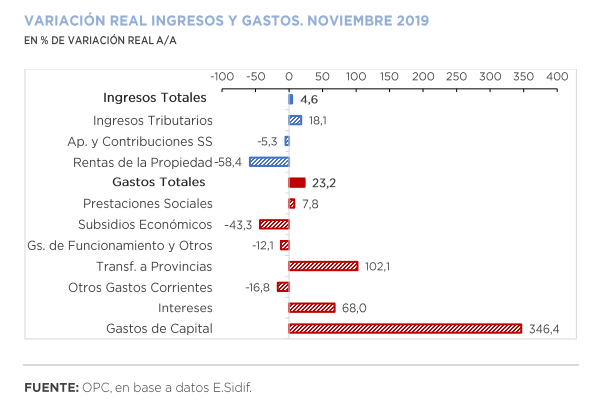

National government revenues increased 58.8% year-on-year (YoY), mainly explained by the growth of Export Duties (141.1% YoY in real terms), as the agro-export sector speeded up settlements due to the expectation of an increase in tax rates.

November was the month with the highest year-on-year expansion of total expenditures so far this year (87.2% YoY), mainly driven by the growth of real direct investment (1,302.6% YoY), transfers to provinces (206.9% YoY) and interest on debt (155.1% YoY).

As of November 30, 82.0% of total budget was accrued, with the execution of current transfers to the provinces (86.2%) standing out. During this period, the initial budget approved for the year increased by AR$797.26 billion, which represents 19.1% of the initial appropriation. A total of 88.8% of the amendments were implemented through Necessity and Emergency Decrees, and the remaining 11.2% through Administrative Decisions.

by Nicolas Perez | Aug 8, 2019 | Budget Execution

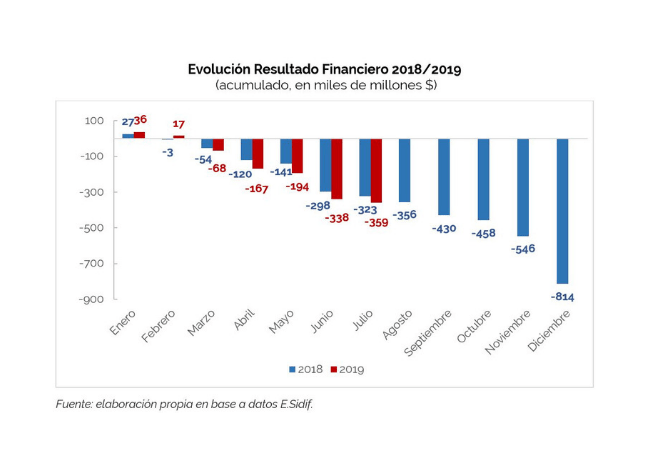

A surplus of AR$43.42 billion was recorded in July, a considerable improvement over the previous year’s figure (-AR$1.9 billion). The financial balance is negative by AR$21.04 billion but implies a drop of 44.4% in real terms in the year-on-year comparison. Transfers to provinces showed a monthly year-on-year drop for the first time this year.

- The increase in resources slowed down in July, although they grew again above expenditures (55.9% vs. 49.0%).

- Tax revenues (58.8%) led total revenue growth, while debt interest (186.4%) and capital expenditures (152.9%) were the fastest growing components of public expenditure.

- In the first seven months of the year, the financial balance was negative by AR$359.1 billion, an increase of 11.2% with respect to the same period of the previous year. In real terms, this represents a reduction of 27.9%.

- During the first seven months of the year, 57.0% of total expenditure was accrued, identical to the level recorded in the same period a year ago.

- From the beginning of the fiscal year to the end of July, the initial budget was increased by AR$88.3 billion, that is, 2.1%. The 39.2% of the amendments were implemented through the Necessity and Urgency Decree 193, while the remaining 60.8% were implemented through four Administrative Decisions.

by Nicolas Perez | Jun 25, 2019 | Budget Law

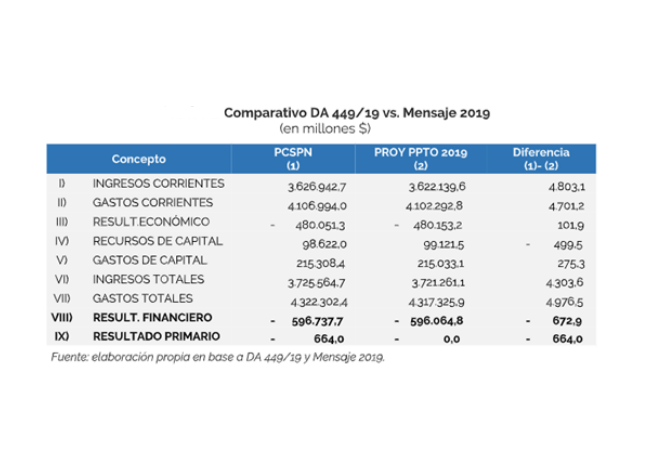

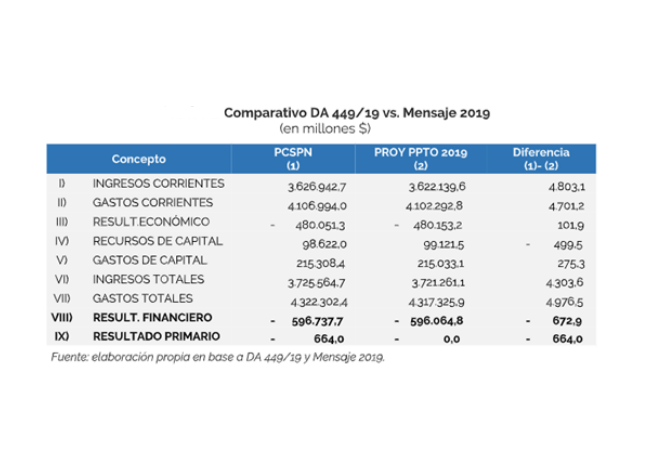

Administrative Decision No. 449/19 approved the Consolidated Budget of the National Public Sector for Fiscal Year 2019, in compliance with the provisions of Article 55 of Law No. 24,156 on Financial Administration and Control Systems of the National Public Sector, as amended. Said article provides that the National Budget Office must prepare the consolidated budget annually and submit it to the National Executive Branch before March 31 of the year in which it is in effect. Once approved, it is submitted to the National Congress.

The Consolidated Budget of the National Public Sector represents the integration of the economic transactions carried out by the different agencies of the National Public Sector, which provides information on the total public expenditure and revenue and the effect on the rest of the economic system.