Economic Analysis of Law 27,430. Tax Reform 2017

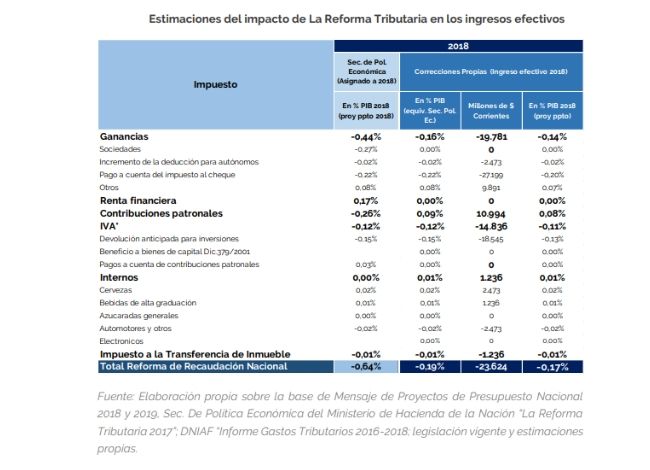

The tax reform provided for by Law 27,430 would have a lower effect on tax revenue in 2018 than officially estimated to date due to the delay in the regulation and implementation of the measures adopted within this framework.

At the end of this year, this reform would result in a decrease in tax revenue of nearly AR$23.5 billion, equivalent to 0.2% of GDP, only one third of the 0.6% of GDP estimated by the Secretariat of Economic Policy.

The impact will be greater as the changes are consolidated, but the volatility of the tax system and its sensitivity to macroeconomic situations makes it difficult to give a precise estimate of the future.