by Nicolas Perez | Sep 9, 2020 | Tax Revenue

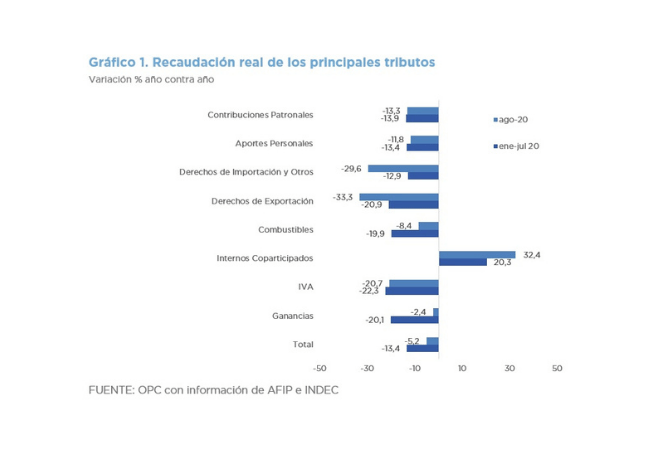

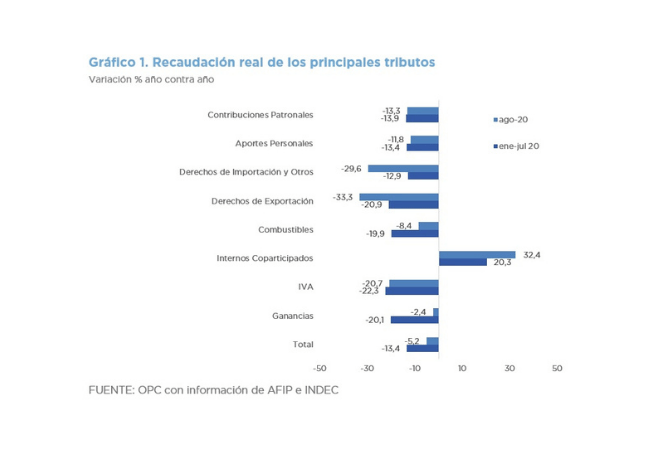

National tax revenue reached AR$612.14 billion in August, which implied a nominal growth of 33.5% year on year (YoY), but a contraction in real terms of 5.2%. This fall was the most moderate since February.

The slowdown in the decline in tax revenue can be explained by the gradual increase in the level of activity due to the partial relaxation of the restrictions imposed in the context of the COVID-19 pandemic. In addition, balances of Income Tax for Individuals and Wealth Tax,

whose original maturity in June was extended to August, were collected. The first advance payment for the year 2020 of the Income Tax for Individuals and Wealth Tax was also collected. PAIS tax reached a collection record, mainly driven by the purchase of foreign currency for hoarding purposes.

The uneven evolution of taxes throughout the year has generated a change in the composition of tax revenue, with a lower weight of the three most important taxes (VAT, Income Tax and Social Security) and an advance of taxes such as Wealth Tax, Co-participated Internal Revenue and PAIS Tax.

Likewise, it is estimated that the resources allocated to the National Administration fell in the first 8 months of the year by 13.6% YoY in real terms, those of Other Non-Financial Public Sector Entities by 16.8% YoY and those of the provinces by 11.5% YoY.

by Nicolas Perez | Aug 10, 2020 | Tax Revenue

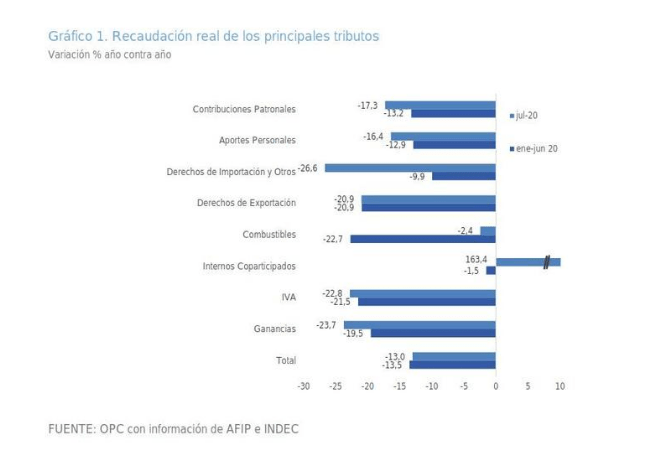

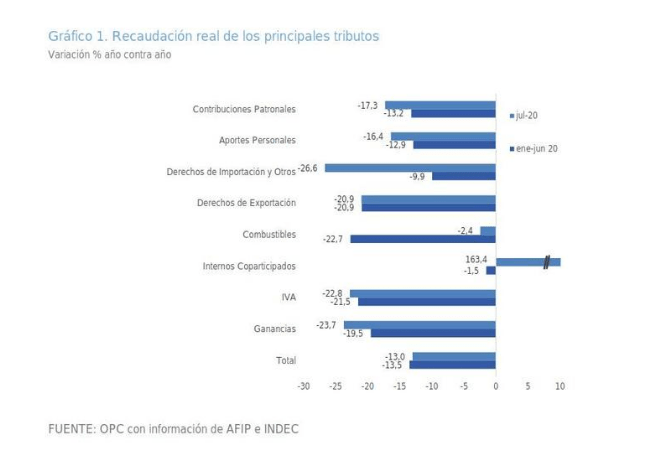

Total tax revenue amounted to AR$559.09 billion in July, which implied a nominal growth of 24% YoY, however, it contracted for the seventh consecutive month when adjusted for inflation, showing a decrease of 13% YoY.

In the first seven months of the year, total collection amounted to AR$3.44 trillion, 26.2% higher than in the same period of last year.

The main factor behind the drop in inflation-adjusted tax revenues was the economic impact of COVID-19. The national tax revenue is strongly linked to the level of activity, so the recessionary context, deepened by the pandemic, is the main factor explaining why tax revenue has decreased in 22 of the last 25 months in real terms.

by Nicolas Perez | Jun 5, 2020 | Tax Revenue

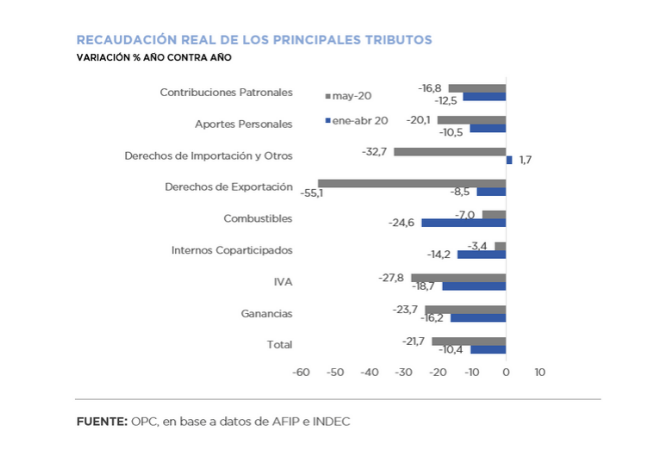

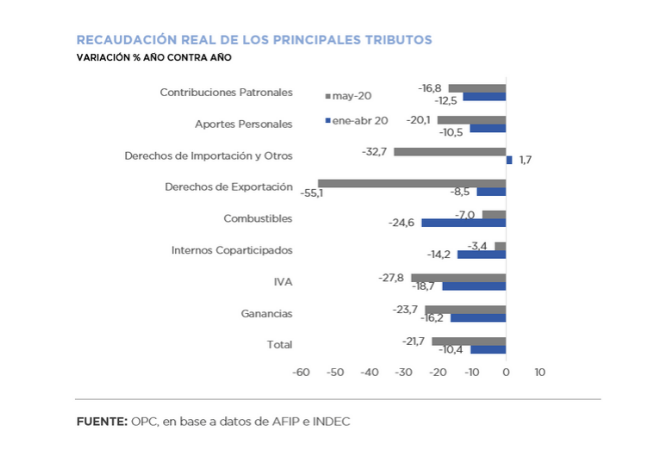

- National tax revenue reached AR$499.53 billion in May, which implied a nominal growth of 12.4% year on year (YoY), but a drop of 21.7% YoY, when adjusted for inflation.

- All taxes shrank in real terms, but the sharpest declines were in taxes related to foreign trade and VAT, with decreases of 49.1% and 27.8%, respectively. Both contractions are the sharpest since the beginning of 2002.

- The decline in tax revenue during May was explained by the adverse macroeconomic context caused by the COVID-19 pandemic and by the fiscal relief measures implemented by the national government.

- There was a record collection of the PAIS Tax (AR$11.9 billion) due to higher purchases of foreign currency.

- Resources for the first five months of the year were 16.3% below OPC’s November estimate, basically because of changes in the economic and regulatory situation.

- Tax relief measures in the framework of the pandemic in the first five months reduced the estimated revenue by AR$75.93 billion.

by Nicolas Perez | May 11, 2020 | Tax Revenue

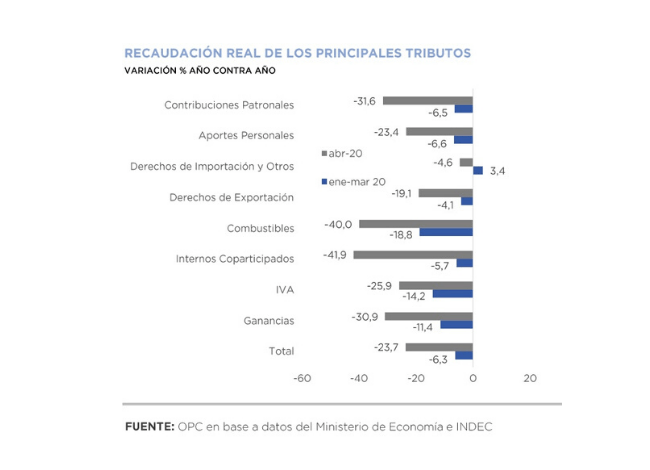

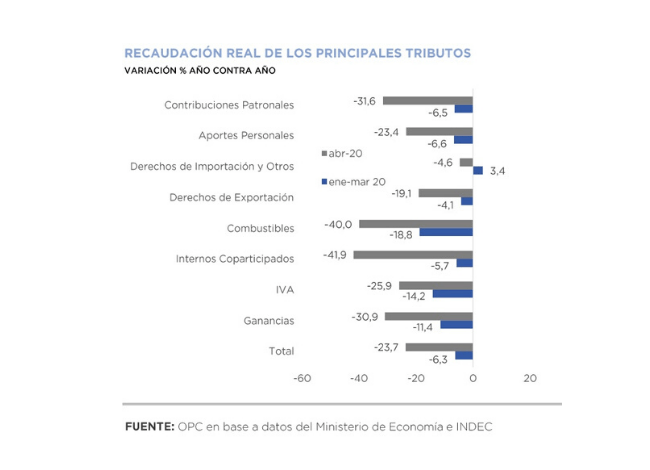

As anticipated, inflation-adjusted tax revenue fell 23.7% year on year (YoY) in April. Beyond some tax measures adopted by the National Executive Power to assist the productive sector in coping with the economic impact of the Mandatory Preventive Social Isolation (ASPO), the fall is explained by the slowdown in economic activity.

Revenues from national taxes totaled AR$398.66 billion, which implied a growth of 11.6% YoY.

The most important taxes had a significant drop in real terms. Income tax collection fell by 30.9% YoY, VAT by 25.9% YoY and Social Security resources contracted by 24.7% YoY. In addition, foreign trade revenues fell 15.2% YoY.

Although the pandemic and the ASPO were the main factors behind the poor collection performance in April, other factors also contributed. From the regulatory point of view, VAT refunds for the purchase of food, the reduction of Employer Contributions for the health sector, the deferral of the SIPA component of Employer Contributions for two months and the freezing of part of the Fuel Taxes in effect during March contributed to the lower inflow of resources. From the macroeconomic point of view, the deterioration of the labor market and the contraction of international trade contributed to the sharp drop in revenues.

May revenues are expected to continue to fall in real terms. Although some economic activities were exempted from the quarantine during April, the impact of the measure on the level of activity remained. On the other hand, measures such as the reduction or deferral of Employer Contributions, the reduction in the rate of the Tax on Debits and Credits to Current Accounts and the VAT refund for dairy products will have an impact on May revenues.

by Nicolas Perez | Nov 8, 2019 | Tax Revenue

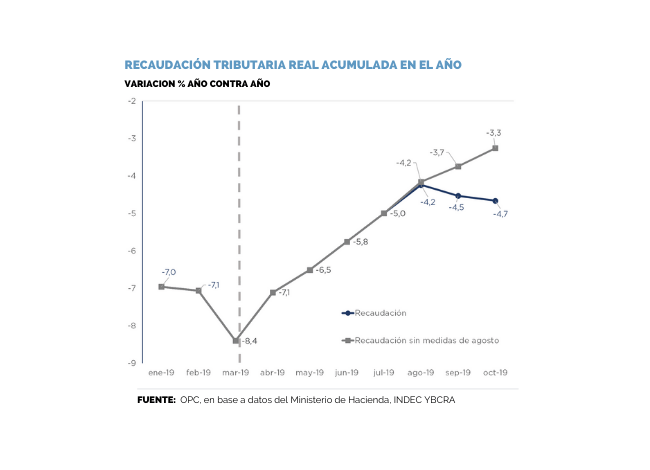

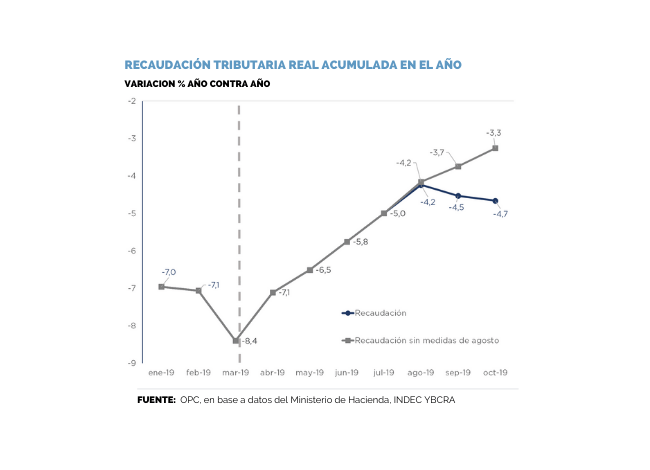

In October, tax revenue totaled AR$446.17 billion, which implied a growth of 42.8% YoY. In the annual cumulative figure as of October, tax resources of the National Public Sector show a 46.8% YoY growth. Revenue decreased by 5.9% YoY in real terms in the tenth month of the year.

October revenues were reduced by the impact of the fiscal stimulus measures announced by the National Executive Power during the month of August. According to OPC estimates, those measures caused a loss of resources of around AR$35 billion last month. Excluding this effect, nominal revenue would have grown 53.9% YoY, and 1.4% YoY in real terms.

The measures mentioned above particularly affected the collection of Income Tax, Social Security and VAT. On the other hand, Export Duties increased in October with respect to the previous month because of a higher number of tons for export.

by Nicolas Perez | Jun 7, 2019 | Tax Revenue

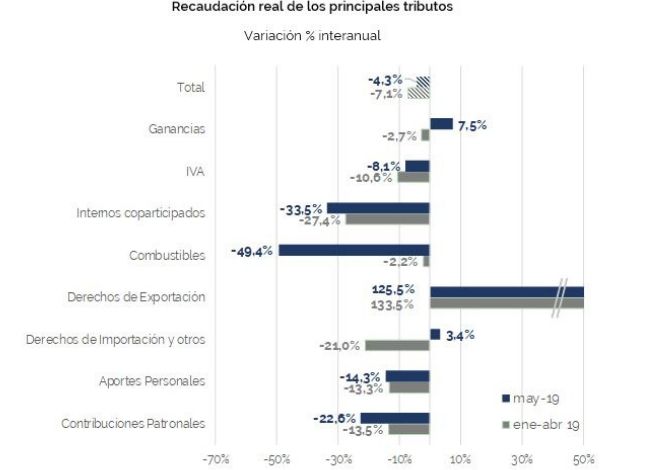

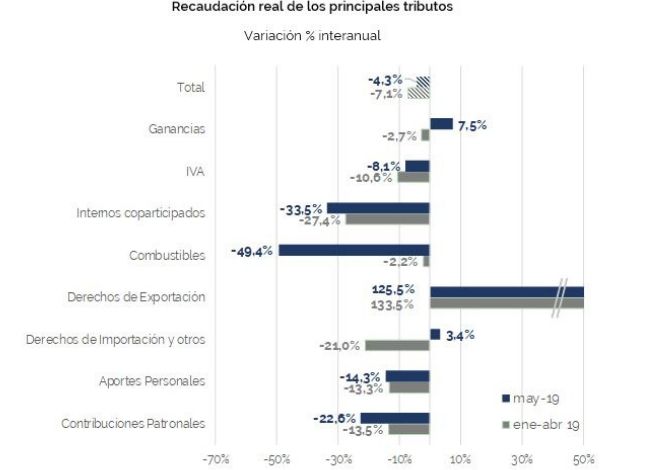

In May, tax revenue grew 50.4% in nominal terms with respect to the same month of the previous year but declined 4.3% in real terms during the same period. This decline deepens to 6.5% when considering the first five months of the year.

Overall tax revenue has been declining in real terms for eleven consecutive months, although it began to reduce the rate of decline.

In this context, Income Tax exceeded the collection expectations for the month with an increase of 7.5% year-on-year in real terms. Together with taxes on foreign trade, it is one of the taxes whose growth exceeded inflation.

VAT contracted by 8.1% in May, although this record implies a deceleration of the falls of the last seven months.

The decline in Social Security resources deepened because of the deterioration of the labor market and the changes in the employer contributions system. However, in the fifth month of the year, Social Security resources might have found its lowest level, and in the following months the trend may consolidate.