TAX EXPENDITURES – METHODOLOGICAL ISSUES AND ANALYSIS OF 2021 BUDGET

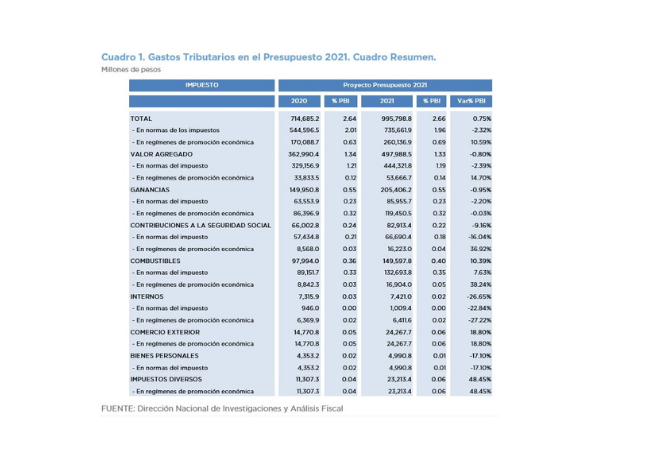

Due to tax exemptions and promotional regimes, the Budget Law estimates that next year’s tax expenditure will be AR$995.8 billion, equivalent to 2.64% of GDP, a level comparable to that of this year.

Of this total, 73.9% consists of special tax treatments included in the current tax legislation (AR$735.7 billion) and the rest is for various economic promotion regimes (AR$260.1 billion).

- For 2020, total tax expenditures are expected to reach AR$714.7 billion, equivalent to 2.63% of GDP and with a similar composition.

- In the projection for next year, lower VAT collection stands out, with a total of AR$444.3 billion (1.18% of GDP); more than half of it is due to reduced rates on meat and vegetables.

- Fuel Tax is the second largest tax expenditure, with AR$132.7 billion, mainly explained by the difference between the rates applied to gasoline and diesel fuel (AR$83.36 billion).

- Nearly half of the reduced income tax collection (AR$85.5 billion) is due to the exemption applicable to the income of judges and officials of the national and provincial Judiciary.

- The two promotional regimes with the highest tax expenditure are those of the province of Tierra del Fuego (AR$77.8 billion) and Knowledge Economy (AR$18.4 billion).

The deferral of tax payments, the accelerated amortization in Income Tax and early refund of tax credits in VAT are not considered tax expenditures; these measures are mainly contained in different promotional regimes.