by Nicolas Perez | Nov 19, 2019 | Budget Law

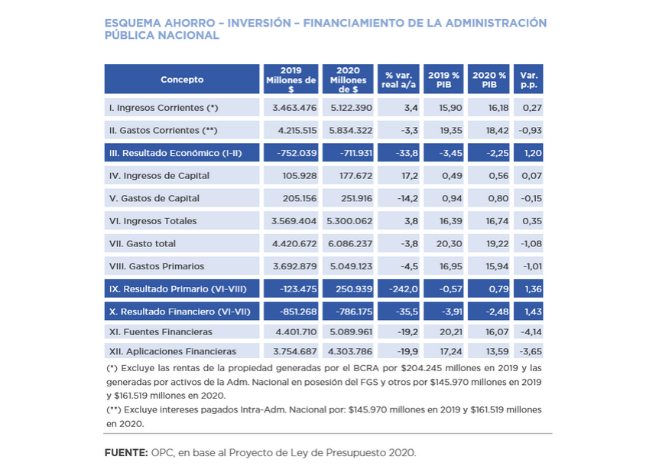

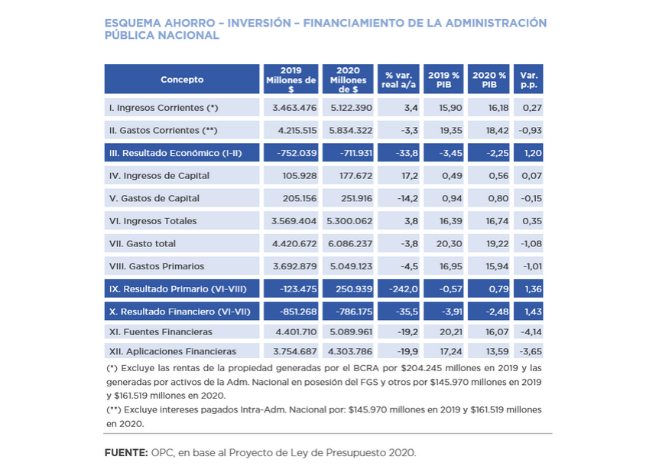

The purpose of this report is to provide a comprehensive description of the basic content of the National Government Budget Bill for 2020, submitted by the National Executive Power in mid-September.

The existing economic and financial volatility, the pending implementation of the agreement with the IMF and the need for a public debt rescheduling process, have determined important adjustments in the macroeconomic projections made. In addition, the outcome of the election process that led to a change of political authorities as of December 10 and, therefore, a very likely change of priorities in the allocation of public resources, are issues that relativize the analysis made in this report. However, it is essential to carry it out, since it will be very useful to understand the constraints in the national budget caused by previously adopted regulations, as well as to provide elements of judgment in the process of discussion and legislative approval.

by Nicolas Perez | Oct 3, 2019 | Tax Policy and Fiscal Federalism

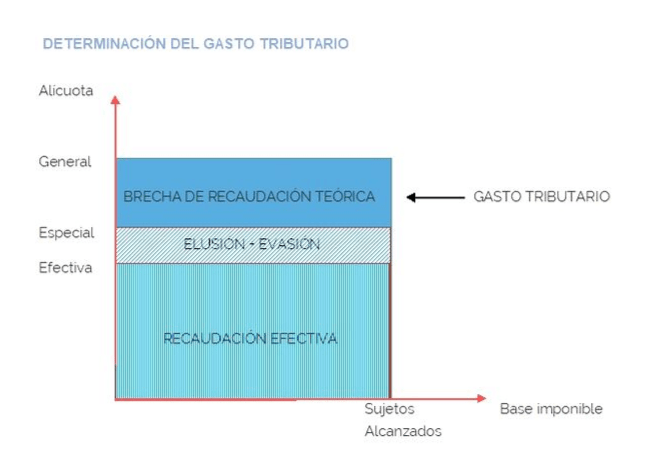

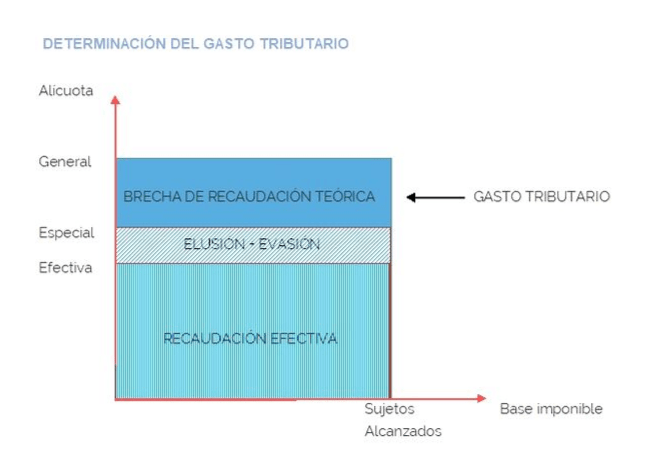

This paper introduces a conceptual discussion aimed at developing a practical methodology for the evaluation of differential tax treatment policies. A two-stage process is proposed; one technical and one political. The first of these stages is the object of study of this paper.

For the development of this evaluation stage, the existing definitions on the concept of tax expenditure, the economic and practical foundations of the use of differential tax treatments as an economic policy tool to the detriment of other instruments are studied, and different methodologies for calculating tax expenditure of an economic measure are described.

Among the mistakes to avoid, the OPC warns against considering that financing public policy through tax expenditure measures is less expensive than financing it through direct expenditure.

by Nicolas Perez | Sep 23, 2019 | Sustainable Development Goals

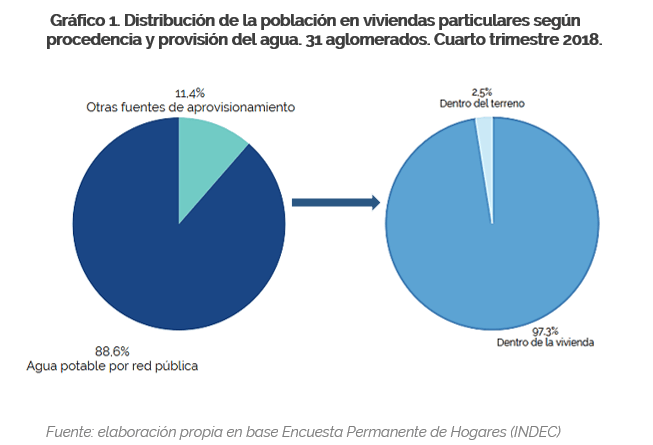

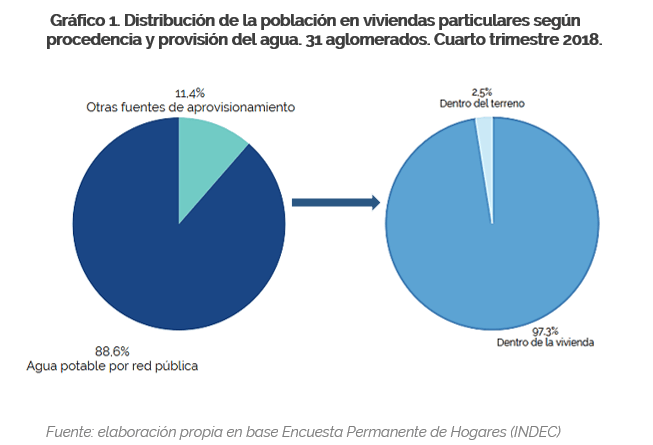

This is the first in a series of reports to be prepared by the Argentine Congressional Budget Office (OPC) to analyze Argentina’s progress in achieving the United Nations Sustainable Development Goals from a budgetary perspective. As there is no international consensus on the SDG budget evaluation methodology, the OPC used its own tool.

The focus is on SDG 6, Clean Water and Sanitation, and SDG 7, Affordable and Clean Energy. In accordance with the provisions of the current year’s Budget Law, the actions to be carried out by Argentina related to the SDG 6 will require AR$25.48 billion, while those related to energy issues have an initial appropriation of AR$212.01 billion.

By 2023, Argentina has committed to universal access to drinking water service through the public network, which would imply, according to INDEC population projections, the addition of 9.5 million people. As for the sewage network, the commitment to universalization was set for the year 2030, bringing the number of citizens to be included up to that year to 26.4 million.

Argentina adopted three targets linked to SDG 7. That of “universalizing access to affordable, reliable and modern energy services” implies meager increases in coverage, since according to the latest available data 98.8% of households had access to electricity and 97.2% to clean fuels for cooking; that of “significantly increasing the proportion of renewable energy” implies using 10.9% of green sources to supply total consumption this year; the most challenging is to increase energy efficiency (total energy vs. GDP), changing the trend shown in recent years.

by Nicolas Perez | Aug 8, 2019 | Budget Execution

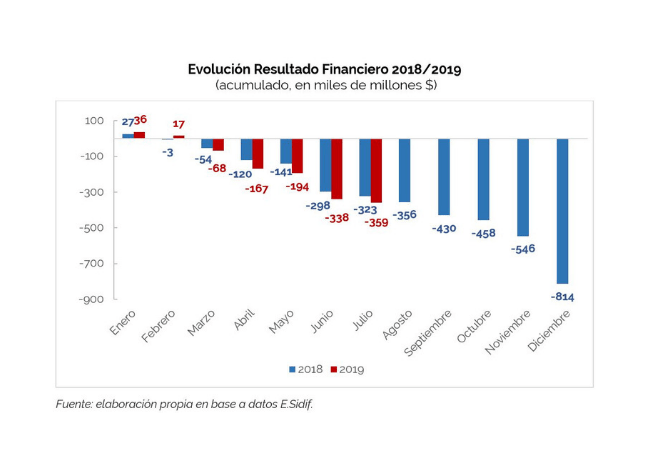

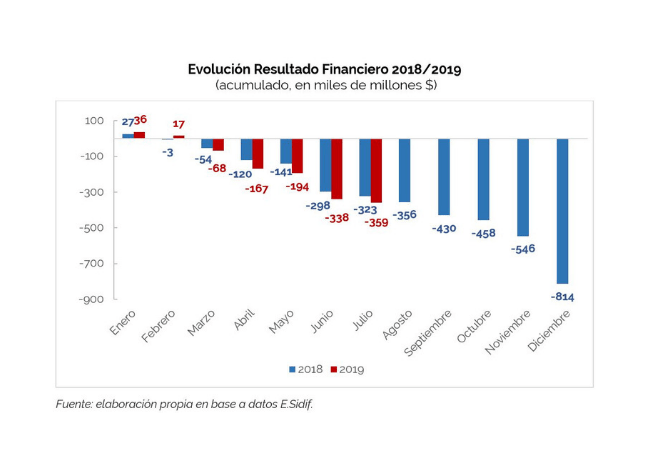

A surplus of AR$43.42 billion was recorded in July, a considerable improvement over the previous year’s figure (-AR$1.9 billion). The financial balance is negative by AR$21.04 billion but implies a drop of 44.4% in real terms in the year-on-year comparison. Transfers to provinces showed a monthly year-on-year drop for the first time this year.

- The increase in resources slowed down in July, although they grew again above expenditures (55.9% vs. 49.0%).

- Tax revenues (58.8%) led total revenue growth, while debt interest (186.4%) and capital expenditures (152.9%) were the fastest growing components of public expenditure.

- In the first seven months of the year, the financial balance was negative by AR$359.1 billion, an increase of 11.2% with respect to the same period of the previous year. In real terms, this represents a reduction of 27.9%.

- During the first seven months of the year, 57.0% of total expenditure was accrued, identical to the level recorded in the same period a year ago.

- From the beginning of the fiscal year to the end of July, the initial budget was increased by AR$88.3 billion, that is, 2.1%. The 39.2% of the amendments were implemented through the Necessity and Urgency Decree 193, while the remaining 60.8% were implemented through four Administrative Decisions.