by Nicolas Perez | Feb 14, 2019 | Budget Execution

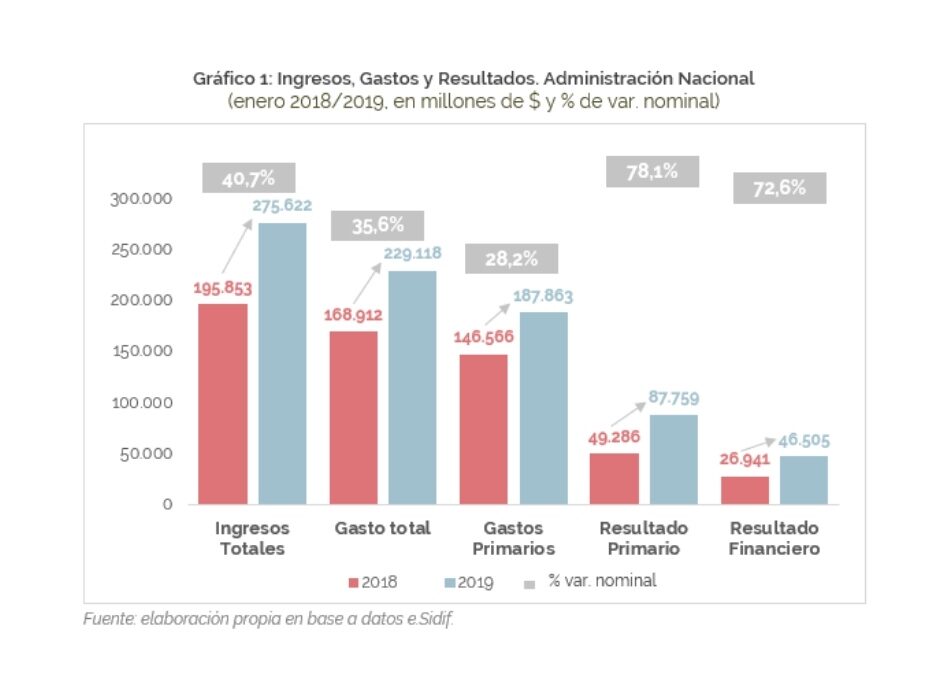

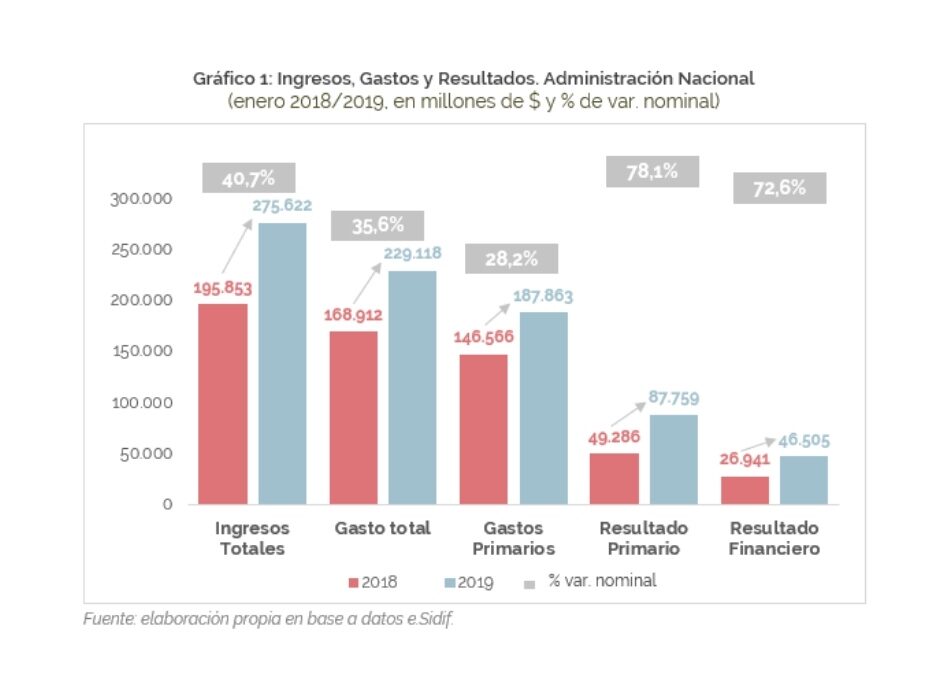

During January, the national government had a financial surplus of AR$87.76 billion, 19.7% higher in real terms than in 2018. Compared to inflation, both total revenues and total expenditures decreased during the month.

Revenues showed a drop -in real terms- in all items, except for property income and capital revenues.

Expenditures showed some exceptions to this pattern. Debt interest payments increased 84.6% YoY (+24.1% in real terms) and economic subsidies grew by 143% (+63.9% YoY in real terms).

Total accrued expenditures accounted for 5.5% of the total item, current expenditures for 5.6% and capital expenditures for 3.0%.

by Nicolas Perez | Feb 7, 2019 | Tax Revenue

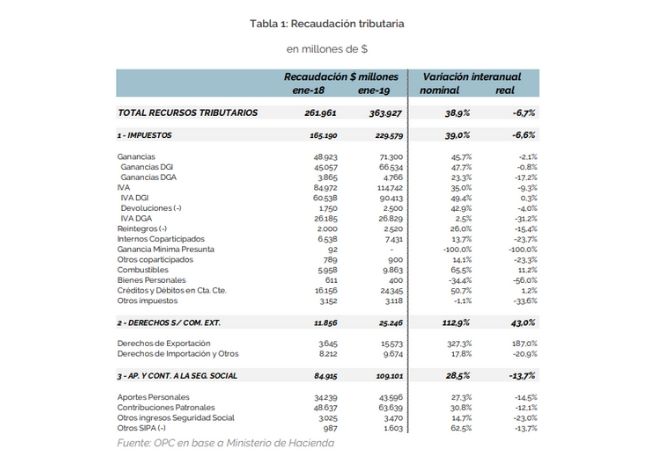

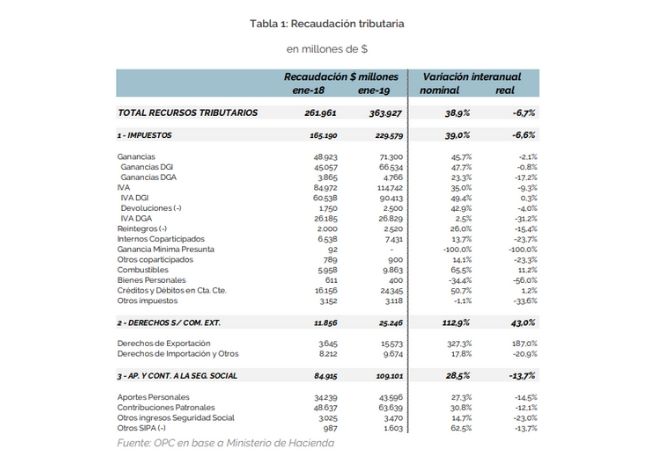

This report analyzes tax revenues for the first month of the year and outlines the scenario for the whole of 2019.

National tax revenue in January 2019 totaled AR$363.92 billion, showing a year-on-year increase of 38.9% in nominal terms, which implied a drop of 6.7% in real terms.

As for the projection for the year, after the submission of the 2019 Budget, three regulatory amendments were introduced with a significant impact on the national tax revenue for 2019.

These amendments have an almost neutral net impact on the projected revenue: a reduction of AR$3.83 billion, which is equivalent to 0.1% of the total projected amount.

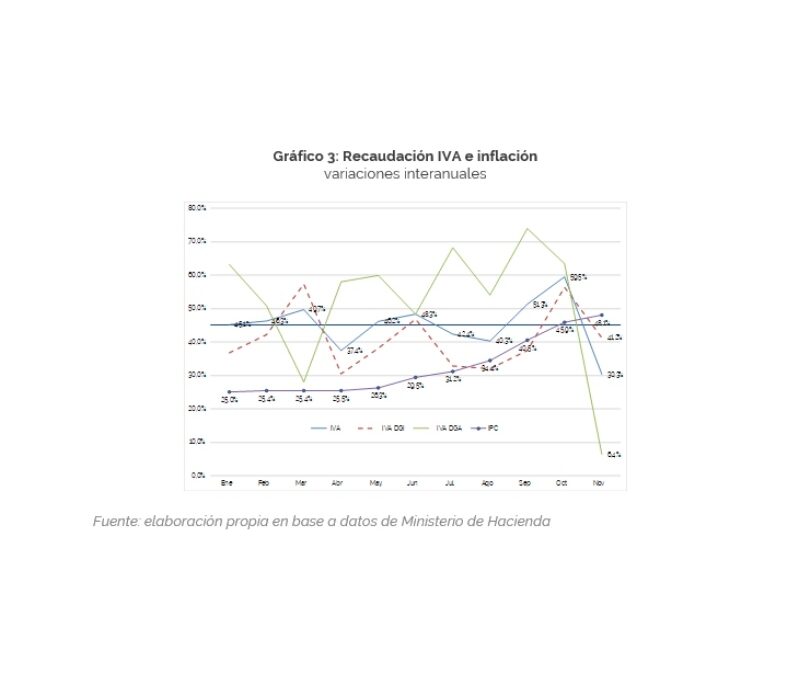

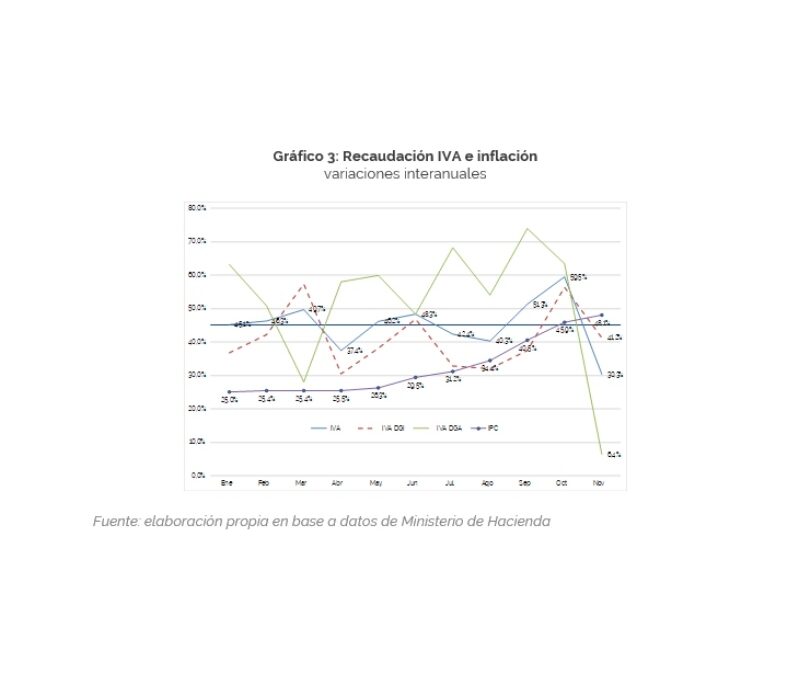

by Nicolas Perez | Dec 13, 2018 | Tax Revenue

National tax revenue fell by 1.6% in real terms as of November 30. Analyzing the closing of the year, we estimate a low probability of reaching the figure included in the introductory statement of the 2019 Budget Bill of AR$3.47 trillion against an 11-month cumulative amount of AR$3.06 trillion.

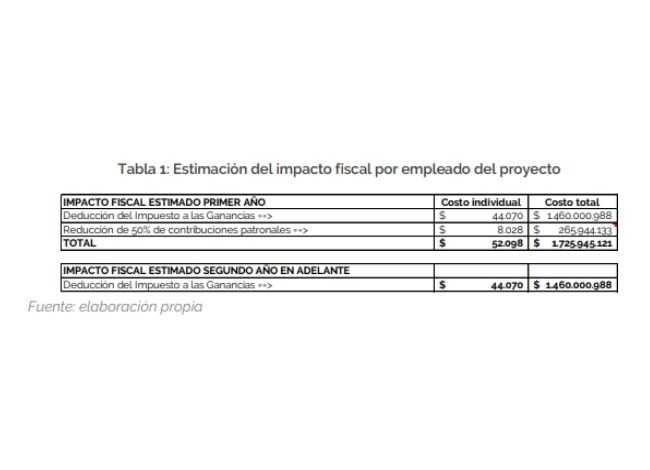

by Nicolas Perez | Nov 23, 2018 | Cost Estimates

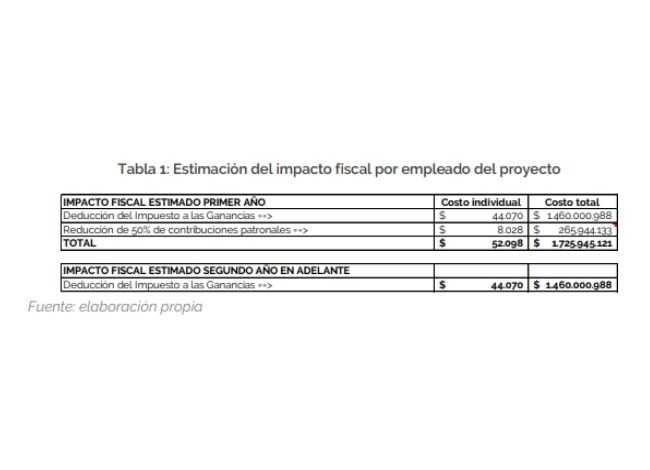

Tax benefits for employers, included in the Bill on a Federal Regime for Socio-labor insertion for People with Disabilities, would cause an estimated negative fiscal impact of AR$1.72 billion in the first year and AR$1.46 billion in the following years.

The benefit of paying half of the employer’s contributions will be in force only for the first year. Throughout the employment relationship, the employer will be able to deduct the entire amount of the wages subject to the Income Tax regime.

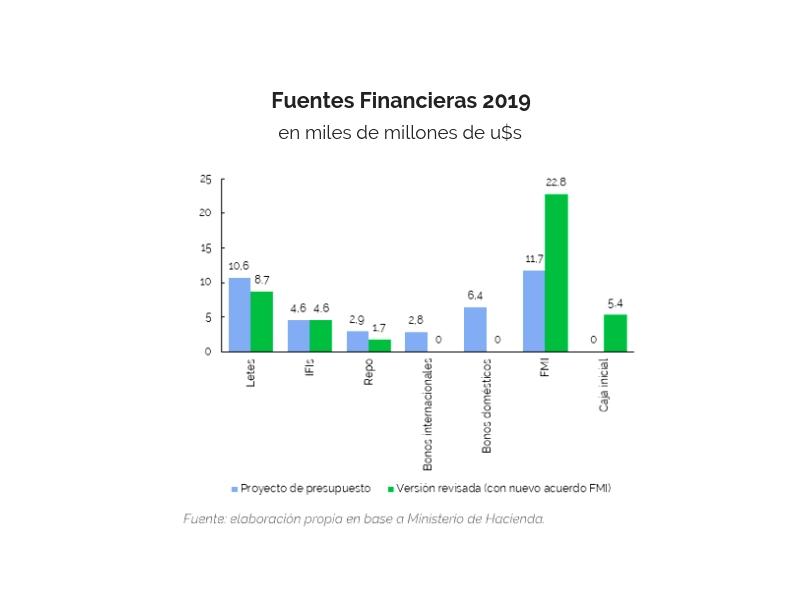

by Nicolas Perez | Nov 6, 2018 | Public Debt

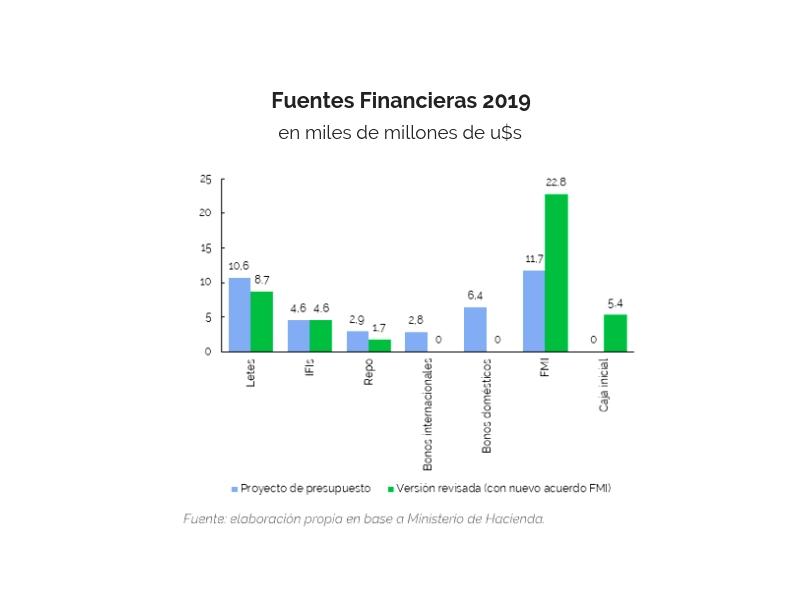

The renegotiation of the stand-by arrangement with the International Monetary Fund (IMF) resulted in a reformulation of the 2019 Financial Program with respect to the version included in the Budget Bill.

With the new arrangement, the IMF will increase its disbursements by USD7.6 billion this year and USD11.1 billion next year. The IMF assistance will cover 54% of next year’s financial needs, a figure that will drop to 14.7% in 2020.

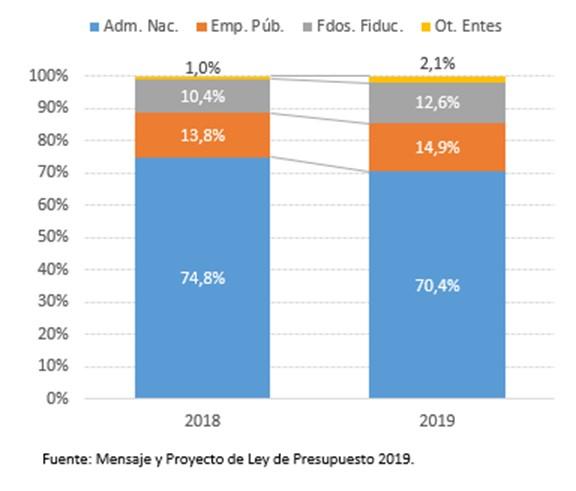

by Nicolas Perez | Oct 17, 2018 | Budget Law

This report analyzes budgetary allocations included in the 2019 Budget Bill for Public Investment, including Real Direct Investment (RDI) and Capital Transfers (CT) within this concept.

The national government public investment budget provided for next year -real direct investment and capital transfers- amounts to AR$171.57 billion, with a drop estimated at 9.7% with respect to 2018.