by Nicolas Perez | Nov 8, 2019 | Tax Revenue

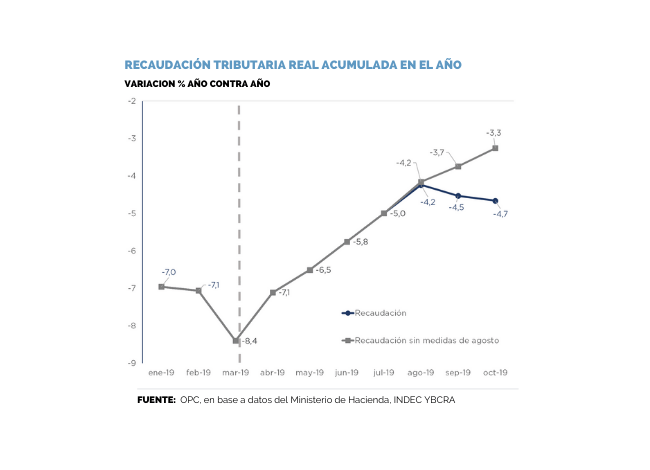

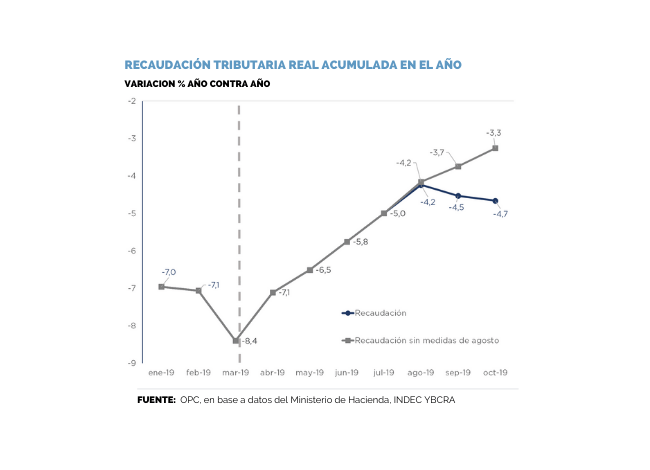

In October, tax revenue totaled AR$446.17 billion, which implied a growth of 42.8% YoY. In the annual cumulative figure as of October, tax resources of the National Public Sector show a 46.8% YoY growth. Revenue decreased by 5.9% YoY in real terms in the tenth month of the year.

October revenues were reduced by the impact of the fiscal stimulus measures announced by the National Executive Power during the month of August. According to OPC estimates, those measures caused a loss of resources of around AR$35 billion last month. Excluding this effect, nominal revenue would have grown 53.9% YoY, and 1.4% YoY in real terms.

The measures mentioned above particularly affected the collection of Income Tax, Social Security and VAT. On the other hand, Export Duties increased in October with respect to the previous month because of a higher number of tons for export.

by Nicolas Perez | Jun 7, 2019 | Tax Revenue

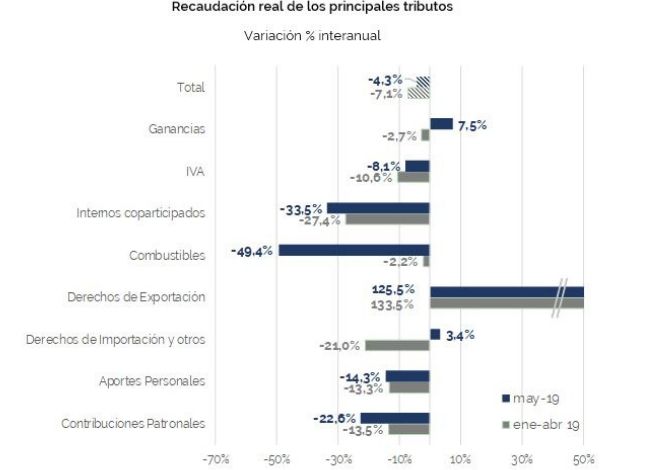

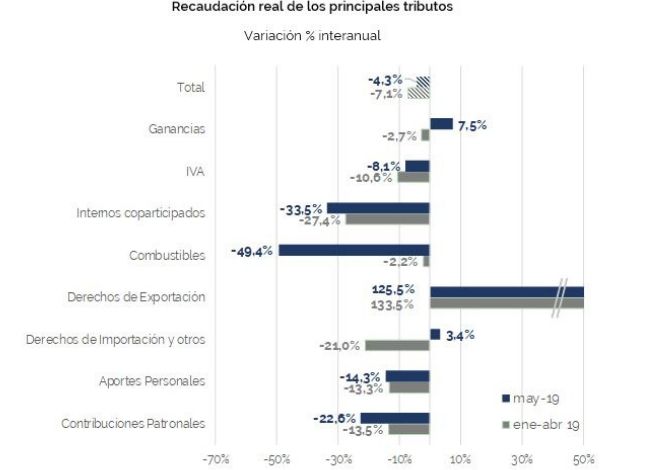

In May, tax revenue grew 50.4% in nominal terms with respect to the same month of the previous year but declined 4.3% in real terms during the same period. This decline deepens to 6.5% when considering the first five months of the year.

Overall tax revenue has been declining in real terms for eleven consecutive months, although it began to reduce the rate of decline.

In this context, Income Tax exceeded the collection expectations for the month with an increase of 7.5% year-on-year in real terms. Together with taxes on foreign trade, it is one of the taxes whose growth exceeded inflation.

VAT contracted by 8.1% in May, although this record implies a deceleration of the falls of the last seven months.

The decline in Social Security resources deepened because of the deterioration of the labor market and the changes in the employer contributions system. However, in the fifth month of the year, Social Security resources might have found its lowest level, and in the following months the trend may consolidate.

by Nicolas Perez | Apr 11, 2019 | Tax Revenue

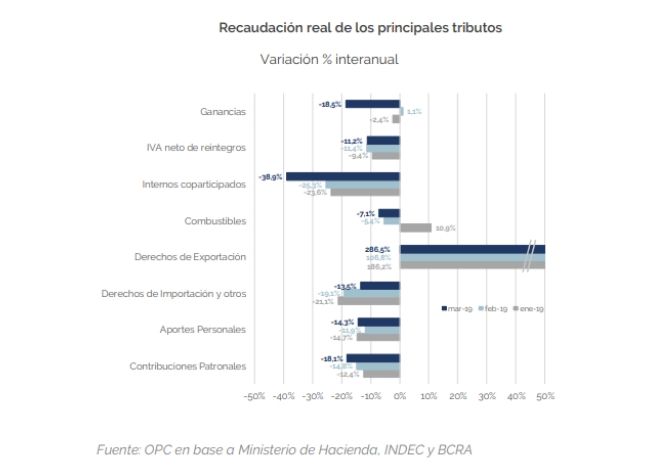

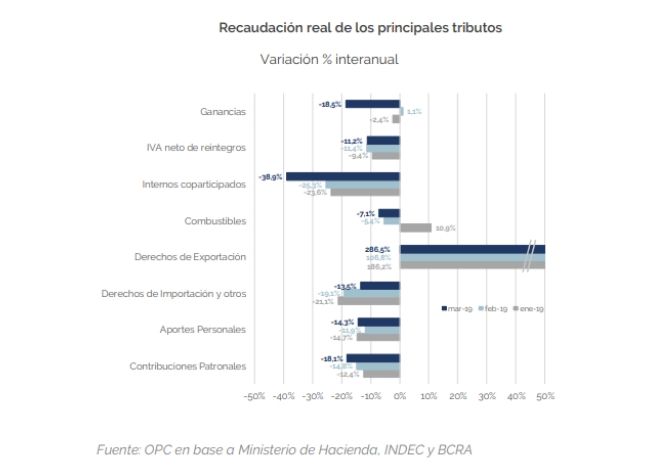

In the third month of the year, national public sector revenues grew by 37.3% in nominal terms compared to the same period of the previous year but fell by 10.5% in real terms. Similar behavior was observed in the first quarter of the year.

This performance also entails a decline compared to previous months and reaffirms that government revenues are strongly linked to the level of economic activity, as shown by the VAT DGI, which fell 7.3%.

Income Tax contracted by 18.5%, partly due to the deferral of some maturities. The significant growth in Export Duties allowed mitigating the fall in the most important taxes of the national tax structure (VAT, Income Tax and Social Security Contributions).