by Juan Fourcaud | Dec 11, 2020 | Cost Estimates

The purpose of the Bill on Comprehensive Protection to Prevent, Sanction, and Eradicate Violence against Older Persons (S-2729/19) is to eliminate all practices that constitute violence against older persons to guarantee the rights recognized in the Inter-American Convention on the Protection of the Human Rights of Older Persons, particularly those referring to the physical and moral integrity and to the development of a dignified life in old age.

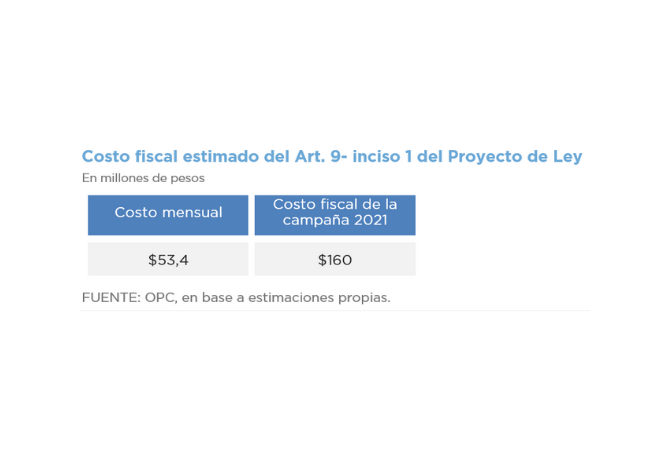

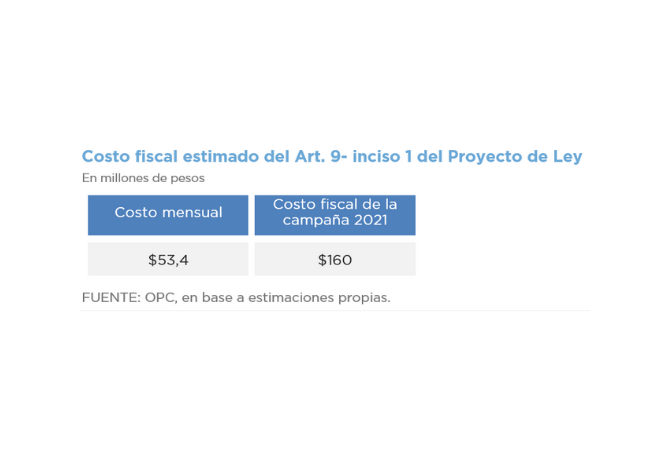

Based on the analysis carried out, the measures with fiscal impact for the national government would be those related to the dissemination campaigns (Section 9.1) and the financial assistance programs for older persons (Section 9.4).

For the dissemination campaigns, an average monthly cost of AR$53.4 million is estimated. It has not been possible to estimate the fiscal impact of the financial assistance programs since information on the scope and modality of the benefit is required.

by Nicolas Perez | Sep 11, 2019 | Cost Estimates

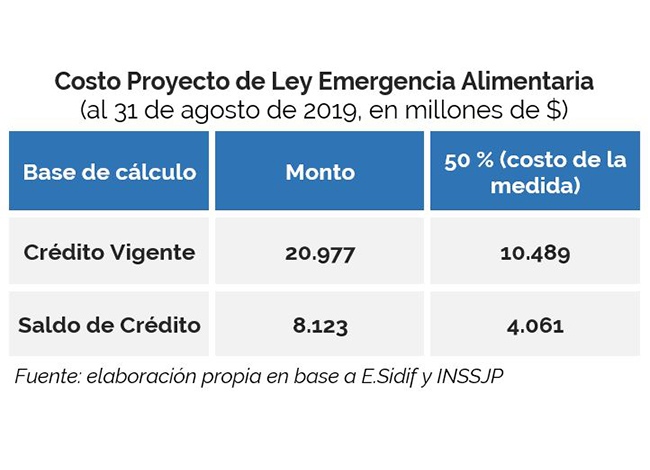

Currently, national public policies on food and nutrition are implemented through the Food Policies and National Social Protection Plan programs, both of the Ministry of Health and Social Development, as well as through the Pro Bienestar program of the National Institute of Social Services for Pensioners and Retirees.

Two possible scenarios for the estimation of a fiscal cost arise from the Bill:

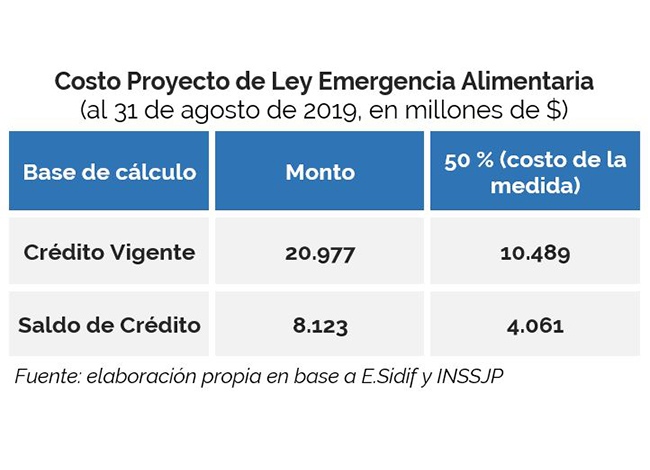

- if the increase is estimated based on the appropriations in force for the identified programs as of August 31, the cost would amount to AR$10.5 billion.

- If the increase is estimated based on the appropriations not executed in the identified programs as of August 31, the cost would amount to $4.06 billion.

by Nicolas Perez | Dec 28, 2018 | Other Publications

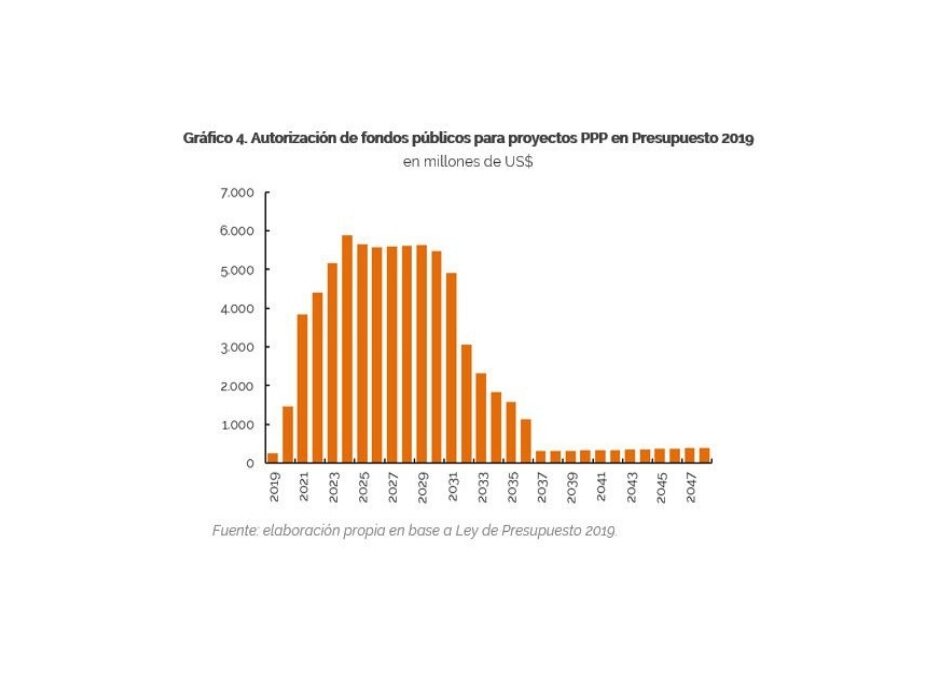

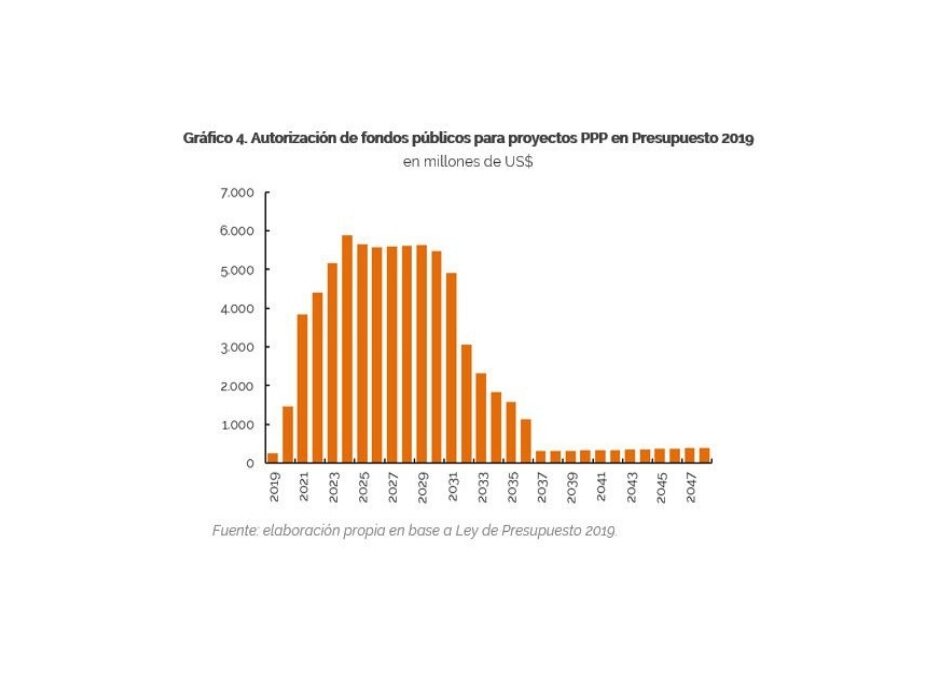

Budget Law 2019 includes eighty projects to be financed through the Public-Private Partnership (PPP) scheme that, if executed, would involve USD73.52 billion of public funds between 2019 and 2048. These projects may generate direct and contingent liabilities for the National Government that will affect the future fiscal performance.

During 2019, the progress of the works is not expected to be recorded as a capital expenditure but as a financial investment (below the line), so it will not have an impact on the balance of the respective fiscal year. Investment Securities (TPI, by its initials in Spanish), issued by the Trusts of each project, are not considered public debt, although they have common features to sovereign bonds and their repayment involves mainly public funds.

Following the best practices in the matter, a methodology for the valuation of contingent liabilities related to PPP projects should be developed, a task on which the Executive Branch is already working.