Methodology for calculating Tax Expenditure

This paper introduces a conceptual discussion aimed at developing a practical methodology for the evaluation of differential tax treatment policies. A two-stage process is proposed; one technical and one political. The first of these stages is the object of study of this paper.

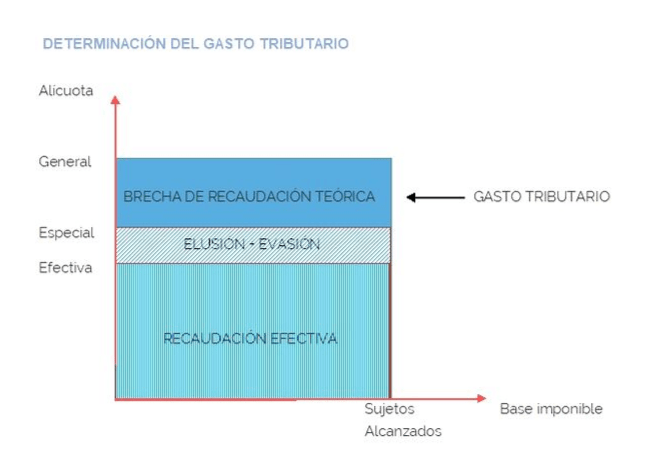

For the development of this evaluation stage, the existing definitions on the concept of tax expenditure, the economic and practical foundations of the use of differential tax treatments as an economic policy tool to the detriment of other instruments are studied, and different methodologies for calculating tax expenditure of an economic measure are described.

Among the mistakes to avoid, the OPC warns against considering that financing public policy through tax expenditure measures is less expensive than financing it through direct expenditure.