Analysis of National Tax Revenue – October 2019

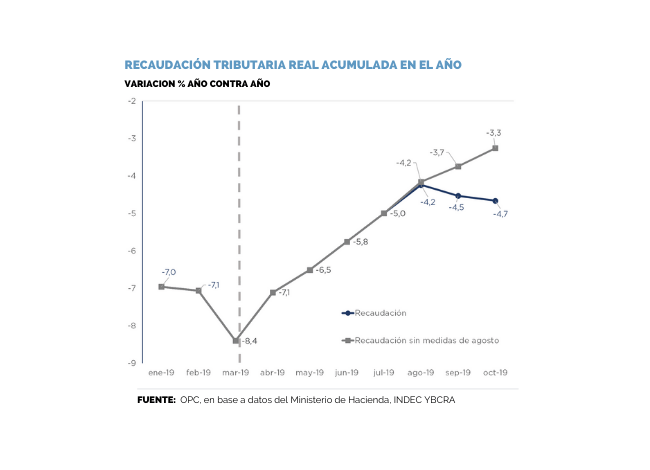

In October, tax revenue totaled AR$446.17 billion, which implied a growth of 42.8% YoY. In the annual cumulative figure as of October, tax resources of the National Public Sector show a 46.8% YoY growth. Revenue decreased by 5.9% YoY in real terms in the tenth month of the year.

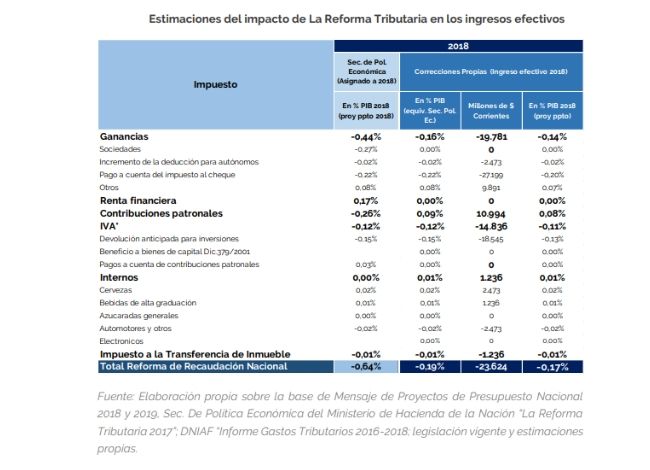

October revenues were reduced by the impact of the fiscal stimulus measures announced by the National Executive Power during the month of August. According to OPC estimates, those measures caused a loss of resources of around AR$35 billion last month. Excluding this effect, nominal revenue would have grown 53.9% YoY, and 1.4% YoY in real terms.

The measures mentioned above particularly affected the collection of Income Tax, Social Security and VAT. On the other hand, Export Duties increased in October with respect to the previous month because of a higher number of tons for export.