by Nicolas Perez | May 14, 2020 | Public Debt Operations

The government submitted its proposal for the restructuring of bonds issued under foreign legislation in April. The proposal covers twenty-one series of bonds totaling US$65.62 billion, eligible for swap into ten new securities (five denominated in dollars and five in euros), with annual payments, maturing in 2030, 2036, 2039, 2043, and 2047. The deadline for creditors to submit their consent, which was due on Friday, May 8, was extended to May 22.

Within the course of the negotiation, the payment of the interest coupons of the BIRAD 2021, 2026 and 2046 bonds (which are part of the bonds eligible for the swap) for a total amount of USD503 million, due on April 22, was not made. The grace period to make the payment runs until May 22, after which a default will occur.

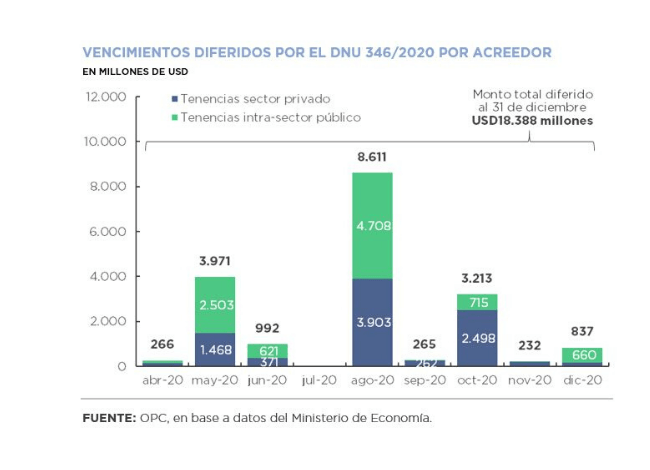

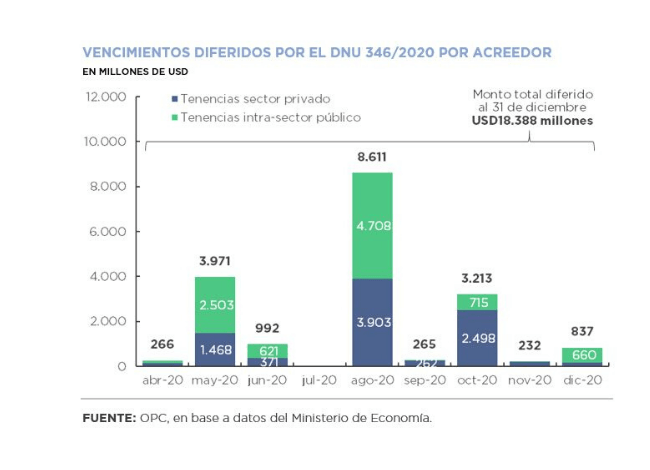

Necessity and Urgency Decree (DNU) 346/2020 postponed to December 31 the payments of interest and amortization of public debt securities in dollars issued under domestic legislation. As a result, payments of USD18.38 billion were deferred until the end of the year, USD9.01 billion of which were held by private investors.

Six auctions were held during the month, resulting in the placement of AR$435.97 billion in securities in pesos, including AR$314.07 billion as part of a swap transaction of the BONCER TC20. In addition, financing was obtained from the Central Bank through the placement of USD171 million in Bills and Temporary Advances (TA) for AR$80 billion.

by Nicolas Perez | Jun 13, 2019 | Public Debt Operations

- During May, placements of government securities and loan disbursements totaled USD6.5 billion, mainly through the issuance of treasury bills and bonds.

- As a result of five public auctions, the equivalent of USD5.48 billion in treasury bills and USD131 million in bonds were placed during the month.

- A voluntary swap of BONAR DUAL for new dollar-linked bills (LELINK) for USD964 million was carried out on May 23.

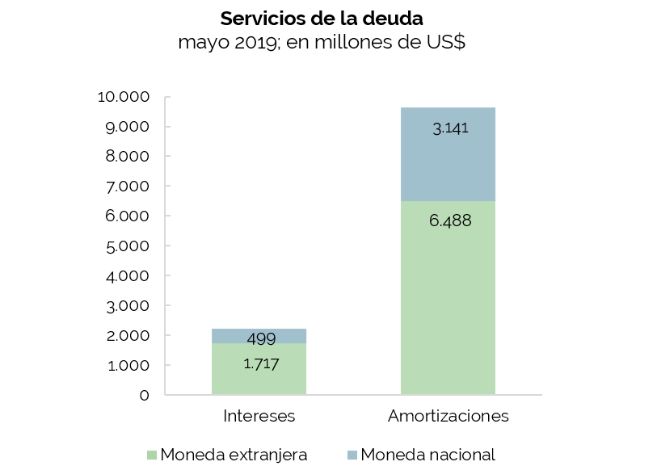

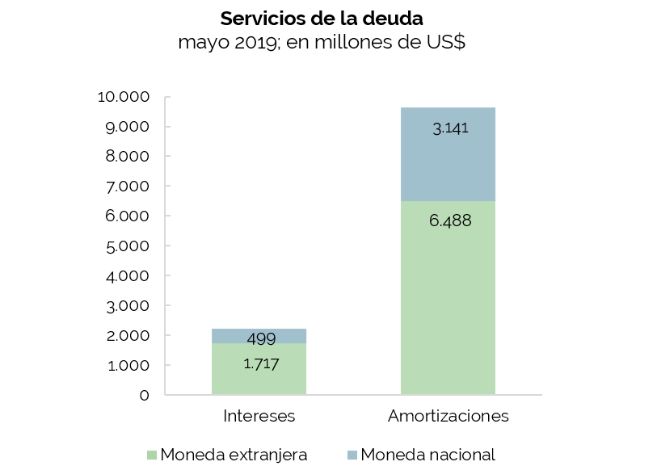

- Debt service for the month totaled the equivalent of USD11.85 billion, of which USD9.63 billion were principal repayments and USD2.21 billion were interest payments.

- At the end of the month, the fifth payment of principal and interest on the loans derived from the 2014 Renegotiation Agreement with the Paris Club was paid. The payment was for USD1.55 billion of principal and USD325 million of interest.

- Main maturities scheduled for the month of June are DISCOUNT bonds, different BONARs in dollars, BONAR Badlar and BOTAPO.

by Nicolas Perez | May 15, 2019 | Public Debt Operations

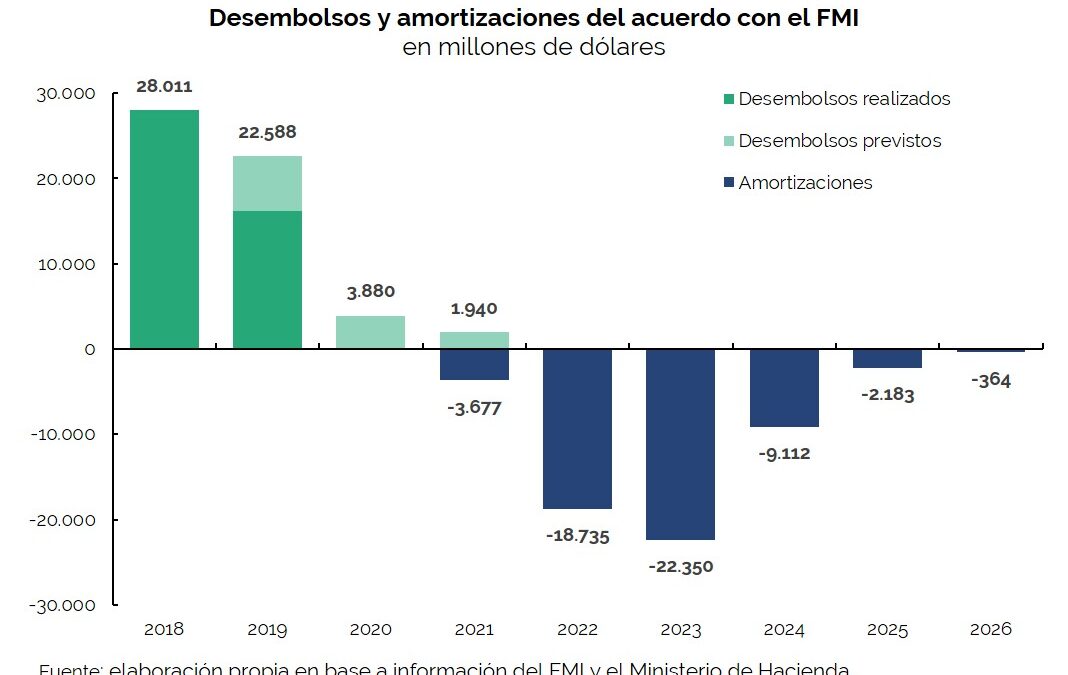

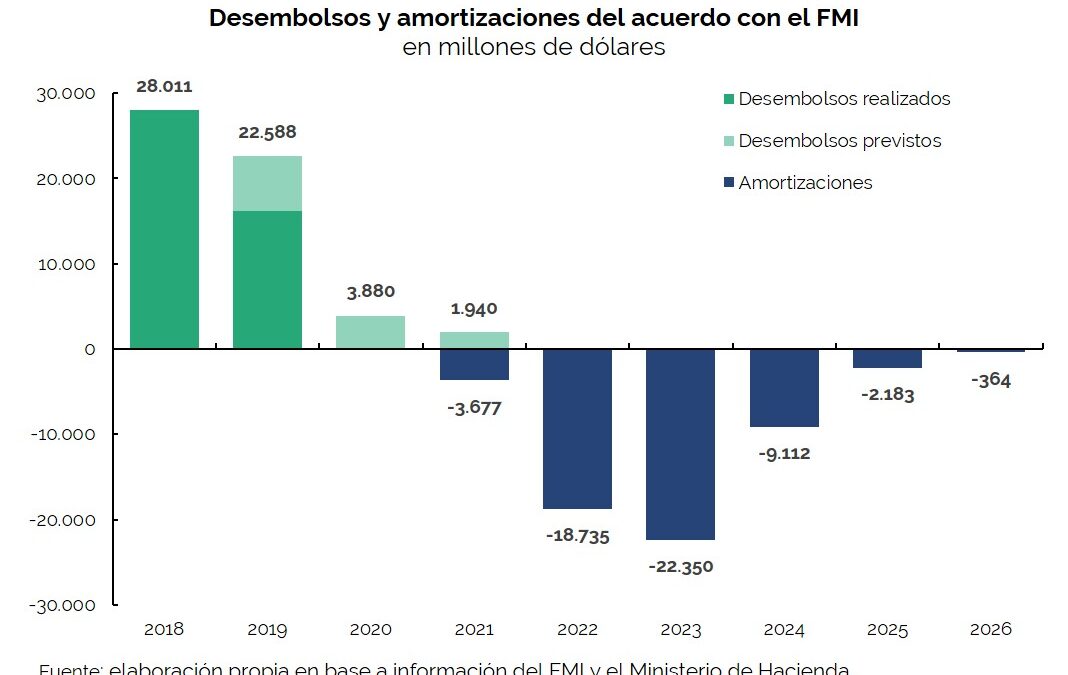

Placements of securities and loan disbursements for USD18.52 billion were recorded during the month of April, of which 58% (USD10.83 billion) consisted of the fourth disbursement from the International Monetary Fund (IMF) within the framework of the Stand-By Arrangement (SBA). Debt service payments during the period totaled USD11.46 billion, of which 82% (USD9.38 billion) were principal payments.

In a context of high volatility, a higher yield was validated in LETES placements, whose refinancing ratio fell to 64% from 87% in April.

During the month, new bonds in dollars for USD1.5 billion were placed to cancel a debt remaining from natural gas production stimulus plans, and securities for USD369 million to satisfy a ICSID arbitration award in favor of the former concessionaire of Aguas Argentinas. On April 22, the first securities issued under the agreement with “holdout” creditors for USD2.75 billion matured.

On May 31, the fifth payment of principal and interest of the loans renegotiated with the Paris Club is due: if the minimum principal established in the agreement is paid, such payment will amount to USD 1.87 billion.