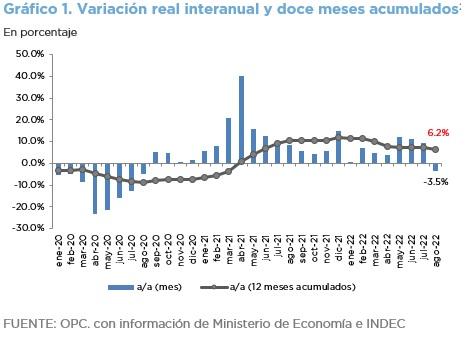

Tax revenues amounted to ARS1,731.319 billion in August 2022, which implied a growth of 72.2% year-on-year (YoY). Adjusted for inflation, it contracted 3.5% YoY.

The difference in Income Tax and Wealth Tax maturities combined with the lower revenues from Export Duties contributed to this result. The non-updating of Fuel Taxes and the higher collections for Export Refunds had a similar effect. However, the recovery of the level of activity since March 2021, the increase in the international prices of commodities and the increase in the nominal exchange rate (39.2% YoY) mitigated the drop in revenues.

Among tax resources, the increase in real terms in PAIS Tax stands out, because of the return to foreign travel as COVID-19 restrictions are removed. VAT and the Tax on Credits and Debits also grew because of the higher economic activity compared to 2021.

Income Tax showed its lowest growth so far this year and Wealth Tax decreased. In both cases there is a high base of comparison since in August 2021 the payment of tax returns for the year 2020 and the first advance payment for the year 2021 were paid together.

Foreign Trade duties continue to decrease due to negative weather effects that affected exports.

On the other hand, Social Security contributions showed a high year-on-year growth.