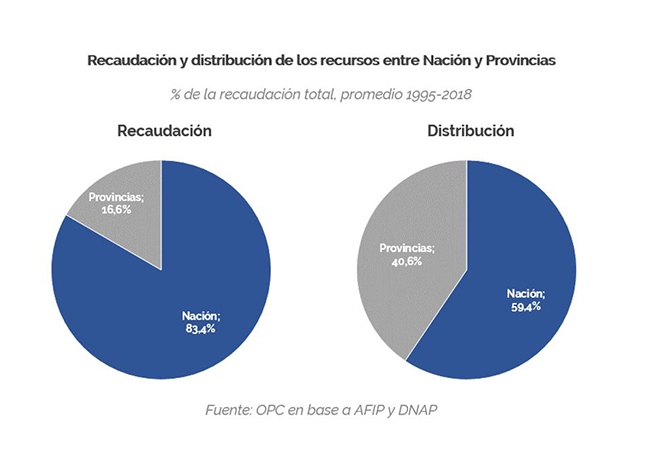

The analysis of the fiscal relations of the Nation and the provinces between 1993 and 2018 reveals a significant increase in provincial own tax resources, as well as in transfers received from the central government: the federal states gained share in the allocation of total tax resources by virtue of agreements between jurisdictions and changes in the tax structure.

- Between 1993 and 2018, total tax burden increased by 9 percentage points, from 19.6% to 28.6% of GDP.

- The fiscal year 2015 was the one with the highest tax burden of the term 1993-2018, when it reached a maximum of 31.1% of GDP.

- Provincial tax resources increased from 3.4% of GDP between 1993 and 2001 to 5.3% between 2013 and 2018. This increase was surpassed by the increase in expenditures, partly financed by higher transfers from the central government.

- The percentage of own taxes in total resources went from a maximum of 82.3% (Autonomous City of Buenos Aires) to a minimum of 4.7% (Formosa).

- Transfers by Federal Co-participation and special laws went from 5% to 7.5% of GDP in that period and showed growth trend, except for the 2001-2003 term. But own resources moved along the same line, which does not necessarily imply greater provincial dependence on the central government.

- In the 2015-2018 term, only three provinces (the Autonomous City of Buenos Aires, the Province of Buenos Aires and Neuquén) had sufficient own resources to cover their expnediture on personnel.

Since 2003, there has been a sustained growth in automatic transfers from the national government.