by Nicolas Perez | Dec 19, 2019 | Sustainable Development Goals

The purpose of this paper is to carry out a budgetary analysis and evaluation of the progress made in Argentina in relation to Sustainable Development Goal 15 (Life of Land): to combat desertification, halt and reverse land degradation and halt biodiversity loss.

This is one of the SDGs set by the United Nations in the framework of the 2030 Agenda, a program to which the country has adhered since 2015 and for which it carried out a process of adaptation of goals and indicators.

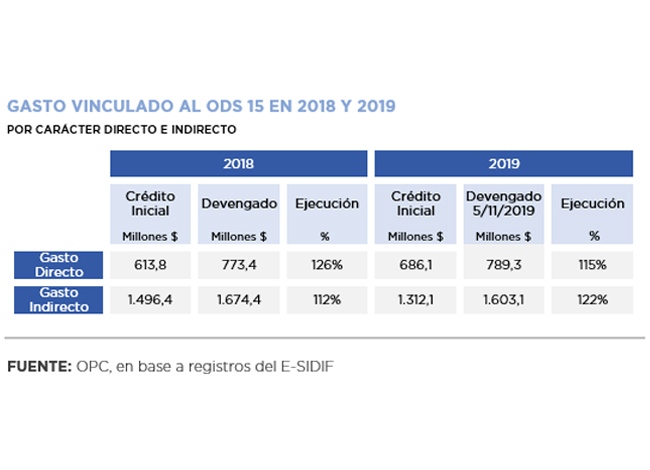

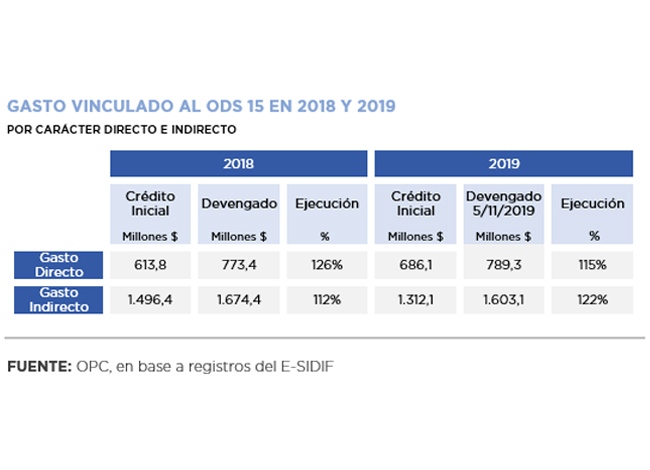

To advance with the implementation of the SDG 15, Argentina allocated AR$686 million in direct expenditures as of October (95% for current expenditures and 5% for investments). This amount is 12% higher than that of 2018 in nominal terms and its execution, two months before the closing of the fiscal year, already exceeds 112%. The budgetary significance given to sustainable forest management stands out (91% of direct expenditure related to SDG 15).

The Secretariat of Environment and Sustainable Development is the main agency responsible for its fulfillment, although there are other government agencies involved in the implementation of related programs or sub-programs.

The analysis of their compliance is difficult due to the scarcity of partial and final targets, and in some cases also of baseline. Their budgetary execution is very uneven at the level of programs and activities, ranging from over-execution of more than 300% to activities with no execution at all.

One example is the National Fund for the Enrichment and Conservation of Native Forests (FNECBN), which began to receive specific budget allocations only in 2010. These never covered the minimum amount provided for by Law 26,331 and were even under-executed in most of the fiscal years.

by Nicolas Perez | Dec 12, 2019 | Public Debt Operations

During November, interest payments totaled USD1.35 billion, of which 68% were made in foreign currency. The main disbursements were for the IMF Stand-By credit, a BONAR in dollars and the BONTE in pesos.

There were placements of securities and loan disbursements for the equivalent of USD2.11 billion, of which USD834 million were securities, placed almost entirely with different public sector entities.

Temporary advances -non-interest-bearing loans from the Central Bank to the Treasury- were made for AR$60 billion, bringing the stock of this instrument to AR$562.73 billion at the end of the month (AR$384.73 billion below the legal ceiling).

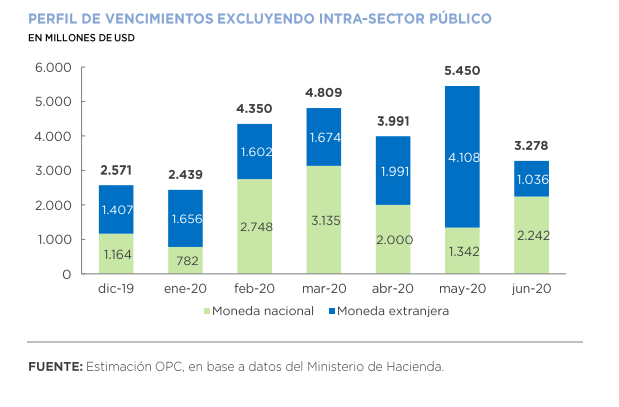

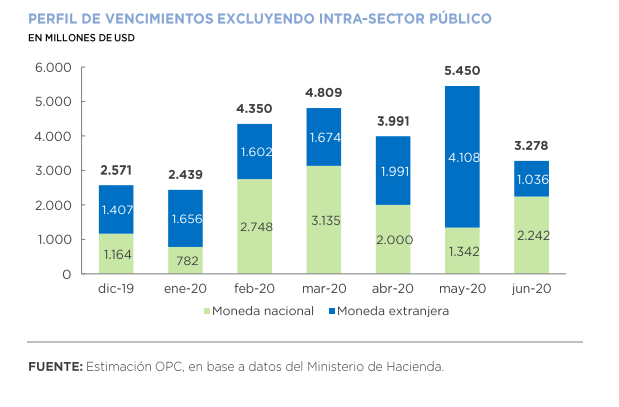

Debt maturities of approximately USD7.3 billion between amortizations (USD4.68 billion) and interest (USD2.62 billion) are to be paid in December.

The debt service maturity profile for the first half of 2020 totals USD45.23 billion. However, when excluding maturities within the public sector, estimated services for the semester are reduced to USD24.31 billion.

by Nicolas Perez | Jul 17, 2019 | Public Debt Operations

- During June, placements of government securities and loan disbursements totaled USD7.72 billion. The issuance of Treasury bills and bonds totaled USD7.3 billion.

- As a result of three public auctions, Treasury bills in pesos and dollars for the equivalent of USD4.72 billion and bonds for USD885 million were placed.

- Debt service amounted to USD7.54 billion in June, with USD6.27 billion in principal payments and USD1.27 billion in interest payments.

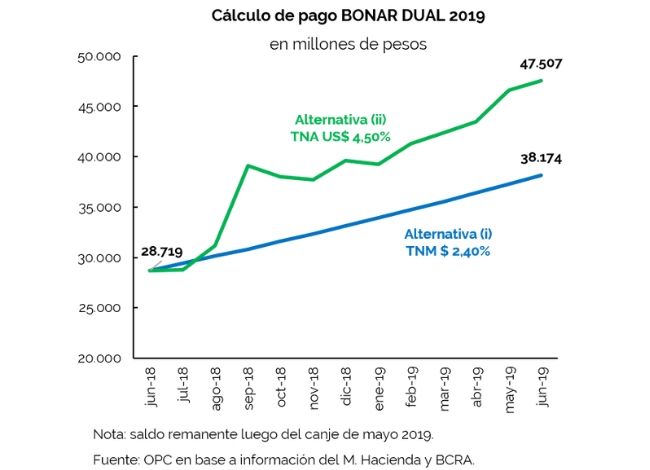

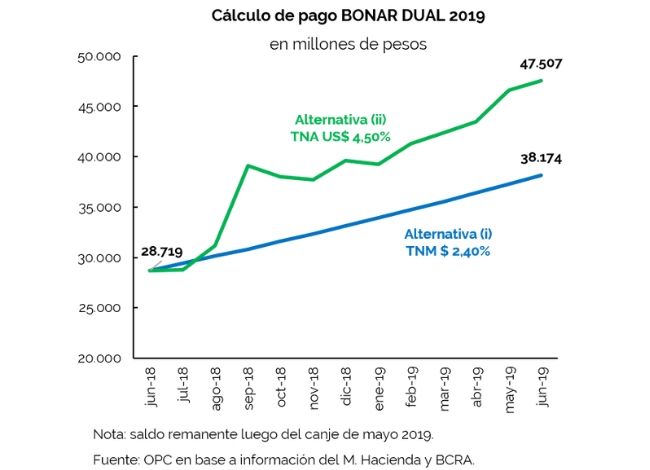

- At the end of the month, the BONAR DUAL 2019 was cancelled for a total of AR$47.5 billion, including AR$45.46 billion of principal and AR$2.04 billion of interest.

- Main maturities scheduled for the month of July are Treasury bills in pesos and dollars. In addition, there will be interest payments on DISCOUNT bonds and different BONARs in dollars whose coupons matured on June 30.

by Nicolas Perez | Jun 13, 2019 | Public Debt Operations

- During May, placements of government securities and loan disbursements totaled USD6.5 billion, mainly through the issuance of treasury bills and bonds.

- As a result of five public auctions, the equivalent of USD5.48 billion in treasury bills and USD131 million in bonds were placed during the month.

- A voluntary swap of BONAR DUAL for new dollar-linked bills (LELINK) for USD964 million was carried out on May 23.

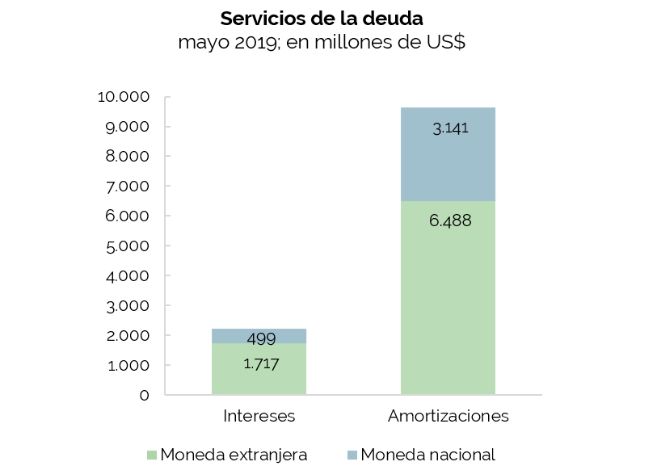

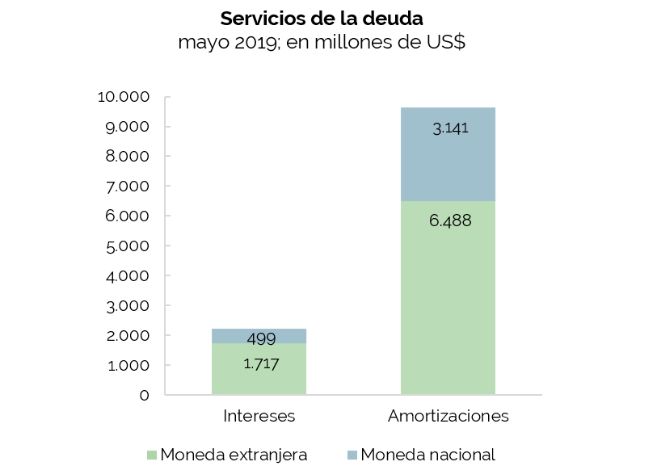

- Debt service for the month totaled the equivalent of USD11.85 billion, of which USD9.63 billion were principal repayments and USD2.21 billion were interest payments.

- At the end of the month, the fifth payment of principal and interest on the loans derived from the 2014 Renegotiation Agreement with the Paris Club was paid. The payment was for USD1.55 billion of principal and USD325 million of interest.

- Main maturities scheduled for the month of June are DISCOUNT bonds, different BONARs in dollars, BONAR Badlar and BOTAPO.

by Nicolas Perez | May 15, 2019 | Public Debt Operations

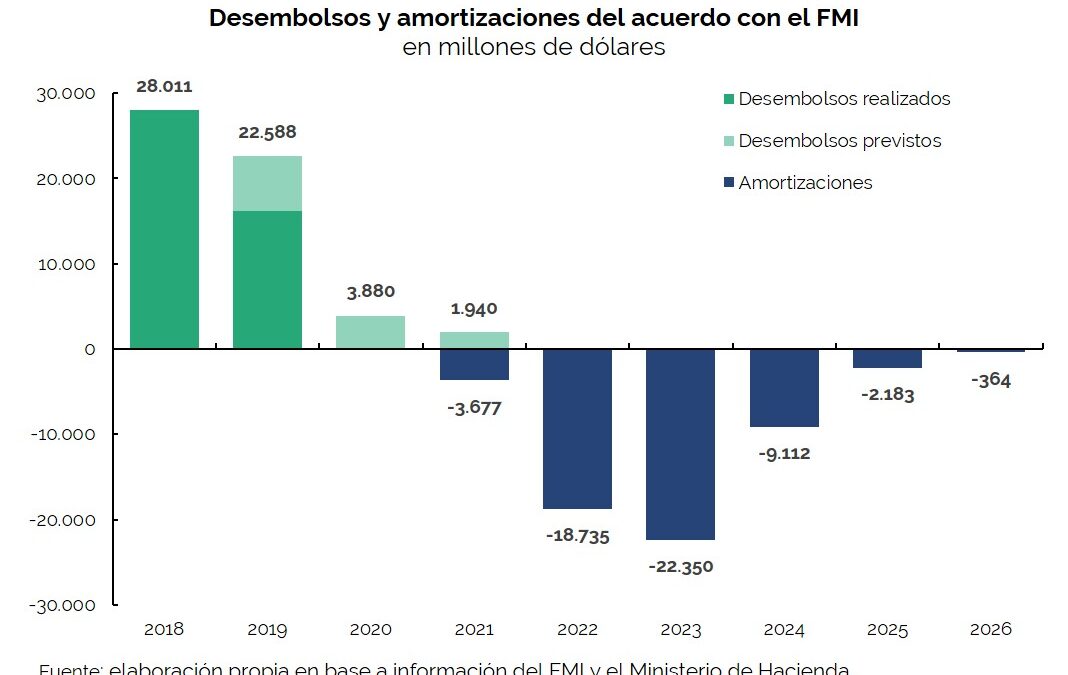

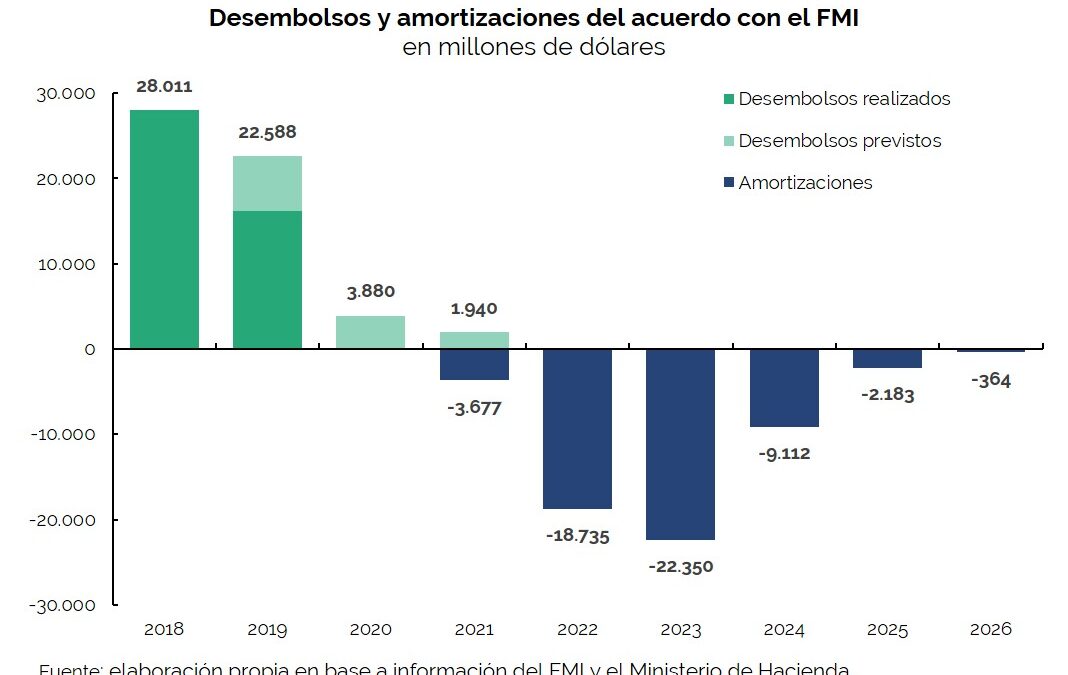

Placements of securities and loan disbursements for USD18.52 billion were recorded during the month of April, of which 58% (USD10.83 billion) consisted of the fourth disbursement from the International Monetary Fund (IMF) within the framework of the Stand-By Arrangement (SBA). Debt service payments during the period totaled USD11.46 billion, of which 82% (USD9.38 billion) were principal payments.

In a context of high volatility, a higher yield was validated in LETES placements, whose refinancing ratio fell to 64% from 87% in April.

During the month, new bonds in dollars for USD1.5 billion were placed to cancel a debt remaining from natural gas production stimulus plans, and securities for USD369 million to satisfy a ICSID arbitration award in favor of the former concessionaire of Aguas Argentinas. On April 22, the first securities issued under the agreement with “holdout” creditors for USD2.75 billion matured.

On May 31, the fifth payment of principal and interest of the loans renegotiated with the Paris Club is due: if the minimum principal established in the agreement is paid, such payment will amount to USD 1.87 billion.