Analysis of National Tax Revenue – April 2020

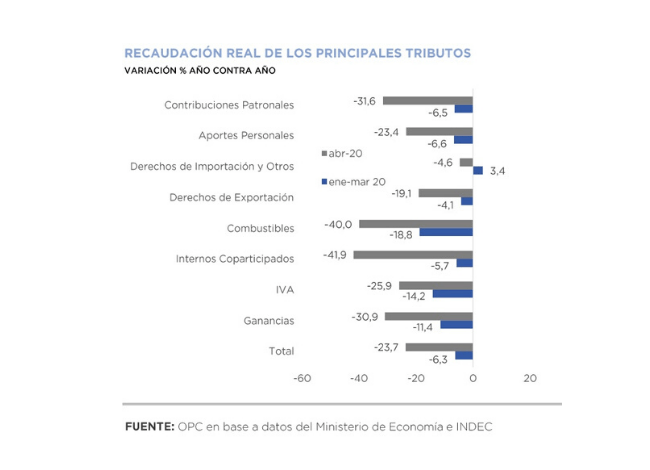

As anticipated, inflation-adjusted tax revenue fell 23.7% year on year (YoY) in April. Beyond some tax measures adopted by the National Executive Power to assist the productive sector in coping with the economic impact of the Mandatory Preventive Social Isolation (ASPO), the fall is explained by the slowdown in economic activity.

Revenues from national taxes totaled AR$398.66 billion, which implied a growth of 11.6% YoY.

The most important taxes had a significant drop in real terms. Income tax collection fell by 30.9% YoY, VAT by 25.9% YoY and Social Security resources contracted by 24.7% YoY. In addition, foreign trade revenues fell 15.2% YoY.

Although the pandemic and the ASPO were the main factors behind the poor collection performance in April, other factors also contributed. From the regulatory point of view, VAT refunds for the purchase of food, the reduction of Employer Contributions for the health sector, the deferral of the SIPA component of Employer Contributions for two months and the freezing of part of the Fuel Taxes in effect during March contributed to the lower inflow of resources. From the macroeconomic point of view, the deterioration of the labor market and the contraction of international trade contributed to the sharp drop in revenues.

May revenues are expected to continue to fall in real terms. Although some economic activities were exempted from the quarantine during April, the impact of the measure on the level of activity remained. On the other hand, measures such as the reduction or deferral of Employer Contributions, the reduction in the rate of the Tax on Debits and Credits to Current Accounts and the VAT refund for dairy products will have an impact on May revenues.