ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – FEBRUARY 2024

Due to a decrease in expenditures (-23.8% YoY) and a slight increase in revenues (+0.4% YoY), in the first two months of the year, the National Government recorded a financial surplus 150.0% higher in real terms than in the same period of the previous year.

- The primary surplus, which does not include interest payments, was 1,805.5% higher than that obtained a year earlier.

- Total revenues grew 0.4% in the year-on-year comparison, driven by increases in the PAIS Tax (405.9% YoY), in Export Duties (70.9% YoY) and in VAT (15.4% YoY). These increases were partially offset by the decrease in resources from Social Security (-25.1% YoY) and Income Tax (-36.5% YoY).

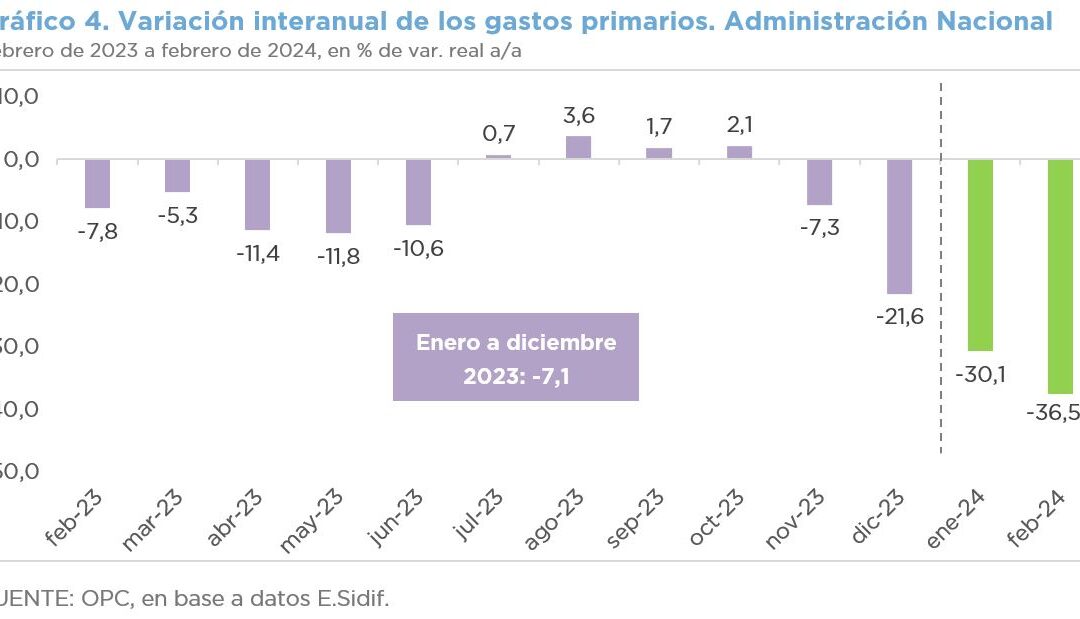

- Total National Government expenditures recorded a real fall of 23.8% YoY in the first two months of the year and the cut in primary expenditures, which does not include the increase in debt interest, rose to 33.6% YoY.

- Pensions (-33.0% YoY real), energy subsidies (-59.5% YoY real), capital expenditures (-82.4% YoY real) and social programs (-29.9% YoY real) were the items that most contributed to the reduction in expenditures. However, debt interest grew 34.2% YoY.

- In February, the financial result was in deficit (-ARS186.635 billion), although in the first two months of the year the surplus was maintained (ARS1,020.296 billion), with levels above the average of a 15-year cycle.

- Total accrued expenditures represented 24.0% of the budget, which is an extension of the budget in force during 2023.