Fiscal Impact of Public-Private Partnership Projects

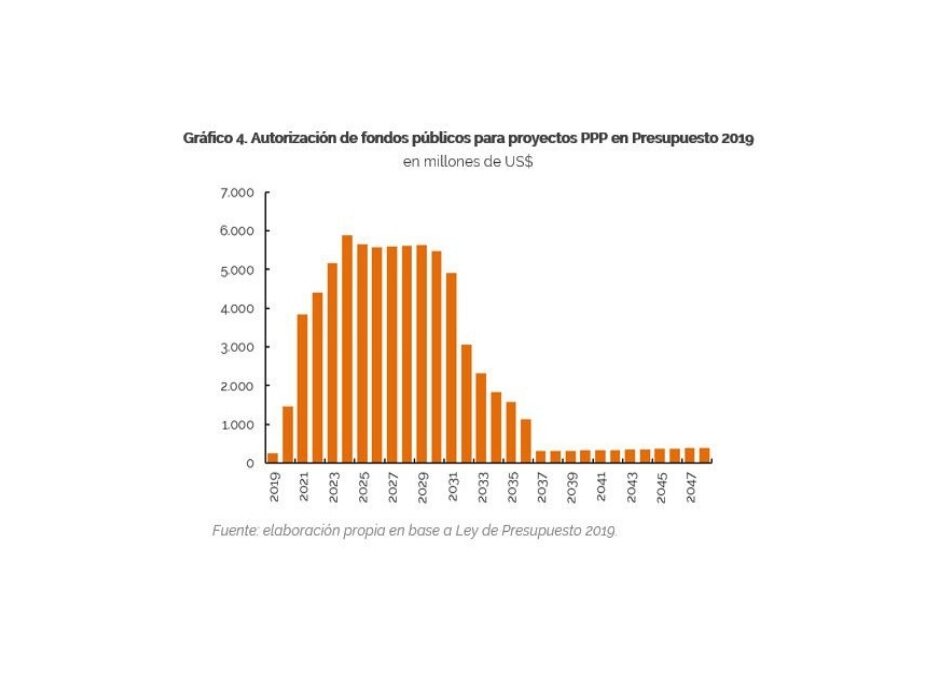

Budget Law 2019 includes eighty projects to be financed through the Public-Private Partnership (PPP) scheme that, if executed, would involve USD73.52 billion of public funds between 2019 and 2048. These projects may generate direct and contingent liabilities for the National Government that will affect the future fiscal performance.

During 2019, the progress of the works is not expected to be recorded as a capital expenditure but as a financial investment (below the line), so it will not have an impact on the balance of the respective fiscal year. Investment Securities (TPI, by its initials in Spanish), issued by the Trusts of each project, are not considered public debt, although they have common features to sovereign bonds and their repayment involves mainly public funds.

Following the best practices in the matter, a methodology for the valuation of contingent liabilities related to PPP projects should be developed, a task on which the Executive Branch is already working.