Budget Evaluation of the Sustainable Development Goals. SDG15: Life on Land

The purpose of this paper is to carry out a budgetary analysis and evaluation of the progress made in Argentina in relation to Sustainable Development Goal 15 (Life of Land): to combat desertification, halt and reverse land degradation and halt biodiversity loss.

This is one of the SDGs set by the United Nations in the framework of the 2030 Agenda, a program to which the country has adhered since 2015 and for which it carried out a process of adaptation of goals and indicators.

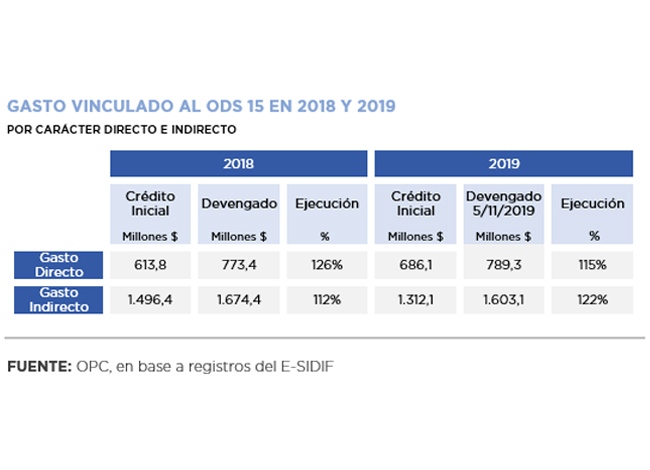

To advance with the implementation of the SDG 15, Argentina allocated AR$686 million in direct expenditures as of October (95% for current expenditures and 5% for investments). This amount is 12% higher than that of 2018 in nominal terms and its execution, two months before the closing of the fiscal year, already exceeds 112%. The budgetary significance given to sustainable forest management stands out (91% of direct expenditure related to SDG 15).

The Secretariat of Environment and Sustainable Development is the main agency responsible for its fulfillment, although there are other government agencies involved in the implementation of related programs or sub-programs.

The analysis of their compliance is difficult due to the scarcity of partial and final targets, and in some cases also of baseline. Their budgetary execution is very uneven at the level of programs and activities, ranging from over-execution of more than 300% to activities with no execution at all.

One example is the National Fund for the Enrichment and Conservation of Native Forests (FNECBN), which began to receive specific budget allocations only in 2010. These never covered the minimum amount provided for by Law 26,331 and were even under-executed in most of the fiscal years.