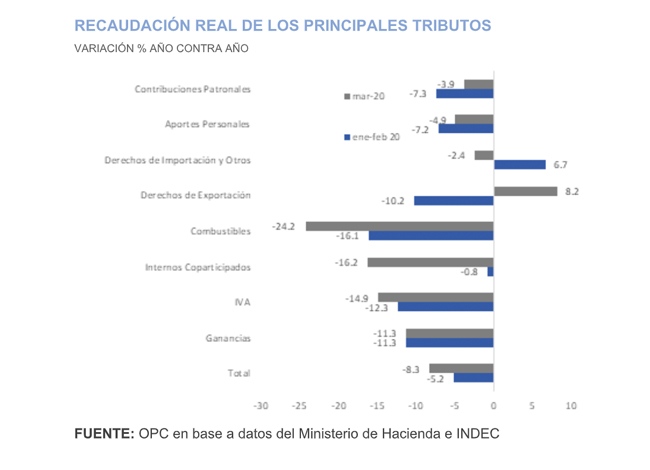

Tax revenue reached AR$443.63 billion in March, which implied a 35.3% year-on-year (YoY) growth. On the other hand, inflation-adjusted tax revenue fell by 8.3% YoY, a poorer performance than that observed in the first two months of this year.

These figures reflect the fiscal impact of the measures applied to contain the effects of the COVID-19 pandemic, although the full effects on tax revenue will be seen in the coming months.

The contraction of three tax resources strongly linked to the level of activity stands out in March: VAT DGI, Internal Taxes and Taxes on Fuels.

On the contrary, the collection of Wealth Tax (the first advance payment for assets abroad for fiscal year 2019 was received in March), of Export Duties (due to the changes in the scheme approved in December) and of the Statistics Tax (increases were introduced in May and December of last year) had better performance than the rest.