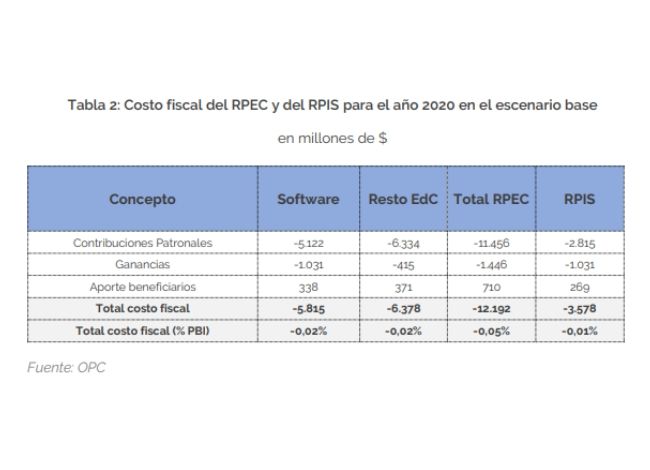

Tax benefits for the economic activities included in what the bill defines as Knowledge Economy, would result in a fiscal cost of AR$12.19 billion during 2020. This represents approximately 0.05% of the projected GDP for the year.

Among the tax exemptions proposed are the early implementation of the non-taxable minimum applicable to the payment of Employer Contributions, the granting of a tax credit certificate equivalent to 1.6 times the amount of such contributions applicable to the payment of other national taxes, the reduction of the Income Tax rate and the non-applicability of withholdings or collections of Value Added Tax. The duration of this promotion regime is established as from 01/01/2020 until 12/31/2029.