- Three auctions were held in November, resulting in the placement of different instruments for a total of ARS479.41 billion. Government securities in local currency were subscribed for ARS391.07 billion and dollar-denominated bonds payable in pesos (USD linked) for ARS37.87 billion.

- On November 4, the T2V1 bond (maturing on November 30) was offered for conversion into two baskets of instruments consisting of USD linked and LEDES bonds. As a result, 52% of the outstanding amount of the T2V1 bond was accepted.

- Net placements of Temporary Advances (TA) for ARS130 billion were recorded, increasing the stock to ARS1.49 trillion. At the end of October, the maximum legal limit on the stock of TA stood at $2.24 trillion.

- During the month, interest payments were made for the equivalent of USD963 million. The payment of interest to the IMF for USD387 million stands out. As of November, the surcharge rate paid by Argentina to the IMF increased by 100 b.p. after 36 months since the debt balance exceeded 187.5% of the quota.

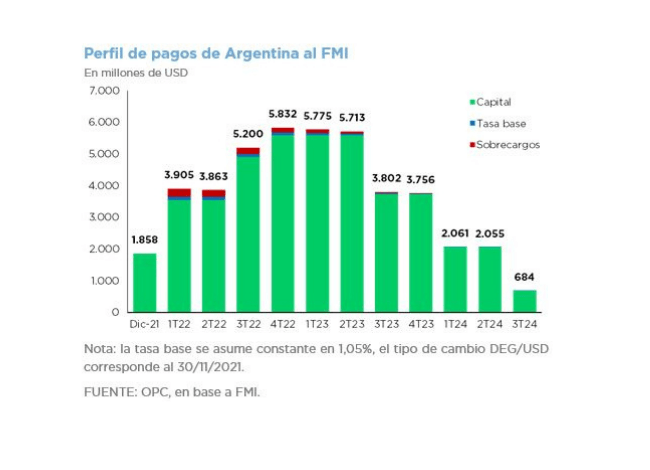

- Maturities for December are estimated to total the equivalent of USD5.156 billion (amortizations for USD4.856 billion and interest for USD300 million). Excluding holdings within the public sector, maturities are reduced to USD4.58 billion, including the principal payment to the IMF of USD1.858 billion.