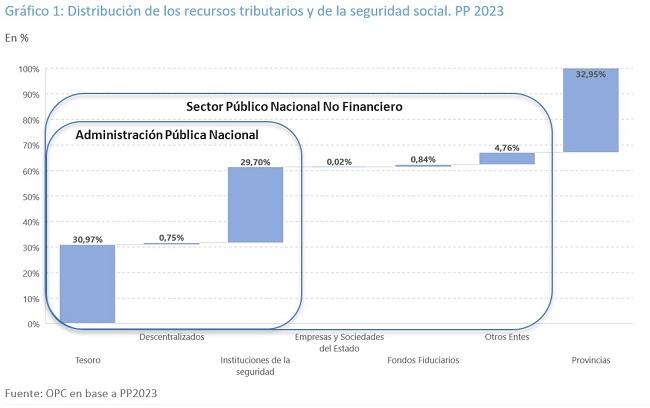

In accordance with the Message of the National Budget Bill for the year 2023, revenues from national taxes and Social Security would reach ARS34,978.541 billion. In the absence of detailed information on the components of the tax revenue and its distribution, the exercise of reconstructing the apportionment of revenues by jurisdiction was conducted. The OPC recorded a difference of ARS125.96 billion between what would be collected and what is distributed.

This difference could arise from certain inconsistencies in the treatment of some revenues that in one case are considered as tax and in others non-tax. This raises the need to review the information historically submitted to Congress with respect to revenue and distribution.

On the other hand, a Separate Note was added to the Message on the concept of Tax Expenditure, resources that the Treasury does not receive due to treatments that deviate from the general rule of the different laws governing taxes, as a way of encouraging parliamentary discussion on them.

According to estimates of the Ministry of Economy, the total of those Tax Expenditures would amount to ARS3,664.818 billion next year (2.49% of the GDP), which are disaggregated into ARS2,669.761 billion for treatments included in the tax rules and ARS995.057 billion generated in economic promotion regimes.

Regarding the content of the Bill, there are 8 Sections that set the tax shares for the year for a total of ARS112.952 billion, and another 20 Sections on tax matters that imply a total of 204 measures, which are not explicitly analyzed in terms of their fiscal impact.