- For next year, the 2022 Budget Bill (BB2022) includes interest payments for ARS1.097 trillion, including interest within the public sector. The proportion of interest in the total expenditure of the National Government would increase from 7.1% in 2021 to 8.2% in 2022.

- Considering government-owned companies, trust funds and other entities, the estimated interest expenditure of the National Non-Financial Public Sector (NFPS) would increase from 1.7% of GDP in 2021 to 1.9% of GDP in 2022. Part of the projected increase reflects the higher interest rates that will accrue in 2022 on securities issued under the restructuring of public debt in foreign currency completed in September 2020, which have an increasing coupon (“step up”).

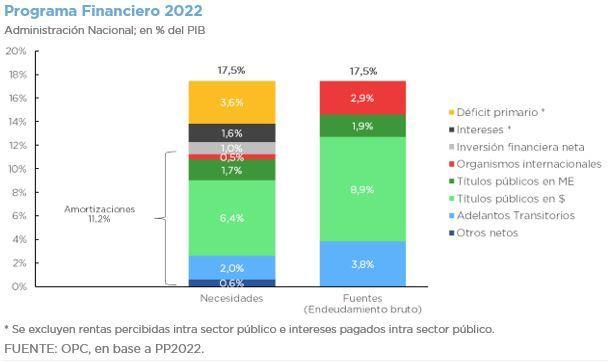

- Projected financing needs for 2022 total 17.5% of GDP. They are expected to be covered by gross placements of government securities (including intra public sector) for 10.7% of GDP, gross granting of Central Bank (BCRA) Temporary Advances for 3.8% of GDP and gross disbursements from international organizations for 2.9% of GDP.

- The BCRA’s net assistance to the Treasury would reach 1.8% of GDP in 2022 and would be made effective exclusively through the net granting of Temporary Advances.

- Sections 39, 45 and 47 of BB2022 establish limits on the gross amounts for securities issuance and loans maturing after the end of fiscal year 2022, with a total authorized amount equivalent to $6.59 trillion, USD32.993 billion and EUR287 million. On the other hand, Sections 40 and 41 authorize the use of short-term credit (maturing within the same fiscal year), establishing limits on the outstanding amounts of such instruments for a total of $2.78 trillion.