Primary, economic, and financial deficits were reduced in the first quarter of the year compared to those recorded in the same period of 2020 because of a real improvement in revenue.

Excluding the profit transfers from the Central Bank to the Treasury last year, total revenues for the first three months grew 9.3% YoY above inflation, despite the fall in Social Security and property income.

- Tax revenue totaled AR$987.15 billion, which implied an increase of 29.2% YoY, due to the positive variations in the collection of main taxes compared to the previous year.

- Resources from Social Security totaled AR$448.93 billion, which implied a drop of 8.4% YoY, due both to lower taxable income and to the drop in the number of contributors.

- Primary expenditures increased by 3.2% YoY, but with a very uneven performance depending on the items. Economic subsidies and capital expenditures grew by more than 100% YoY, while pensions and salaries contracted.

- Capital expenditures grew 126.9% YoY and were mainly allocated to the development of social housing (AR$15.55 billion) and Agua y Saneamiento Argentino S.A. (AR$15.35 billion).

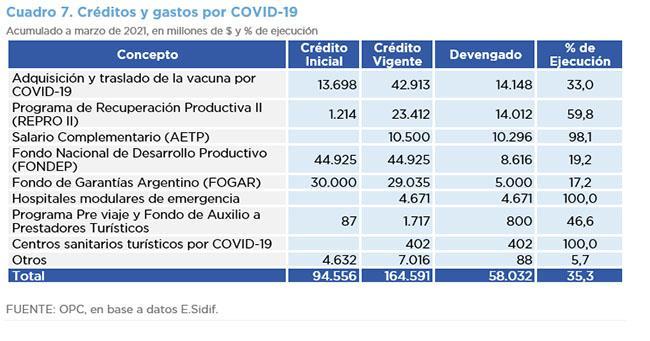

- During the first quarter of 2021, expenditures related to the COVID-19 pandemic accrued approximately AR$58.03 billion, 3.6% of primary expenditures.

- The initial approved budget increased by AR$47.9 billion, with the largest increase in COVID-19 vaccine logistics and distribution services.

- Financial assistance for the construction of modular hospitals totaled AR$4.67 billion.

- As of March 31, total expenditures totaled AR$1.71 trillion, equivalent to 20.3% of the current budget appropriation.

- According to AFIP (Federal Administration of Public Revenues), collection of Solidarity Contribution, which is considered a non-tax revenue, totaled AR$6.06 billion in the first quarter.