The purpose of this study is to continue with the evaluation of the consolidated tax burden on a group of economic activity sectors in different regions of the country. This time, the analysis was focused on the municipalities of what is called the first ring (cordón) of the Greater Buenos Aires.

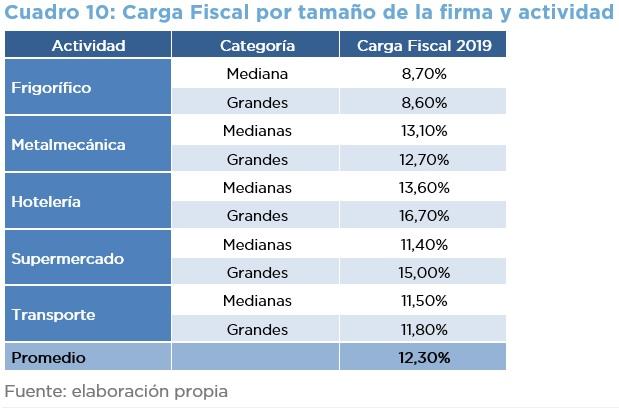

Under certain assumptions and without including some taxes such as Taxes on Fuels or Export Duties, the average tax burden is equivalent to 12.3% of the companies’ turnover.

- On average for the sectors and districts analyzed, the tax burden is 12.3% of annual turnover, varying between 8.6% and 16.7%.

- Tax impact is substantially higher than average in the hotel industry, with significant differences depending on whether the company is an SME or a large company.

- At the other extreme is the meat processing sector. This same result was obtained in the previous analysis of other 30 districts.