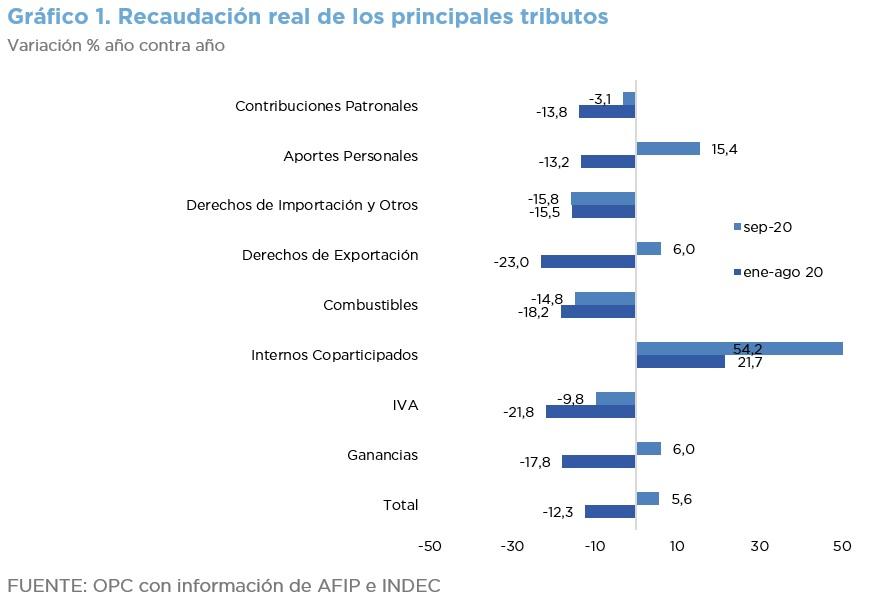

ANALYSIS OF NATIONAL TAX REVENUE – NOVEMBER 2020

Tax revenue amounted to AR$649 billion in November, a nominal growth of 36.7% YoY, which is explained by the gradual increase in the level of activity, but mainly due to the payment facilities arising from Income Tax and Wealth Tax deadlines that this year took place in August. Revenue from the second income tax collection for transactions subject to PAIS tax also had a positive effect.

The real variation was 0.1% YoY in November, the third registered so far this year, partly due to the modified calendar of tax deadlines, the relaxation of social isolation, and a lower base of comparison with respect to November 2019.

In absolute terms, the taxes that most contributed to the nominal increase in revenue were Income Tax (39%), Value Added Tax (28.6%), Wealth Tax (10.6%) and Social Security resources (12.5%). PAIS Tax decreased its share due to greater restrictions applicable to taxable transactions. For this reason, it contributed only AR$8.5 billion.