FISCAL IMPACT OF BILL ON ASSISTANCE AND COMPREHENSIVE HEALTH CARE DURING PREGNANCY AND EARLY CHILDHOOD (CD-54-2020)

The purpose of the National Law on Assistance and Comprehensive Health Care during Pregnancy and Early Childhood (Bill CD-54-2020) is to provide comprehensive care for the health and life of women, and other gender identities capable of gestation, and their children during the first years of life to reduce mortality and malnutrition, protect early bonds, physical and emotional development, comprehensive health, and prevent violence.

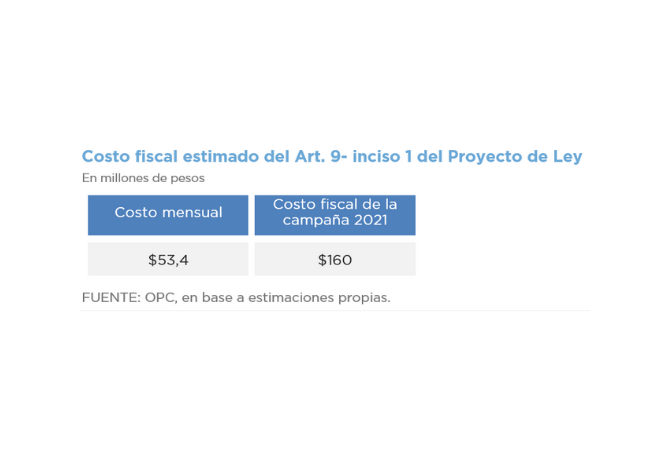

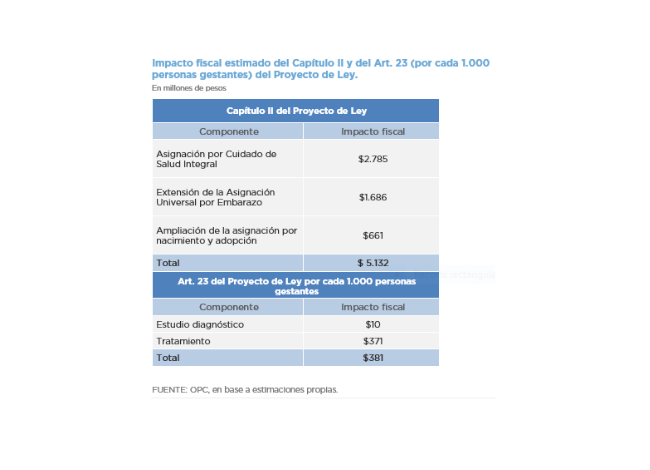

Based on the assessment carried out, it is estimated that the measures with fiscal impact for the national government would be those related to the expansion of family allowances policy (Sections 4, 5, 6, 7 and 10 of the Bill), training of personnel involved in the care of pregnancy and early childhood (Section 17) and the provision of medical tests and treatments for pregnant persons at risk of thrombophilia (Section 23).

The cost of the expansion of family allowances is estimated at AR$5.13 billion. For its part, it has not been possible to estimate the cost of personnel training since information on the duration and modalities, target population and personnel in charge of providing the training is required. Finally, in relation with the care for pregnant persons with high-risk pregnancy due to thrombophilia presumption, a fiscal cost of AR$381 million per 1,000 pregnant persons is estimated.