by Juan Fourcaud | Nov 12, 2020 | Public Debt Operations

Placements of securities were made, and loan disbursements received for the equivalent of USD6.76 billion in October, of which AR$148.24 billion (USD2.09 billion) were for auctions for marketable securities in pesos. For the first time this year, dollar-linked bonds were auctioned, resulting in the placement of new instruments for USD3.43 billion.

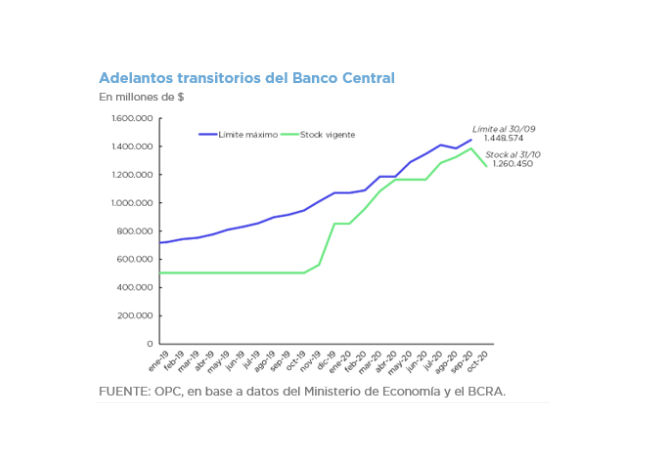

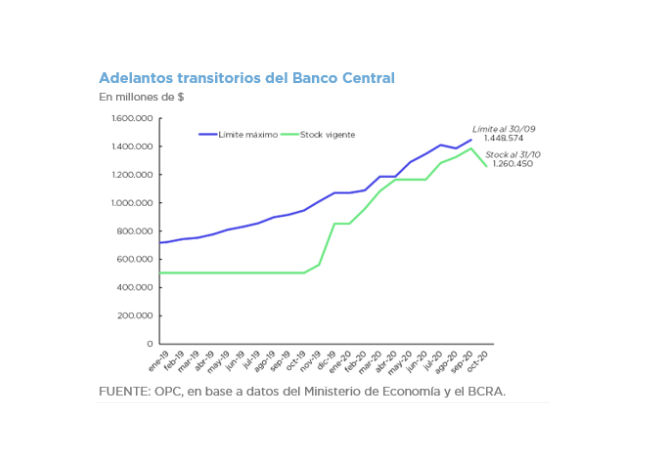

On the other hand, the equivalent of USD4.87 billion of principal was canceled, mainly due to maturities of Treasury bills in pesos. There was a net cancellation of BCRA (Central Bank of the Argentine Republic) Temporary Advances for AR$125.78 billion (US$1.6 billion), of which AR$100 billion were a pre-cancellation made in the last week of the month.

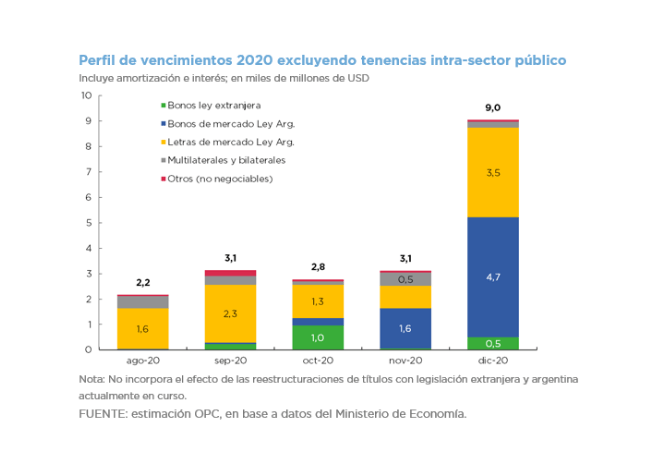

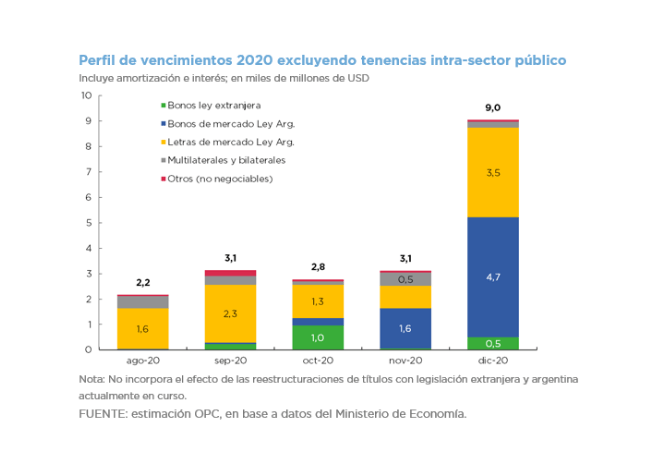

Debt service maturities for November and December are estimated at the equivalent of US$13.2 billion, which is reduced to approximately US$7.7 billion if holdings within public sector are excluded.

Following a request from Argentina, talks with the IMF formally began to negotiate a new program to refinance the debt with the IMF for approximately US$45 billion.

by Juan Fourcaud | Oct 15, 2020 | Public Debt

The Budget Bill for the year 2021 estimates an interest expense for the national government of AR$665.95 billion for 2020 and AR$661.18 billion for 2021, including interest payable to entities within the national government. If government-owned companies, trust funds and other entities are considered, the estimated interest expense of the National Non-Financial Public Sector is equivalent to 2.5% of GDP in 2020 and 1.8% in 2021.

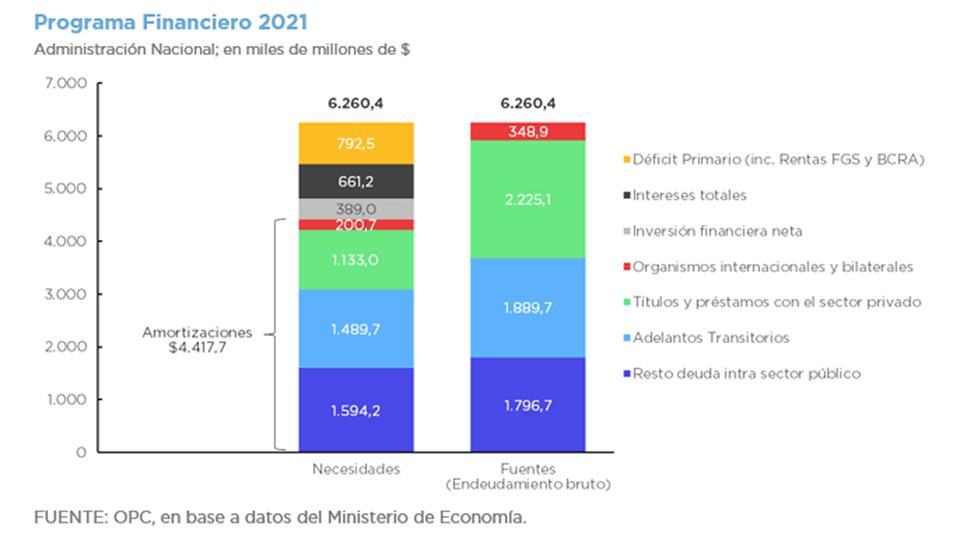

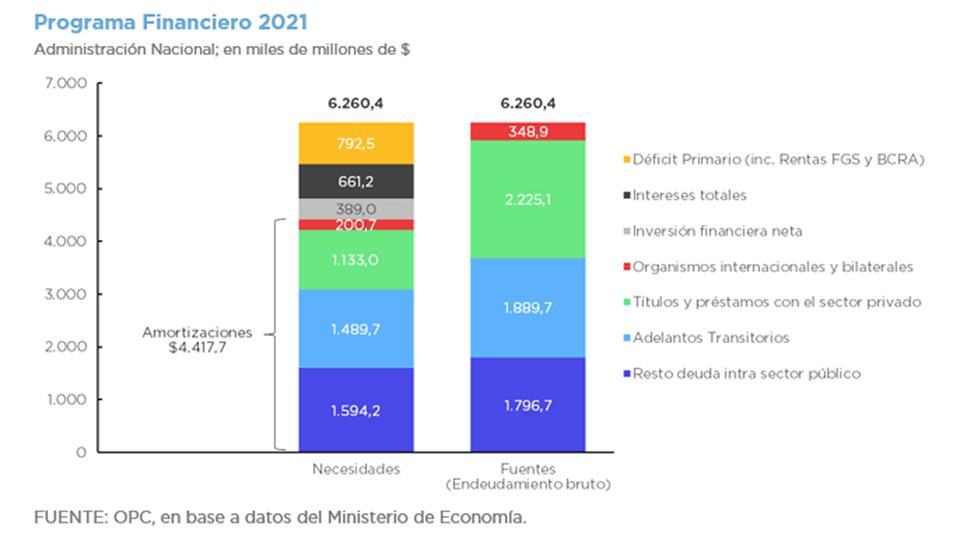

For 2021, the Budget Bill foresees financing needs for a total of AR$6.26 trillion (16.7% of GDP) which is assumed to be financed with new debt with entities of the national public sector for a total of AR$3.68 trillion (including temporary advances from the BCRA – Central Bank of the Argentine Republic), issuance of domestic debt securities to the private sector for AR$2.22 trillion and disbursements from international and bilateral entities for AR$348.9 billion.

Regarding BCRA’s financial assistance to the Treasury, the Budget Bill anticipates a net financing through Temporary Advances for AR$400 billion in 2021 (1.1% of GDP). In addition, profit transfers from the BCRA to the Treasury are estimated at AR$800 billion (2.1% of GDP).

Sections 42, 28 and 50 of 2021 Budget Bill establish limits to the gross amounts of securities issuance and loans maturing after the closing of fiscal year 2021 with a total authorized amount equivalent to AR$6.57 trillion. On the other hand, Sections 43 and 44 authorize the use of short-term credit (maturing within the same fiscal year), establishing limits on the outstanding amounts of such instruments for a total of AR$1.75 trillion.

by Nicolas Perez | Oct 14, 2020 | Budget Law

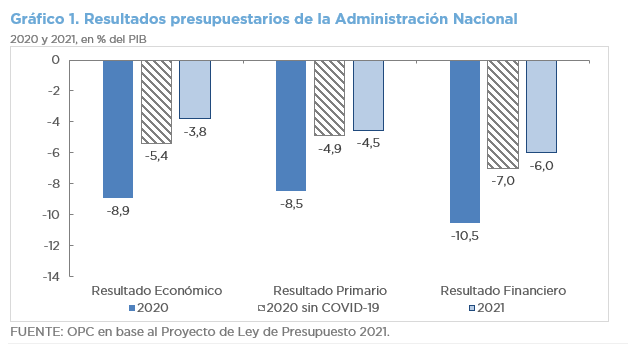

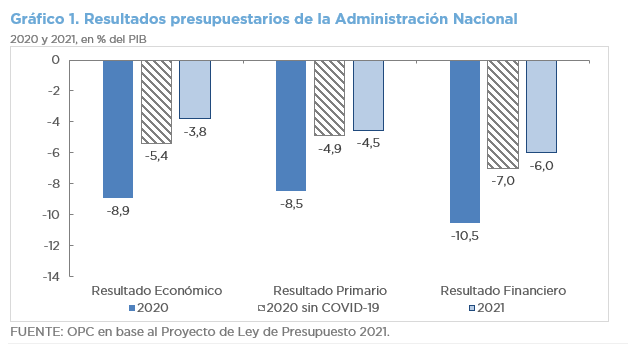

The National Budget Bill for 2021 foresees for next year a decrease in deficits due to the partial

recovery of the economy, with an increase in public investments and a reduction in the payment

of interest on the debt.

- According to the macroeconomic estimates of the Bill, the Gross Domestic Product

(GDP) will suffer a real fall of 12.1% this year, the nominal exchange rate will be AR$81.4

per dollar at the closing of the fiscal year, and the YoY inflation rate will be 32%. Next

year’s GDP is expected to rise 5.5% in real terms, with a nominal exchange rate of

AR$102.4 per dollar in December, and an inflation rate of 29% YoY.

- Resources will increase by 9.7% YoY in real terms and total expenditure will fall by

10.4% YoY.

- This dynamic between revenue and spending will lead to an improvement in the primary

balance in 2021, which would go from a deficit of 8.5% of GDP in 2020 to a deficit of

4.5% in 2021. The same applies to the financial balance, which would vary from a deficit

of 10.5% of GDP in 2020 to a deficit of 6.0% in 2021.

- Capital expenditures will have the largest real increase and debt interest the sharpest

decline.

- Gross financing needs in the next fiscal year will be AR$6.4 trillion (17.2% of GDP). The

Central Bank will contribute AR$800 billion to the Treasury, 62.2% less than this year.

- Exports are expected to recover from a 14.2% YoY decline this year to a 10.4% YoY

increase next year.

- The Budget Bill does not provide neither financial allocations for Emergency Family

Income – IFE (Ingreso Familiar de Emergencia) nor for assistance for the payment of

private salaries (ATP), but it does provide a 24.1% increase in resources for vaccines

(AR$45.4 billion), including the purchase of doses against COVID-19 (AR$13.69 billion).

by Nicolas Perez | Oct 14, 2020 | Public Debt Operations

In September, the restructuring operations of foreign currency securities issued under foreign

legislation (Law 27,544) and local legislation (Law 27,556) were settled, which involved

cancellations of eligible securities for USD108.1 billion and placements of new bonds for

USD110.9 billion.

Excluding these operations, there were placements of securities and loan disbursements for the

equivalent of USD4.7 billion, of which AR$252.8 billion (USD3.4 billion) were auctions of

marketable securities in pesos. On the other hand, the equivalent of USD3.1 billion of principal

was paid, mainly due to maturities of Treasury bills in pesos. Likewise, interest payments were

made for the equivalent of USD447 million, of which 76% were in pesos.

Debt service maturities for the equivalent of USD3.86 billion are estimated for October, totaling

USD17.06 billion until the end of the year (approximately USD8.4 billion if holdings within the

public sector are excluded).

by Nicolas Perez | Aug 12, 2020 | Public Debt Operations

Placements of securities and loan disbursements were recorded for the equivalent of USD9.8 billion, of which AR$528.15 billion (USD7.7 billion) consisted of auctions of marketable securities in pesos.

In addition, the equivalent of USD7.37 billion of principal payment was made, mainly due to a voluntary swap of securities in dollars for new instruments in pesos carried out on July 17.

During the month, interest coupons were not paid on several foreign-legislation BIRAD bonds totaling USD584 million. As of July 31, outstanding interest coupons on bonds issued under foreign legislation totaling USD1.67 billion remain unpaid, which are expected to be recognized as part of the restructuring process of such securities currently underway.

We estimate debt service maturities for the equivalent of USD3.13 billion for August, amounting to USD35.53 billion by the end of the year (approximately USD20.29 billion excluding holdings within the public sector).

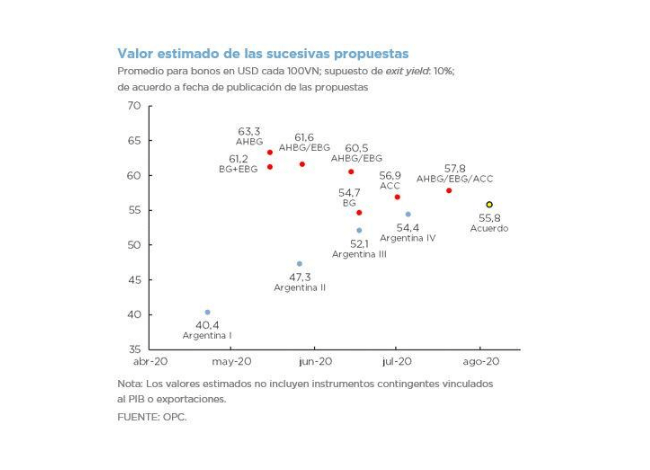

On August 4, the government announced an agreement with the main groups of creditors for the restructuring of bonds issued under foreign legislation. The deadline for creditors to accept the revised proposal was extended until August 24, while the settlement date of the transaction is September 4. At the same time, Law 27,556 on the restructuring of government bonds in dollars issued under Argentine legislation with the same conditions as the bonds under foreign legislation was enacted.

by Nicolas Perez | Aug 6, 2020 | Public Debt

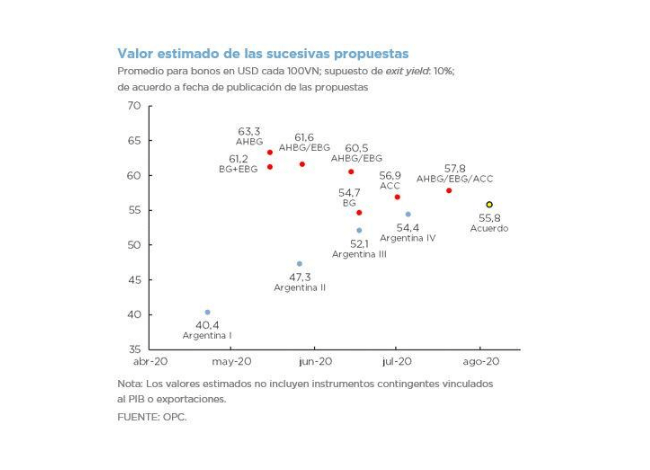

On August 4, the government announced an agreement with the main groups of creditors to restructure bonds under foreign legislation. Based on the agreement, the terms of the last offer made by Argentina on July 6 are modified.

The modifications include the advancement of some maturities of the new bonds to be delivered, new conditions for the swap for bonds in different currencies and the commitment to introduce some adjustments to the collective action clauses of the new securities that are supported by the international community.

Assuming an exit yield of 10%, the settlement has an estimated average value of USD55.8 per USD100 of eligible face value. The agreement involves an improvement of USD1.4 over the previous official proposal.

Under the assumption that the full eligible amount is swapped, the new bonds would generate amortization and interest payments of approximately USD4.6 billion in the term 2020-2024 and USD42.7 billion in the term 2020-2030.

The creditor groups that negotiated the agreement, together with other bondholders that would provide support, claimed to hold 60% of the eligible bonds issued under the 2005 indenture and 51% of the 2016 indenture bonds.

According to the current schedule, the creditors have a deadline to accept the proposal until August 24 and, in case of acceptance, the swap transaction would be settled on September 4.