Three market auctions were held in September, resulting in the placement of government securities for a total of ARS325.167 billion and an average maturity of 233 days.

- During the month, amortizations were paid on market government securities for ARS260.611 billion. In addition, to reduce the burden of BONTE TS21, a swap was offered to Banco Nación (Bank of the Argentine Nation) and as a result, 97% of the bond stock was swapped.

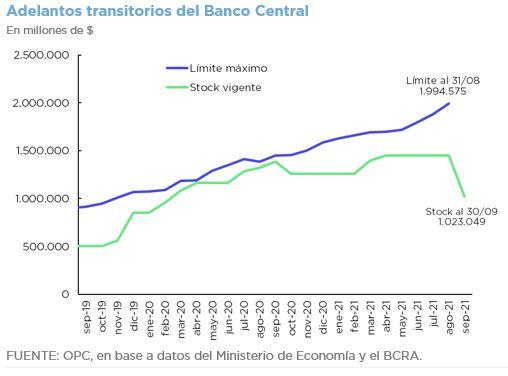

- To pay the first amortization of the IMF Stand-By loan, the Treasury placed a bill with the Central Bank for USD1.888 billion. Simultaneously, Temporary Advances were cancelled with resources from the IMF’s extraordinary allocation of Special Drawing Rights (SDR).

- It is estimated that maturities for October total the equivalent of USD4.975 billion. Excluding holdings within the public sector, maturities are reduced to USD3.658 billion.

- The Ministry of Economy announced the creation of a new type of short-term debt instrument, the National Treasury Liquidity Bills (LELITES), exclusively for Mutual Funds (FCI).