When comparing execution with the initial Budget, total revenues and total expenditures showed deviations of 50.7% and 44.1%, respectively.

Given the lack of parliamentary approval of the Budget Law for fiscal year 2020, the extension of the Budget Law for fiscal year 2019 (Law 27,467) applied under the terms of Section 27 of Law 24,156.

Property income was the main source of the increase in current revenues, with a real positive variation of 198.1% YoY, due to the transfer of profits from the Central Bank of the Argentine Republic (BCRA) for ARS1.6 trillion. Without this transfer, total revenues would have fallen 16.6% YoY.

Primary expenditures increased by 17.1% during 2020. This variation is mainly explained by the package of measures related to COVID 19, which implied an accrued expenditure of ARS921.6 billion, without which primary expenditures would have shown a slight expansion of 0.2% YoY.

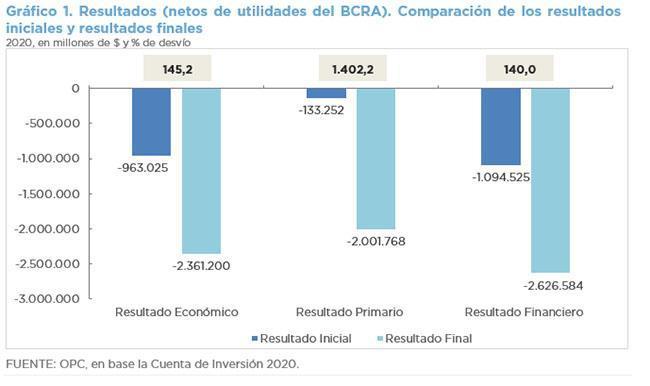

If the BCRA’s profits are excluded, the primary deficit stood at ARS2.0 trillion (7.3% of GDP) with a decline of 6.6 percentage points (p.p.) with respect to the 2019 deficit (0.7% of GDP). Meanwhile, the financial result implied an imbalance of ARS2.6 trillion (9.6% of GDP), reflecting a decline of 4.6 percentage points (p.p.) with respect to the previous year.

Public Debt and Increase in Other Liabilities totaled ARS3.43 trillion, which resulted in an amount 30.1% (ARS1.47 trillion) below the initial Budget, while Debt Amortization and Decrease in Other Liabilities amounted to ARS1.82 trillion, 46.6% (ARS1.59 trillion) below the initial Budget.

The stock of national public debt in pesos showed an increase of ARS8.9 billion during the year, largely explained by a 40.5% increase in the exchange rate. Among the debt operations, the restructuring of debt in foreign currency, both under local and foreign legislation, stood out. As a result of both operations, net debt fell by USD2.43 billion.